How Sovos Customer Support Impacts Your Sales Tax Experience

My colleague, Lisa Holmquest, previously discussed what can be expected from implementing new sales tax software. Sovos aims to deliver value quickly and reduce the

My colleague, Lisa Holmquest, previously discussed what can be expected from implementing new sales tax software. Sovos aims to deliver value quickly and reduce the

In sales tax, ideas spread fast. In the new E-988 surcharge, we may be seeing the very beginning stages of what ultimately might become a

This blog was updated on January 4, 2023. In virtually every market, your sales tax obligations will grow as your retail operations expand. When creating

With ecommerce continuing to rise in popularity, businesses can face unexpected operational challenges when there are increases in sales. But when utilizing the state of

This blog was updated on April 6, 2023. In today’s rapidly evolving and technology-driven regulatory environment, businesses and governments have had to change their operations

Whether your business is looking to expand into more states (or countries), adding e-commerce options or exploring any number of other digital needs, integrating a

Sales and use tax compliance is quickly becoming a critical function for numerous types of businesses. When it comes to your tax and finance team,

Change is scary, but it is often also necessary. With sales tax solutions in particular, change management is often fueled by total cost of ownership

Having a cloud-based sales tax solution can be greatly beneficial for businesses that are working to stay compliant in an ever-evolving industry. While user-centric solutions

Sales tax compliance is complicated, ever-evolving and often an increasing burden on IT teams. How can organizations manage the shifting rules and regulations, while also

Direct selling companies and multi-level marketing (MLM) businesses have numerous complexities to consider when it comes to sales tax calculation and reporting requirements. Along with

Change is rarely easy, but when it comes to implementing new sales tax software it doesn’t have to be a constant struggle. Organizations want to

Economic nexus thresholds have become standard procedure for most U.S. states, but the taxability of software and digital products continues to vary across taxing jurisdictions.

Sales tax is a necessary evil for all businesses but you don’t want to spend more time thinking about it than you have to. Implementing

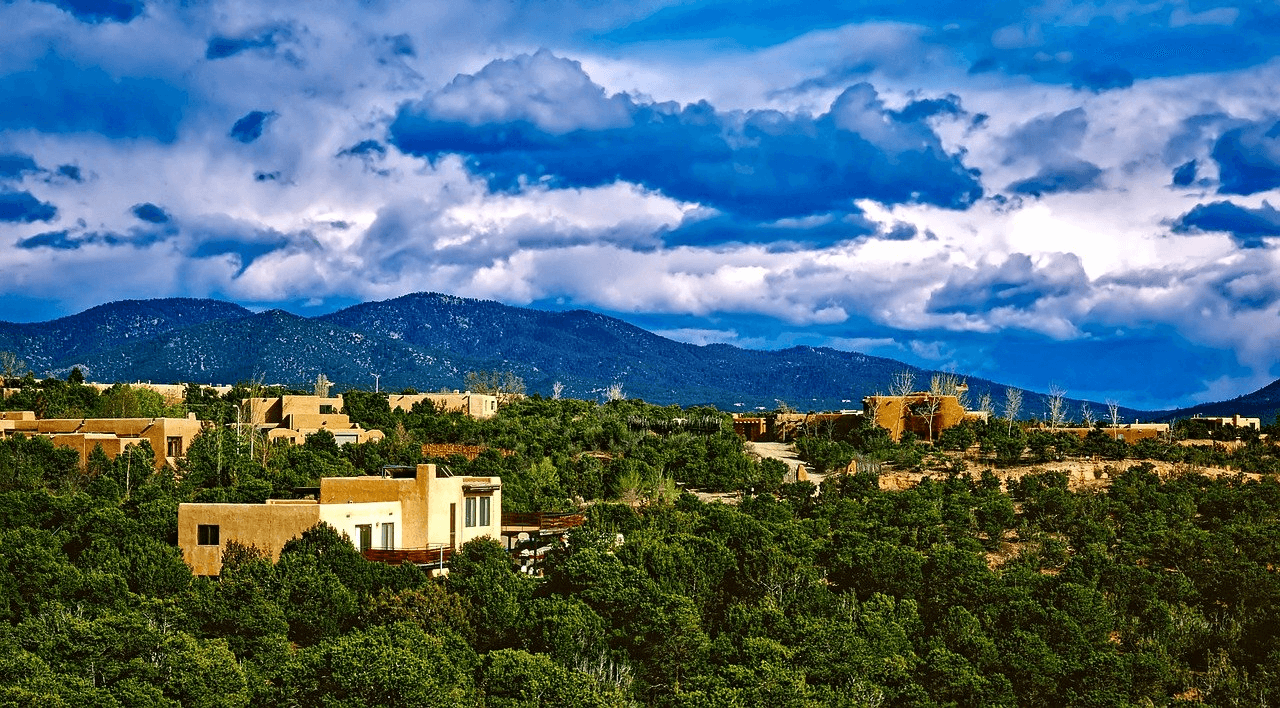

New Mexico is one of many states that updated its economic nexus following the South Dakota v. Wayfair, Inc. decision. With the passing of New

Taxpayers worried about complying with the new Massachusetts “Advance Payment” requirement, applicable to sales/use and room occupancy tax taking effect on April 1, 2021, should

North Carolina Sales Tax Nexus Following the South Dakota v. Wayfair, Inc. Supreme Court decision, North Carolina issued a policy directive (SD-18-6) indicating that it

As previously reported by my colleague, Erik Wallin, the Massachusetts Department of Revenue is set to start enforcing a new advance payment program applicable to