Blog

New bookkeeping law – Lov om bogføring On 19 May 2022, the Danish Parliament passed a new bookkeeping law – Lov om bogføring – introducing requirements for companies to use a digital bookkeeping system. Section 16 of the Law requires many Danish companies to use a digital bookkeeping system and make their bookings electronically. The final […]

A recent preliminary ruling request to the European Court of Justice, Case C-664/21, NEC PLUS ULTRA COSMETICS, has re-emphasised the importance of collecting documentation when carrying out a zero-rated supply in the EU. The 2017 NEC PLUS ULTRA COSMETICS case involved a company established in Switzerland selling cosmetics products under the Ex Works clause from […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and insurance premium tax (IPT) compliance services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about regulatory changes and developments in global tax regimes to […]

France is implementing a decentralised continuous transaction control (CTC) system where domestic B2B e-invoicing constitutes the foundation of the system, adding e-reporting requirements for data relating to B2C and cross-border B2B transactions (sales and purchases). Under this upcoming regime, data or invoices can be directly sent to the Invoicing Public Portal ‘PPF’ (Portail Public de […]

Update: 25 January 2024 by James Brown Judgment in the Netherlands and Lloyd’s Position on Space Insurance There have been a couple of key developments in the space insurance landscape in recent months from an IPT perspective. The Netherlands’ judgment on space insurance In October 2023, a District Court in the Netherlands passed judgment […]

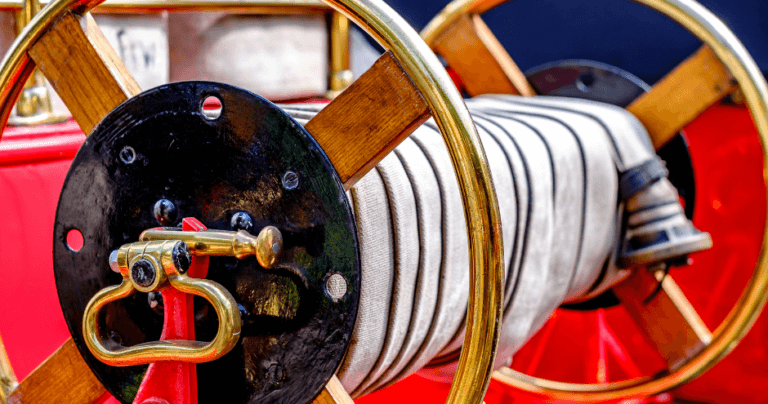

There are several countries within the European Union (EU) and European Economic Area (EEA) that have introduced a Fire Brigade Tax (FBT). Fire Brigade Tax is payable on certain premium amounts and usually in addition to Insurance Premium Tax (IPT). Fire Brigade Tax, or the Fire Brigade Charge (FBC) or Fire Protection Fee (FPF) as […]

The Legislative Assembly of El Salvador has published Decree 487 on reforms to the tax code. The decree enables the use of Electronic Tax Documents (Documentos Tributários Electrónicos – DTE) in the country, introduces new articles to the tax code and reforms existing ones. The decree incorporates new articles to the tax code to regulate […]

In recent months, we’ve been helping clients with VAT rate changes within and beyond the EU. The reason for these VAT rate changes ranges from a desire to reduce inflation, action to help support families with the cost of living, helping businesses deal with rising costs and as in the Swiss case, reforming the state […]

For Insurance Premium Tax, Location of Risk is vital in determining the correct tax. In this episode of the Sovos Expert Series, Anita Blanusic asks James Brown, IPT Consultant, to explain the Location of Risk for marine insurance and how it’s determined. Listen as he answers the following questions: What is meant by marine […]

The world of Insurance Premium Tax (IPT) is ever changing, with countries updating rates and thresholds whenever the need arises, introducing new taxes regularly and adjusting tax rates to adapt to changes within a country. But how do you keep up with so much change when you’re already busy doing your job? Parliamentary debates One […]

Update: 19 October 2022 Since taking up his new duties as Chancellor of the Exchequer on 14 October, Jeremy Hunt has reversed the previous mini-budget drafted by his predecessor. One of the schemes that was announced to be reintroduced was the VAT Retail Export Scheme. This scheme would have allowed overseas visitors to benefit from […]

HMRC has announced a new penalty regime to replace the default surcharge regime for VAT periods starting on or after 1 January 2023. The new regime will affect UK VAT registered businesses that submit late UK VAT returns or make late VAT payments in the UK. There will also be changes to how VAT interest […]

Update: 27 July 2023 by Edit Buliczka Changes to IPT registration requirements in Austria The registration requirements for settling taxes in a country are similar – if not the same, usually involving the central tax administration or tax authority. This, however, is not always the case and there are exceptions. For example, due to a […]

Update: 13 March 2023 by Enis Gencer Northern European Jurisdictions: CTC Update The European Commission’s VAT in the Digital Age (ViDA) proposal continues to unfold with the latest details published on 8 December 2022. As a result, many EU countries are stepping up their efforts towards digitizing tax controls – including mandatory e-invoicing. While we […]

Portugal’s state budget entered into force on 27 June 2022 after protracted negotiations. The budget contained an interesting provision: the obligation to present invoice details to the tax authorities was extended to all VAT-registered taxpayers including non-resident taxpayers

Continuing our IPT prepayment series, we take a look at Italy’s requirements. In previous articles we have looked at Belgium, Austria, and Hungary. All insurers authorised to write business under the Italian regime have a legal obligation to make an advance annual payment for the following year. What is the prepayment rate in Italy? The […]

When organising a virtual event, it’s important to determine how this supply will be treated for VAT purposes. We have previously discussed VAT rules and place of supply for virtual events, this blog will discuss the potential future changes to the VAT position for EU Member States. Current VAT position for virtual events in Europe […]

Brazil is known for its highly complex continuous transaction controls (CTC) e-invoicing system. As well as keeping up with daily legislative changes in its 26 states and the Federal District, the country has over 5,000 municipalities with different standards for e-invoicing. The tax levied on consumption of services (ISSQN – Imposto Sobre Serviços de Qualquer […]