Blog

Note: The Finance Law for 2024 has been officially adopted and published in the Official Gazette on 30 December 2023. Our blog, France: B2B E-Invoicing Mandate Postponed, is promptly updated whenever there are changes to the rollout of the French mandate. France will implement a mandatory B2B e-invoicing and an e-reporting obligation. Every company operating in […]

It’s essential to stay on top of your company’s VAT requirements. This requires sound knowledge of the rules and what authorities expect of businesses. This includes dealing with supplies of goods and services outside standard VAT obligations. Not every product or service incurs VAT. This is VAT exemption. VAT exempt supplies of goods and services […]

The EU Commission’s VAT in the Digital Age proposals include a single VAT registration to ease cross-border trade. Due to enter into force on 1 July 2028 (1 January 2027 for electricity, gas, heating and cooling), the proposal is part of the commission’s initiative to modernise VAT in the EU. The single VAT registration proposal would mean only […]

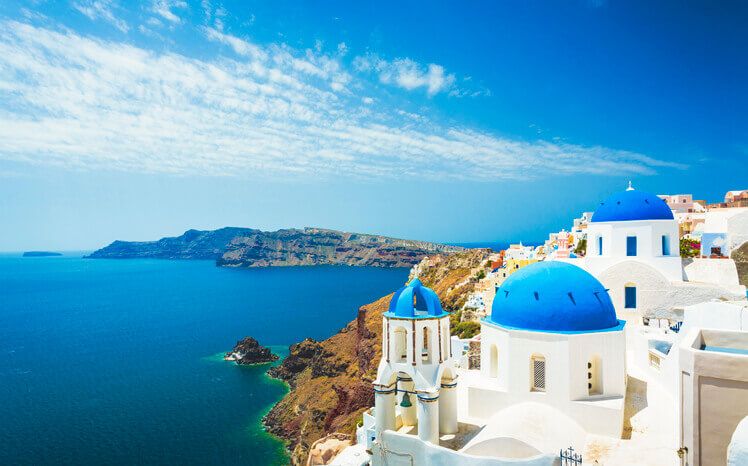

In the past year, the Greek tax authority published a series of legislative acts introducing new requirements (the QR code and prefilling of VAT returns) and amending existing ones. It’s been more than three years since the rollout of myDATA as a voluntary scheme, but the system is far from complete. myDATA is a broad […]

Did you know? Over 170 countries worldwide have implemented VAT or GST. Despite how common VAT is, the tax is difficult at the best of times to understand. Knowing who pays VAT – the buyer or the seller – is straightforward, though, if you take the time to learn about the tax or have help. […]

Following the publication of various circulars by the Federal Ministry of Finance in Germany in 2021, rules on the taxation of guarantee commitments were made effective 1 January 2023. This blog explains how this affects insurers and other suppliers. Scope of the rules for guarantee commitments The Ministry of Finance published its initial circular in […]

VAT Registration Threshold of EU Countries The European Union is a collective but its Member States have their own rules and nuances where VAT is involved. Knowing what rules are at play is essential when trading in the EU, and that’s where Sovos’ EU VAT Buster comes in. Each Member State has its VAT threshold […]

With the VAT in the Digital Age (ViDA) officially adopted by the EU on 11 March 2025, businesses have many questions about its rollout and impact on their operations. We answer the most frequently asked questions. When will businesses begin to see an impact from ViDA? ViDA is leading to changes in several areas […]

What is the EU VAT Reform? Aimed at making life easier for businesses, the EU E-Commerce VAT Package simplifies the VAT reporting requirements when trading across European Union Member States. This package is part of wider EU VAT reform. Our live blog collates vital information on the package, with updates whenever governments or tax authorities […]

It can be difficult to know where you stand regarding EU VAT changes and European tax laws. There have been sweeping changes implemented in recent years. This blog breaks down the major updates, including the EU VAT reform, to help ensure your business is on the right path. Additionally, you can speak with our team […]

All European countries charge VAT on goods and services. VAT is a consumption tax added during each production stage of goods or services. Although VAT is near-universal according to the EU VAT Directive, VAT rates within the EU do differ. This is because the EU VAT Directive allows Member States to choose whether to implement […]

Insurance Premium Tax in Germany is complex. From IPT rates to law changes, this quick guide will help you navigate the challenges of IPT in Germany. For an overview of IPT in general, read our Insurance Premium Tax guide. What is the filing frequency for IPT declarations in Germany? Based on IPT declarations made for […]

The EU VAT E-Commerce package has been in place since 1 July 2021. This applies to intra-EU B2C supplies of goods and imports of low value goods. Three schemes make up the package. These are based on the value of goods and the location of the sale of goods. All OSS schemes are currently optional. […]

Nearly every major economy has a form of VAT. That’s 165 countries, each with its own compliance and reporting rules. The main exception is the United States. VAT is by far the most significant indirect tax for nearly all the world’s countries. Globally VAT contributes more than 30% of all government revenue. Levying VAT is […]

The European Commission’s VAT in the Digital Age initiative brings significant modifications to the VAT treatment of the platform economy related to the operators in the short-term accommodation and passenger transport services. Short-term is defined as a maximum of 30 days – however, to adapt to different national specificities of the sector, EU Member States should have […]

Electronic invoicing in Poland via KSeF has undergone a long journey. Providing new expectations for B2B and B2G transactions alike, it is vital for taxpayers to understand what’s to come – though that can be tough when rules and regulations change frequently. This blog provides a comprehensive timeline of Poland’s advancement towards its e-invoicing mandate, […]

The European Commission has announced its long-awaited proposal for legislative changes in relation to the VAT in the Digital Age (ViDA) initiative. This is one of the most important developments in the history of European VAT, and affects not only European businesses, but also non-EU companies whose businesses trade with the EU. This guide about VAT […]

Problems encountered with Fire Brigade Tax rate increase in Slovenia Slovenia’s Fire Brigade Tax (FBT) has changed. The rate increased from 5% to 9%. This came into effect on 1 October 2022. The first submission deadline followed on 15 November 2022. Unfortunately, the transition has been plagued by problems. We discuss some issues and how […]