Blog

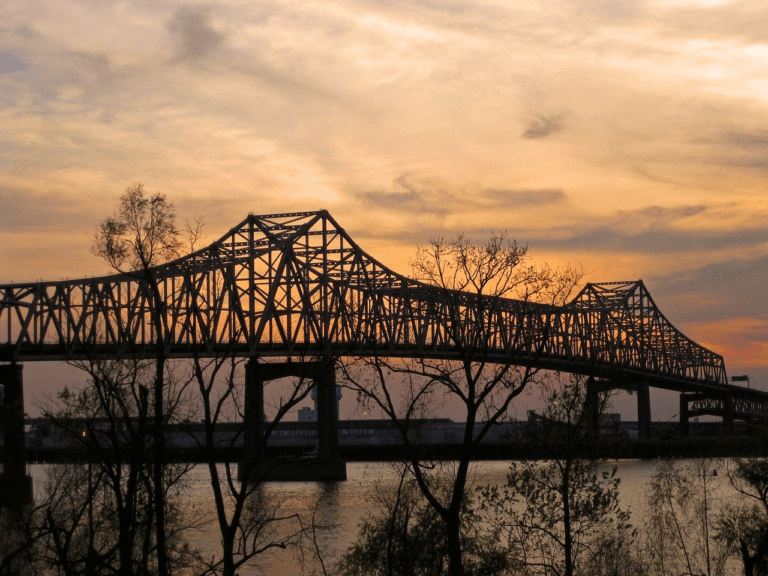

We’ve previously discussed the Louisiana economic nexus sales tax, and how remote sellers will need to collect and remit all state and local sales taxes on their sales into the state once certain thresholds are met. In the wake of South Dakota v. Wayfair, Inc., the state created a new Louisiana Sales and Use Tax […]

Incentive law numbered 7252 was published in the Official Gazette for private sector employers on 28 July 2020. Thanks to this law, private sector employers who applied for short work allowance (SWA) and cash wage support before July 2020 and whose short-time working ended will be able to benefit from financial support. How to claim […]

Find out why it makes sense to invest in tech and automation to streamline tax processes and alleviate the burdens finance teams face. The shift towards digitisation necessitates a radical adaption and shift in existing tech for industries across the board. As this occurs, tensions and anxieties rise around automation and job losses. With Oxford […]

There are many different avenues an insurer can use to write insurance business. These include brokers, intermediaries and managing agents to name a few. When using a third party and looking at the rules around insurance premium tax (IPT) calculation and submission by each of the tax authorities, it can be difficult to know how […]

The Kentucky sales tax nexus is one example of how states have started to evolve their economic nexus requirements after the South Dakota v. Wayfair, Inc. decision. Kentucky adopted HB 487, which kept the same thresholds as were in the Wayfair case. Even so, we have outlined key points for remote sellers and marketplace facilitators […]

This blog was last updated on July 18, 2024. The South Dakota v. Wayfair, Inc. decision impacted how numerous states require businesses to collect and remit sales tax. The economic nexus in Maine is one such example. However, Maine enacted its own statute prior to Wayfair, saying that “a person selling tangible personal property, products […]

The wine market is in greater flux than ever as producers, retailers and consumers navigate the impacts of a global pandemic. Keeping a pulse on marketplace data has never been so important given these shifting dynamics. Nielsen is collaborating with Wines Vines Analytics and Sovos ShipCompliant to provide a much more comprehensive view of the […]

