Blog

Today, we announced Sovos will acquire Istanbul-based Foriba, bringing another global pioneer of e-invoicing compliance into the Sovos solution. The Foriba acquisition marks a milestone for Sovos and for our customers around the world, who face a monumental shift in digital taxation. As tax administrations accelerate adoption of continuous compliance, businesses are dealing with the […]

The Costa Rican government enacted law 9635/2019 which introduces a new value added tax (VAT) system effective July 1, 2019. The new VAT replaces the current hybrid General Sales Tax (locally known as IGV) which existed for almost four decades. The new VAT is markedly different from the IGV, with some of the key differences […]

Split payments is one of the methods that European countries with a considerable VAT gap use to tackle it. Across the EU, the VAT gap in the EU in 2016 was reported to be €147.1bn. Poland introduced voluntary VAT split payments in July 2018. Since then around 25% of taxpayers have adopted this payment method. […]

Marketplace Facilitators and Payment Processors Find Themselves in the Global Tax Compliance Crosshairs – Part III The spread of the digital economy presents massive growth opportunity, but it also creates challenges for global taxation. As the VAT landscape responds to technological change, compliance becomes increasingly burdensome and costly, and the need for a complete solution […]

With more companies focusing on global integration, cross-border supply chains and expanding ecommerce, governments across the globe are introducing new ways to enforce tax rules and close their tax gaps. The evolving global regulatory environment produces unique tax determination and reporting challenges in the United States and additional VAT and e-invoicing compliance challenges around the […]

Pawel Smolarkiewicz, chief product office at Sovos, will speak on the digital transformation of tax and its effect on SAP S/4HANA at next week’s SAPPHIRE conference in Orlando. As countries make continuous tax compliance the new normal, businesses are finding that they have to respond by putting tax compliance functionality at the core of […]

The great corporate awakening Many corporations that previously saw e-invoicing mandates as a developing country problem are now realizing that invasive transaction-based digital tax controls are popping up everywhere around the world. Teams of experts and executives across finance, IT, tax and other functions are being pulled together by leading enterprises to define ways to […]

SAP Central Finance is driving migration to SAP S/4HANA as companies look to deliver value to their finance and accounting organizations, as well as improve on the configuration of previous financial systems. And for most companies making the transition, tax compliance is a priority. In a recent survey by SAP Insider, 74 percent of SAP […]

A draft circular, published by the Ministry of Treasury and Finance of Turkey on 15 May, has proposed an extension to the deadline for the mandatory issue of e-waybills. Whilst the circular still needs to be formally approved, the new deadline is expected to be 1 January 2020. The postponement to the transition period gives […]

SAP S/4HANA is the promised land for SAP customers: an entire suite of ERP functionality in one place with a single data store. The ability to run all ERP capabilities, both from SAP and non-SAP systems, from a single source represents delivery of a model IT professionals and SAP administrators have sought for years. Getting […]

Marketplace Facilitators and Payment Processors Find Themselves in the Global Tax Compliance Crosshairs – Part II As we discussed in part I, “Marketplace Facilitators and Payment Processors – The New Taxpayers?” an indirect tax trend the past several years is an effort to expand the number of types of businesses responsible for collecting tax, such […]

Very little about the emerging global digital tax environment is simple. That includes the countless different models tax authorities use to execute it. The two types of continuous transaction controls, reporting and clearance, may on the surface look similar but are not at all the same, and companies need to know how to operate under […]

The value-added tax (“VAT”) was described in the EU as a “”money machine” over 20 years ago. Yet according to a 2015 study by the European Commission by the Centre for Social and Economic Research (CASE), the “VAT gap” was approximately 168 billion EUR. This represents 15 percent of the theoretical VAT that would be […]

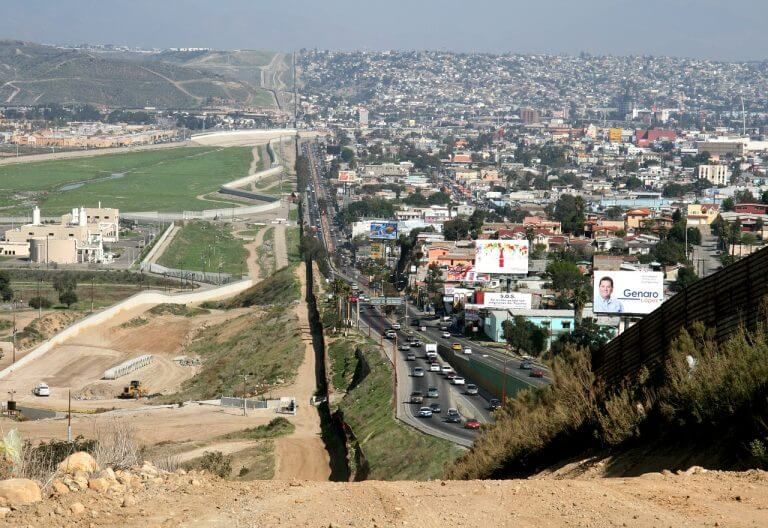

Mexico has overhauled its e-invoicing requirements in recent years, and while businesses of all kinds have had to adapt, keeping up with changes is particularly important for maquiladoras. Maquiladoras are manufacturers, often with factories near the border with the US, which have a special designation from the Mexican government that allows them to import materials […]

Sovos being named a “Leader” in the IDC MarketScape: Worldwide Sales Tax and VAT Automation Applications 2019 Vendor Assessment is a validation of its current and future product and business strategy. For those who are less familiar with IDC and its vendor evaluation process, or who are more familiar with the Gartner Magic Quadrant or […]

Earlier this week, IDC released its first-ever MarketScape Report, “IDC MarketScape: Worldwide SaaS and Cloud-Enabled Sales Tax and VAT Automation Applications 2019 Vendor Assessment,” focused on global tax compliance software, signaling two things at a crucial moment in the digital transformation of tax: Modern tax technology is an important part of the digital financial core […]

As global enterprises further their digital transformation initiatives to move financial applications to the cloud, many are at a crossroads with how they choose a deployment strategy that consolidates disparate financial and other departmental solutions and processes. Many organizations that consolidated under the auspice of a single enterprise resource planning (ERP) solution to combine administrative […]

2018 was a volatile year in indirect tax compliance for tax, finance and IT professionals worldwide. With an increase in globalization and tax gaps surpassing tens of billions in some countries, it’s not surprising that one of the biggest challenges governments are addressing is revenue collection. Like enterprises, governments are creating new, technology-driven processes to […]