Blog

Earlier this week, the Star Tribune (Minneapolis, MN) released its annual list of Top Workplaces. The newspaper compiles this list based on employee satisfaction scores for companies across Minnesota. Sovos has once again been named to this list as a national standard setter of leading workplaces because of the actions we take to put employees […]

The French Minister of Public Accounts and Action, which has authority over all tax matters, has taken advantage of the process that is required to transpose the EU E-Commerce Directive to launch a number of initiatives to curb VAT fraud, including a renewed attempt to create a system of mandatory e-invoicing. Going from B2G to […]

An insurer may need to reclaim insurance premium tax (IPT) from a tax authority for many reasons. These include a policy cancellation or mid-term adjustment, an administrative error or issuing a no claims bonus. In each case, it’s important to be aware of the issues involved ahead of any reclaim to ensure taxes are recovered […]

Beginning July 1, 2019, Connecticut will become the latest state to permit the direct-to-consumer (DtC) shipping of wine by out-of-state retailers. Governor Ned Lamont signed SB 647 on June 5. The new law amended many provisions of the state’s alcohol statutes, including the current rules for wineries’ DtC shipments of wine, which now include language […]

Of course it is! A lost dog wandering the streets is fairly easy to identify as lost, and his location doesn’t change your ownership. You know that the lost and found box at the front desk is there to reunite you with something you misplaced, but how do you identify what is ‘abandoned’ or ‘unclaimed’ […]

When performing accounting functions, understanding how our actions will affect the company downstream is important. For some functions, the consequences are obvious, but for unclaimed property reporting, consequences of inaccurate reporting can be uncertain at best. Is it really a big deal if you are reporting everything to your company’s state of incorporation instead of […]

Marketplace sales tax laws are being used by states as an additional means to collect more sales tax revenue from remote sellers on marketplaces like Amazon, eBay, Etsy, and WalMart. These online marketplaces and the rules being introduced to compel marketplace tax compliance have introduced new sales tax collection and remittance questions and complexity. According […]

“We have less than $1,000 to submit, we’ll just do it ourselves.” Does this thought process sound familiar? The thought is if it’s a small amount, it doesn’t matter nearly as much. It’s totally understandable for one to think along these lines. Unfortunately, the states may disagree with you. Regardless of the dollar amount or […]

For the second time in the last month, the IRS has alluded to forthcoming guidance related to cryptocurrency and digital asset transactions. IRS Commissioner Charles Rettig said in late May that clarification on crypto tax regulations might arrive by the end of June and gave further hints as to what might be included in the […]

To help reduce delays in the payment of invoices, the French authorities by Ordinance No. 2019-359 of 24 April 2019 have clarified their invoicing rules to include two new mandatory content requirements. These are in addition to those already in place. The two new requirements stipulated in the France invoice mandate are: 1) To provide […]

Since Italy’s electronic invoicing mandate was introduced at the start of this year, suppliers performing cross-border transactions have been exempt from this obligation. This is about to change as Italy and the enclaved country of San Marino will shortly agree on mutual mechanisms to allow the use of e-invoices for transactions between the two countries […]

Companies are always looking for simplified ways of handling the entire unclaimed property process. As an example, generating reports to be remitted to the state(s) has come a long way in the software vendor world. Electronic reporting can minimize or eliminate manual efforts such as downloading state files to CD’s, printing coversheets, and mailing individual […]

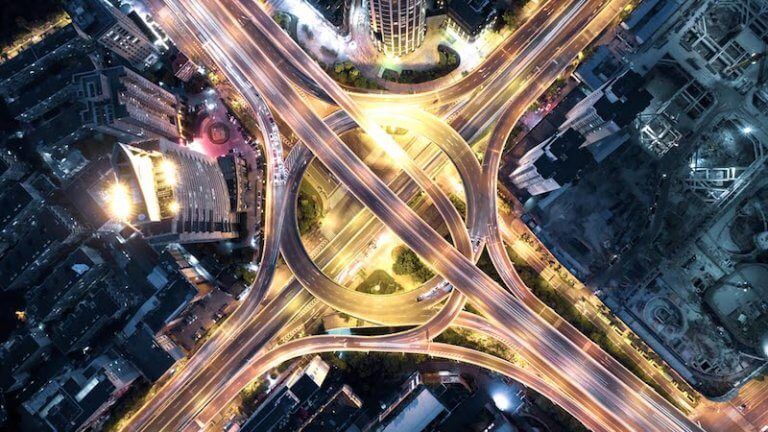

Clearance-model e-invoicing will sweep the globe because it works – at least for tax administrations. With the VAT gap opening to more than half a trillion dollars worldwide, governments around the world are likely to follow the Latin American model of tax authorities inserting themselves into transactions. A new report from Bruno Koch at industry […]

Many people hear about state exemptions for unclaimed property reporting, and they get very excited. Free money, what could go wrong? I will share what I know about exemptions and let you decide. Let’s start with a simple kind of exemption. Some states exempt reporting of gift cards or gift certificates that do not have […]

Part of a 2017 amendment to Delaware’s unclaimed property law has left many people confused. According to Del. Code Ann. tit. 12, § 1170(b), if the state feels that a report is inaccurate or incomplete the company may be selected for a compliance review. There is not a clear definition to which the policy applies in […]

It’s been quite a week at Sovos. Hours after announcing Sovos’ intent to acquire Foriba, expanding our geographic footprint into Turkey and bringing together the pioneers of e-invoicing compliance, we shared our plan to expand into new and existing markets in the U.S. with the acquisition of Eagle Technology Management (ETM). Eagle Technology Management (ETM) […]

We all know that invoicing processes are increasingly tangled up in real-time and other complex tax requirements around the world. However, when you ask companies if they are in control of the storage of their accounts payable and accounts receivable invoices, you often get somewhat surprised—if not vaguely insulted—reactions. Really, what kind of company doesn’t […]

Today, we announced Sovos will acquire Istanbul-based Foriba, bringing another global pioneer of e-invoicing compliance into the Sovos solution. The Foriba acquisition marks a milestone for Sovos and for our customers around the world, who face a monumental shift in digital taxation. As tax administrations accelerate adoption of continuous compliance, businesses are dealing with the […]