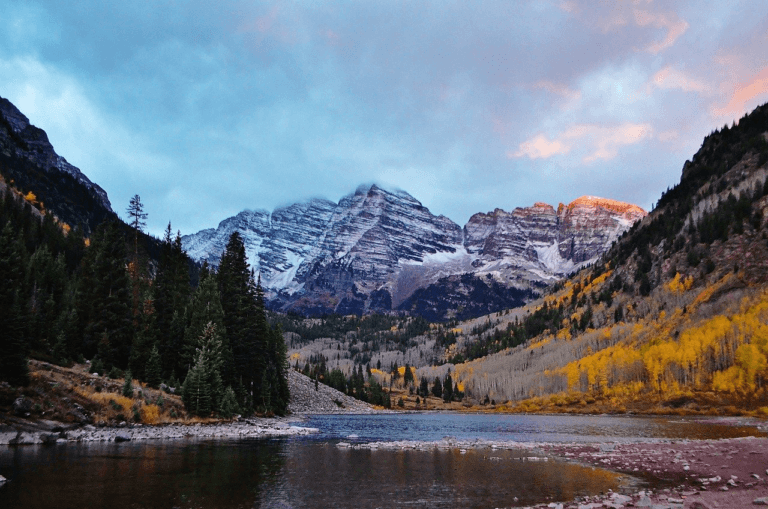

The South Dakota v. Wayfair, Inc. decision impacted the Colorado economic nexus sales tax details. Colorado joined nearly every other state (and Washington, D.C.) in clarifying economic nexus for remote sellers and in how marketplace facilitators collect and remit sales tax. While Colorado enacted legislation similar to what was laid out in Wayfair, there are […]

When South Dakota v. Wayfair, Inc. was decided, remote sellers across the country had to start ensuring that they were staying compliant with how they collected and remitted sales tax. The sales tax nexus laws in Oklahoma are just one example of where businesses without a physical presence in the state had to change their […]

Even with the South Dakota v. Wayfair, Inc. decision, there is no impact to the Delaware economic nexus. Delaware does not have state or local sales tax. The Delaware Division of Revenue states that “merely creating an Internet site by a non-Delaware business does not, by itself, create nexus. But, locating a server in Delaware […]

The Ohio economic nexus was one of many state-specific regulations that changed in the wake of the South Dakota v. Wayfair, Inc. decision. Both remote sellers and marketplace facilitators that have gross sales into Ohio should ensure that they are compliant with the latest regulations. Below, we have highlighted the key points for businesses. Enforcement […]

After effects of the South Dakota v. Wayfair, Inc. decision swept across the nation and pushed nearly every state to adjust its economic nexus. New Jersey economic nexus rule is fairly consistent with the Wayfair decision, but there are a few differences remote sellers and marketplace facilitators should know. Below, we have highlighted key points […]

Following the South Dakota v. Wayfair, Inc. decision, economic nexus laws began to change around the country. Sales tax nexus in Hawaii was one of many that adjusted how remote sellers and marketplace facilitators must collect and remit sales tax. We have highlighted the major points below for organizations. Enforcement date: July 1, 2018. Sales/transactions […]

France is introducing continuous transaction controls (CTC). From 2023, France will implement a mandatory B2B e-invoicing clearance and e-reporting obligation. With these comprehensive requirements, alongside the B2G e-invoicing obligation that is already mandatory, the government aims to increase efficiency, cut costs, and fight fraud. Find out more. France shows a solid understanding of this complex […]

As we move full speed ahead towards the proposed deadline of 1 July 2021 for the new VAT e-commerce rules, EU countries are beginning to implement the changes to e-commerce transactions and distance sales into local legislation. While we track each Member State’s implementation, certain questions have been brought to the forefront and we can’t […]

Connecticut was one of many states that quickly implemented sales tax nexus rules in response to the South Dakota v. Wayfair, Inc. decision. In fact, while Connecticut initially enacted a $250,000 threshold in December 2018, the state has already made adjustments to its economic nexus law by lowering its threshold to $100,000. Connecticut Governor Ned […]

Following the South Dakota v. Wayfair, Inc. decision, Arizona, like many other states, enacted economic nexus standards that required sellers without a physical presence in Arizona to collect and remit tax. Arizona Governor Doug Ducey signed House Bill (H.B.) 2757 into law on May 31, 2019, which specified how remote sellers and marketplace facilitators must […]

This week, the IRS released draft instructions for 2021 reporting of tax information on Forms 1099-MISC and 1099-NEC. One of the most notable changes included in the “What’s New” section of the instructions is the indication that the IRS has added the Payer Made Direct Sales of $5K or more checkbox to the Form 1099-NEC. […]