Blog

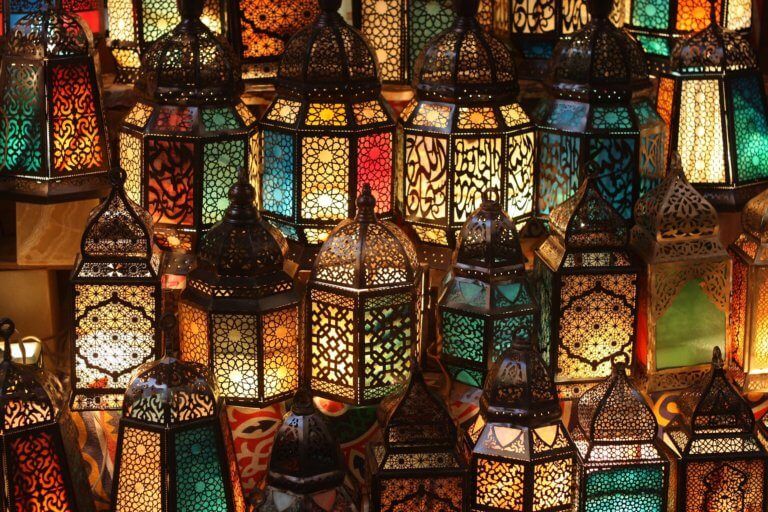

Update: 20 November 2023 by Dilara İnal E-invoicing systems in the Middle East and North Africa are undergoing significant transformations, aiming to modernise the financial landscape and improve fiscal transparency. Recent updates have seen numerous countries implementing electronic invoicing solutions designed to streamline tax collection and reduce VAT fraud. E-invoicing Trends in the Middle East […]

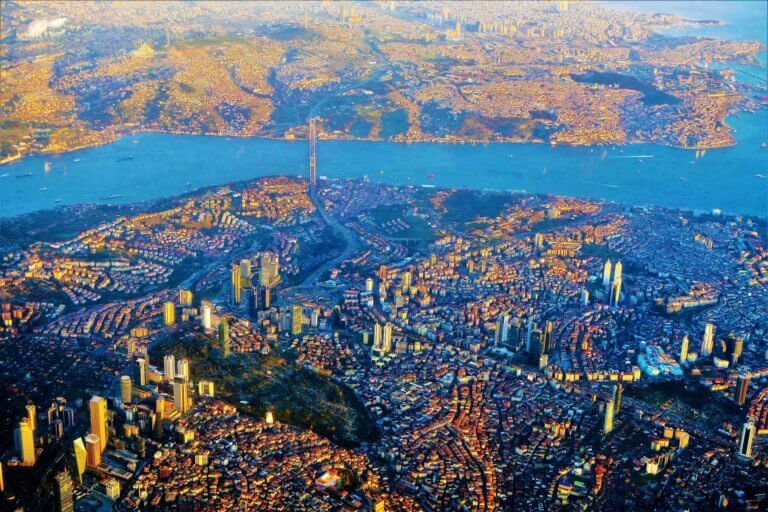

The era of paper invoices is coming to an end. With the e-arşiv invoice system, you can issue an electronic invoice, even to non-registered e-invoice taxpayers. This regulation enables companies to send invoices directly to the end-user via e-mail removing the need for paper invoices. Due to the official statement from the Turkish Revenue Administration […]

Throughout this year, one development we’ve seen substantially increase is the use of targeted VAT rate changes by governments around the world. Given the large proportion of transactions in an economy that attract VAT, these changes are used as a key tool in economic stimulation, especially as economies throughout Europe slowly start to re-open following […]

After a period of solid work around the myDATA framework, with little documentation left to implement the entire scheme in Greece, the IAPR has shifted its attention to e-invoicing. Last week the IAPR and the Ministry of Finance signed the long-awaited myDATA bill, which once turned into law will enforce the myDATA system within Greece. […]

