Blog

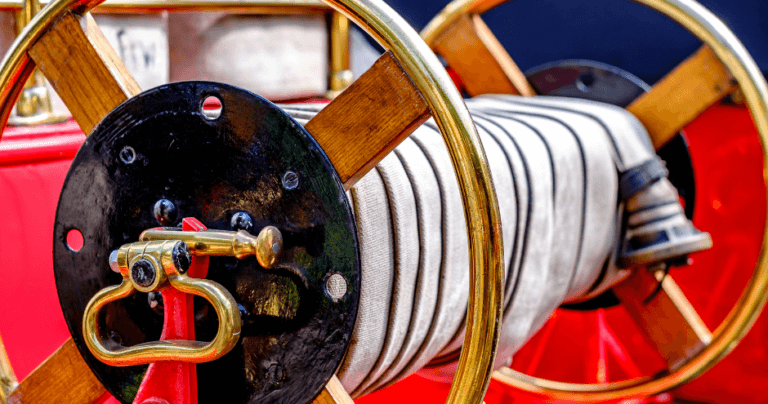

There are several countries within the European Union (EU) and European Economic Area (EEA) that have introduced a Fire Brigade Tax (FBT). Fire Brigade Tax is payable on certain premium amounts and usually in addition to Insurance Premium Tax (IPT). Fire Brigade Tax, or the Fire Brigade Charge (FBC) or Fire Protection Fee (FPF) as […]

For Insurance Premium Tax, Location of Risk is vital in determining the correct tax. In this episode of the Sovos Expert Series, Anita Blanusic asks James Brown, IPT Consultant, to explain the Location of Risk for marine insurance and how it’s determined. Listen as he answers the following questions: What is meant by marine […]

The world of Insurance Premium Tax (IPT) is ever changing, with countries updating rates and thresholds whenever the need arises, introducing new taxes regularly and adjusting tax rates to adapt to changes within a country. But how do you keep up with so much change when you’re already busy doing your job? Parliamentary debates One […]

Update: 27 July 2023 by Edit Buliczka Changes to IPT registration requirements in Austria The registration requirements for settling taxes in a country are similar – if not the same, usually involving the central tax administration or tax authority. This, however, is not always the case and there are exceptions. For example, due to a […]

Continuing our IPT prepayment series, we take a look at Italy’s requirements. In previous articles we have looked at Belgium, Austria, and Hungary. All insurers authorised to write business under the Italian regime have a legal obligation to make an advance annual payment for the following year. What is the prepayment rate in Italy? The […]

Update: 17 April 2025 by Edit Buliczka New IPT Prepayment Rules in Hungary Starting in 2025, new prepayment rules will apply to the Extra Profit Tax on Insurance Premium Tax (EPTIPT). The current structure of two prepayments—due in May and November—will be replaced by a single prepayment, which must be made by 10 December 2025. […]

In the next edition of our series of blogs in Insurance Premium Tax (IPT) prepayments, we look at a less familiar regime to many, the Austrian IPT Prepayment. IPT prepayments in Austria Those who are well versed in the IPT sphere will be perplexed at this blog, as they most likely will never have paid […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and insurance premium tax (IPT) compliance services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about regulatory changes and developments in global tax regimes, to […]

It’s time to return to Insurance Premium Tax (IPT) prepayments – a continuation of our blog series on the important IPT topic. You can find the first entry in our blog series here. Throughout Europe’s different countries and jurisdictions, IPT is declared and settled in different ways. Monthly, quarterly, biannually – this varies across Member […]

The Dutch government issued an updated Policy Statement for Insurance Premium Tax (IPT) on 12 May 2022. The first of its kind since February 2017, the update is intended to replace the 2017 version in full. While much of the content remained consistent, there were notable details pertaining to Netherlands storage insurance and ‘own transport’ […]

There are some countries across Europe where declaring and settling insurance premium tax (IPT) and parafiscal charges on time is not enough to prevent late payment penalties. You may ask why. Or you may say it’s unfair. The answer is simple. Some European countries collect insurance premium tax and parafiscal charges or part of them […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about regulatory changes and developments in global tax regimes, to support you in your […]

An increasing insurance premium tax (IPT) trend is using transactional level information in various returns and reports. Preparation and education are key to ensuring details are being captured on an ongoing basis rather than at the last moment. Furthermore, in some cases where legacy systems are being utilised and don’t have the capability to capture […]

A parafiscal tax is a levy on a service or a product which a government charges for a specific purpose. It can be used to financially benefit a particular sector (public and private). Unlike the drastic changes in Stamp Duty reporting within the Portuguese region, the parafiscal taxes have remained consistent and unchanged for many […]

Update 7 October 2024 by Edit Buliczka Hungarian Tax Office Updates IPT Declaration Form for 2023 The procedure necessary to correct an underdeclared premium figure in Hungary can be complicated. The complexity of a correction for return form 2320 has become even more challenging. Following a Sovos query, the Hungarian Tax Office (HUTA) updated the […]

Identifying the location of risk for Insurance Premium Tax (IPT) purposes is the first step to ensuring IPT compliance in a given territory. This area perhaps isn’t as straightforward as it first seems for marine insurance. As with the location of risk rules for all classes of insurance in Europe, the starting point for marine […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about regulatory changes and developments in global tax regimes, to support you in […]

Insurance Premium Tax in Italy is complex. This blog helps insurers navigate challenges in Italy, from IPT rates to reporting requirements. You can find all recent updates on IPT in Italy below in the update section. Read our Insurance Premium Tax guide for an overview of IPT in general. Update: 16 August 2024 by James Brown IPT […]