Blog

Update: 05 January 2023 by Andres Landerretche More taxpayers join the Electronic Invoicing System of Paraguay (SIFEN) Since Paraguay started implementing its National Integrated System of Electronic Invoicing (SIFEN) plan in 2017, the Undersecretary of State for Taxation of Paraguay (SET) has carried out the process. The different phases are: Pilot plan Voluntary phase Mandatory […]

Governments throughout the world are introducing continuous transaction control (CTC) systems to improve and strengthen VAT collection while combating tax evasion. Romania, with the largest VAT gap in the EU (34.9% in 2019), is one of the countries moving the fastest when it comes to introducing CTCs. In December 2021 the country announced mandatory usage […]

According to research firm Gartner, IT spending will reach an estimated $4.5 trillion in 2022. This represents a 5.1% increase as compared to 2021. This much needed increase allows businesses to focus on technology updates and advancements that had to be placed on the backburner due to the COVID-19 pandemic. IT departments are now eager […]

In today’s global and digital world, organizations are continually having to adjust to the challenges posed by government mandated e-invoicing. With governments continually leveraging technology to facilitate compliance and track tax fraud efficiently, there has never been a more crucial time for businesses to remain compliant. While remaining compliant and avoiding costly penalties and fines […]

The European Commission’s “VAT in the Digital Age” initiative reflects on how tax authorities can use technology to fight tax fraud and, at the same time, modernise processes to the benefit of businesses. A public consultation was launched earlier this year, in which the Commission welcomes feedback on policy options for VAT rules and processes […]

In November 2021, a Draft Royal Decree was published by the Chancery of the Prime Minister of Belgium, aiming to expand the scope of the existing e-invoicing mandate for certain business to government (B2G) transactions by implementing mandatory e-invoicing for all transactions with public administrations in Belgium. This obligation was already in place for suppliers […]

On 10 March, the European Parliament (EP) adopted a Resolution to the Commission’s Action Plan on fair and simple taxation supporting the recovery strategy, which set forth 25 initiatives predominantly related to European Union Value Added Tax (EU VAT). The document includes several general considerations and recommendations to the Commission for the VAT Directive revision […]

Poland has been moving towards introducing the CTC framework and the system, the Krajowy System e-Faktur (KSeF), since early 2021. As of 1 January 2022, the platform has been available for taxpayers who opt to issue structured invoices through KSeF and to benefit from the introduced incentives. As the taxpayers have been using KSeF for […]

Governments throughout the world are implementing government mandated e-invoicing for its ability to facilitate compliance and track fraud quickly and efficiently. Driven by the continual growth of global digitization, governments are increasingly leveraging technology to review every transaction in real-time. Real-time monitoring and enforcement has introduced a range of potentially costly penalties ranging from fines […]

Unlike many other country initiatives that we have seen in the e-invoicing space recently, Australia does not seem to have any immediate plans to introduce continuous transaction controls (CTC) or government-portal involvement in their B2B invoicing. Judging from the recent public consultation, current efforts are focused on ways to accelerate business adoption of electronic invoicing. […]