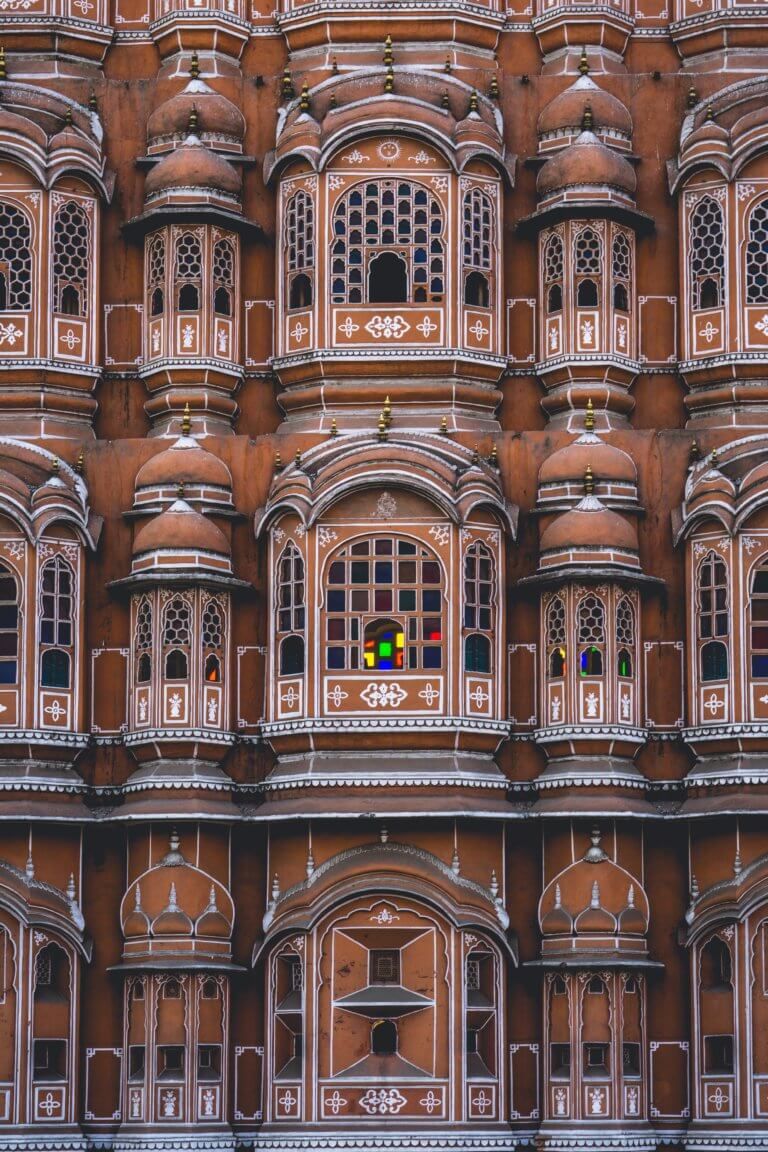

Renowned for its diversity, India is taking the same approach to its e-invoicing framework. There have been several changes and new possibilities included in the required processes and technical (“JSON”) invoice schema since e-invoicing was introduced. Such changes are unsurprising as many of the existing Continuous Transaction Controls (CTC) systems regularly bring new elements to […]

From 1 July 2020, all taxpayers with revenue above 25 million TL in 2018 or subsequent years must switch to the e-delivery note system. E-invoice instead of e-delivery note With the deadline fast approaching, one of the questions on taxpayers’ minds is whether e-invoices can be used to replace e-delivery notes as paper invoices can […]

In the midst of ongoing negotiations following the UK’s exit from the European Union (EU), the Court of Justice of the European Union (CJEU) has ruled that the UK has impermissibly expanded the scope of its 0% VAT rate on futures trading. And, that this has been occurring over a period spanning more than forty […]

As negotiations to determine the future relationship between the EU and UK beyond the end of the transition period resume, after a COVID-19 initiated pause, it’s worth taking a moment to review some of the anticipated VAT implications of Brexit, and in particular the impact on Northern Ireland. Prior to the UK leaving the EU, […]

Following the trailblazing efforts by countries such as Italy, Hungary and Spain, this past year has seen an increase in European countries announcing digital tax control reforms. Earlier this year, Albania joined the ranks of France and Poland by announcing the introduction of a continuous transaction controls (CTC) system, called fiscalization. This scheme requires clearance […]

Following the successful implementation of the e-invoicing mandate that has gradually expanded its scope, Turkey introduced a new mandate to track the movement of goods in a more technology-efficient way. Like many other countries, Turkey has already been able to retroactively track the movement of goods by obliging taxpayers to issue delivery notes. Having seen […]

On Friday 8 May, the European Commission (EC) published a legislative proposal to delay implementation of the e-Commerce VAT Package by six months due to the impact of the COVID-19 crisis. The implementation of the new measures, which were set to come into force on 1 January 2021, have been delayed until 1 July 2021. […]

We recently reported the Polish government’s decision to delay introduction of the new JPK_VAT with a declaration structure until 1 July 2020. This move is part of the country’s Tarcza antykryzysowa (“Anti-Crisis Shield”) initiative to support business during the coronavirus pandemic and gives welcome extra preparation time especially as the Ministry of Finance only recently […]

Finland’s government already receives over 90% of invoices electronically. Aiming to expand the use of e-invoices in B2B transactions, the country has granted B2B buyers the right to receive a structured electronic invoice from their suppliers if requested. The scheme applies to all Finnish companies with a turnover above €10,000 and came into force on […]

Sovos recently published a blog regarding prospective measures EU member states are taking in response to the Covid-19 pandemic. Included below are additional actions introduced from countries across the EU: European Union The European Commission has approved requests from all EU Member States to temporarily suspend VAT and customs duties on imported medical equipment. This […]

On 3 April 2020, storage guidelines for e-ledger were published by the Turkish Revenue Authority (TRA). The guidelines set out the requirements and standards for special integrators, and the requirements for supporting secondary storage services for e-ledgers, e-ledger summary report (Berat) files and other documents created through the e-ledger system. Background The Communique, first published […]

From 1 April 2020, Norway will require non-resident suppliers of “low value” goods to Norwegian consumers to charge VAT on such supplies. Norway is the latest in a series of countries to take this step ahead of similar changes scheduled to begin in the European Union next year. Around the world, countries impose VAT style […]

In the past five years, transaction automation platform vendors who embraced e-invoicing and e-archiving compliance as integral to their services grew on average approximately 2.5 to 5 times faster than the market. Two decades of EU e-invoicing: many options, different models Until 1 January 2019, when Italy became the first European country to mandate B2B […]

For companies operating in Turkey, 2019 was an eventful year for tax regulatory change and in particular, e-invoicing reform. Since it was first introduced in 2012, the e-invoicing mandate has grown, and companies are having to adapt in order to comply with requirements in 2020 and beyond. According to the General Communique on the Tax […]