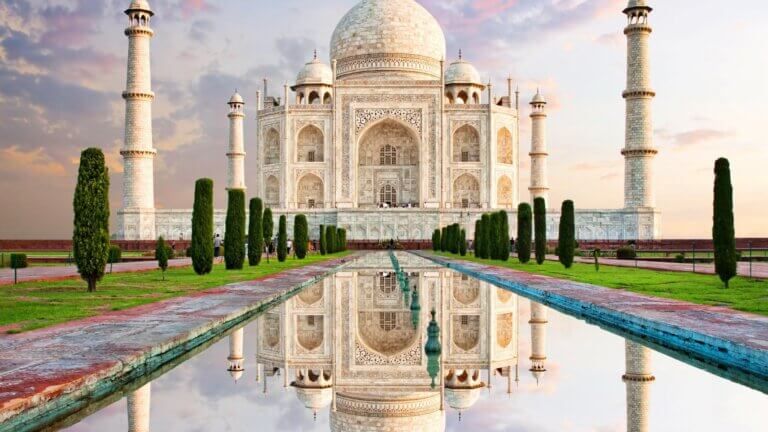

On 24 February 2022, the Indian Central Board of Indirect Taxes and Customs (CBIC) issued a notification (Notification No. 01/2022 – Central Tax) that lowered the threshold for mandatory e-invoicing. In India, e-invoicing is mandatory for taxpayers when exceeding a specific threshold (businesses operating in certain sectors are exempted). The current threshold for mandatory e-invoicing […]

Update: 7 December 2023 by Carolina Silva Spain Establishes Billing Software Requirements The long-awaited Royal Decree, establishing invoicing and billing software requirements to secure Spanish antifraud regulations, has been officially published by the Spanish Ministry of Finance. The taxpayers and SIF developers, defined further below in this article, must be aware of several new official […]

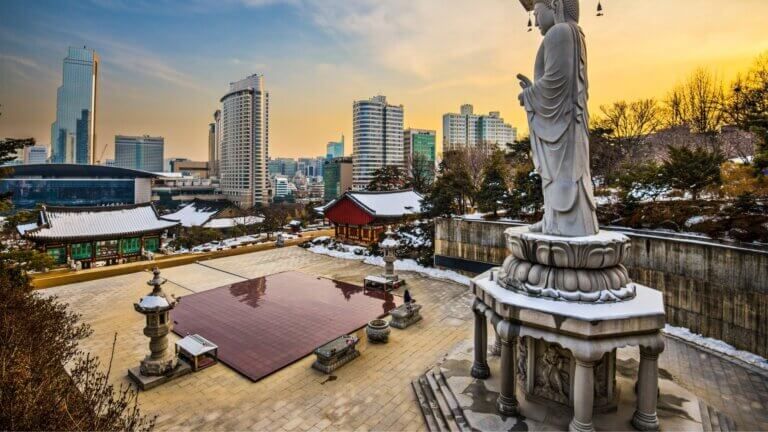

South Korea has an up-and-running e-invoicing system that combines mandatory e-invoicing with a continuous transaction controls (CTC) reporting obligation. This mature and well-established system, launched over a decade ago, is seeing its first significant changes in years. Presidential Decree No. 31445 (Decree) has recently amended certain provisions of the Enforcement Decree of the Value-Added Tax […]

During the last decade, the Vietnamese government has been developing a feasible solution to reduce VAT fraud in the country by adopting an e-invoice requirement for companies carrying out economic activities in Vietnam. Finally, on 1 July 2022, a mandatory e-invoicing requirement is scheduled to enter into force nationwide. 2020 e-invoicing mandate postponement Despite the […]

On 30 January 2022, the Zakat, Tax and Customs Authority (ZATCA) published an announcement on its official web page concerning penalties for violations of VAT rules, and it is currently only available in Arabic. As part of the announcement, the previous fines have been amended, ushering in a more cooperative and educational approach for penalizing […]

Towards the end of 2021, the tax authority in Turkey published a draft communique that expands the scope of e-documents in Turkey. After minor revisions, the draft communique was enacted and published in the Official Gazette on 22 January 2022. Let’s take a closer look at the changes in the scope of Turkish e-documents. Scope […]

The Tax Bureaus of Shanghai, Guangdong Province and Inner Mongolia Autonomous Region have all issued announcements stating they intend to carry out a new pilot program for selected taxpayers based in some areas of the provinces. The pilot program will involve adopting a new e-invoice type, known as a fully digitized e-invoice. Introduction of a […]

Sovos’ 13th annual Trends report takes an in-depth look at the world’s regulatory VAT landscape. Governments globally are enacting new policies and controls to close their tax gaps. These changes affect all companies doing business internationally, regardless of the location of their headquarters. With authorities now inserting themselves into every aspect of business operations, organisations […]