Blog

When it was announced recently that the introduction of a new French e-invoicing mandate had been delayed until September 2026 there was a collective sigh of relief amongst many in the tax and finance world. More time to adequately prepare, put systems and methodologies in place and have your business ready to be compliant from […]

E-documents or electronic documents are rapidly growing in usage across businesses of all shapes and sizes, in countries around the world. While the automated exchange of e-documents is a relatively new phenomenon which is being adopted on a country-by-country basis, there is basic universal information that your business would benefit from understanding – and potentially […]

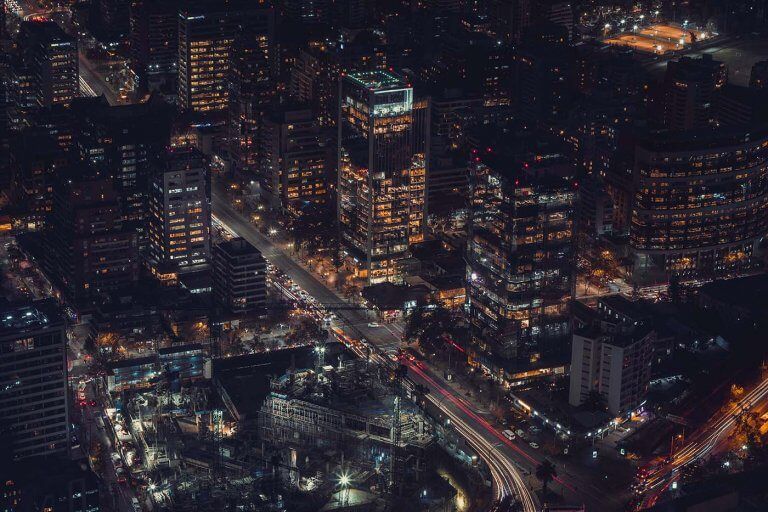

The Chilean Internal Revenue Service (SII) recently published version 4.00 of the document describing the format of electronic tickets for Sales and Services. The electronic ticket (or Boleta Electrónica) is an electronic receipt issued for the sale of goods or services to individuals, consumers or end users. The document includes basic information about the transaction, […]

Extension of the implementation dates of the B2B e-invoicing Mandate. Update: 9 December 2024 On September 15th, 2024, the French Tax Authorities published a Press Release announcing a profound change in the upcoming French Mandate for electronic e-invoicing & e-reporting. Indeed, the Public Portal (aka PPF) will no longer provide e-Invoicing Services, making it compulsory […]

Update: 12 September 2025 by Kelly Muniz Expansion of E-invoicing Scope Malaysia has expanded the scope of its mandatory e-invoicing requirements to include additional types of activities/transactions, according to the latest E-Invoice Specific Guideline (Version 4.4) released on 12 September 2025 by the Inland Revenue Board of Malaysia (IRBM). Key Updates Effective 1 January 2026, two additional […]

The Portuguese government has been working on introducing mandatory B2G (Business-to-Government) electronic invoicing in recent years, alongside other obligations for the digitization of VAT compliance in the country. This aligns with the European Union’s efforts towards harmonising the adoption of e-invoicing in public procurement. To achieve this goal, the EU has implemented Directive 2014/55/EU to outline […]

The Electronic Invoicing Law of the Dominican Republic was published on 17 May 2023, mandating e-invoicing throughout the territory as of 18 May 2023. The law was published in the Official Gazette, whose purpose is to regulate the mandatory use of electronic invoicing in the Dominican Republic, including the establishment of the electronic invoicing tax […]

The Spanish government has published the much-anticipated draft regulation with the framework for implementing mandatory B2B e-invoicing. The proposed legislation outlines the operation of the Spanish e-invoicing system. Its main feature is the reliance on the principles of interoperability of e-invoice formats and interconnectivity of e-invoicing platforms. The goal is to promote digitalization (particularly for […]

According to the latest global market report, Billentis, the Asia Pacific region is expected to achieve the highest annual e-invoice volume growth rates compared to Latin America and Europe until 2025. This is mainly because the Asian market, outside of South Korea, is new to the tax digitization journey and is accelerating the adoption of e-invoicing as […]

Japan’s new e-invoice retention requirements are part of the country’s latest Electronic Record Retention Law (ERRL) reform. Along with measures such as the Qualified Invoice System (QIS) and the possibility to issue and send invoices electronically via PEPPOL, Japan is implementing different indirect tax control measures, seeking to reduce tax evasion and promote digital transformation. […]

What is TicketBAI? TicketBAI is a joint project of the Provincial Treasuries and the Government of the Basque Country with the objective of implementing a series of legal and technical obligations for the taxpayers’ invoicing software. These obligations allow the tax authorities to control their economic activities, especially those in the sector of sales of […]

5 Questions to Ask Yourself Note: The Finance Law for 2024 has been officially adopted and published in the Official Gazette on 30 December 2023. Our blog, France: B2B E-Invoicing Mandate Postponed, is promptly updated whenever there are changes to the rollout of the French mandate. Tax compliance in France is already complicated. New e-invoicing […]

Bizkaia is a province of Spain, and a historical territory of the Basque Country, with its own tax system. Before the approval of the Batuz strategy, the Bizkaia tax authority developed different approaches to implement a comprehensive strategy that would reduce tax fraud. The goal was to stop fraud from affecting revenue generated from economic […]

Northern European Jurisdictions: CTC Update The European Commission’s VAT in the Digital Age (ViDA) proposal continues to unfold with the latest details published on 8 December 2022. As a result, many EU countries are stepping up their efforts towards digitising tax controls – including mandatory e-invoicing. While we see different approaches to initiate this transition […]

Note: The Finance Law for 2024 has been officially adopted and published in the Official Gazette on 30 December 2023. Our blog, France: B2B E-Invoicing Mandate Postponed, is promptly updated whenever there are changes to the rollout of the French mandate. France will implement a mandatory B2B e-invoicing and an e-reporting obligation. Every company operating in […]

You have SAP and you need a solution to manage your e-invoicing compliance. What should you do? As an SAP user, when it comes to implementing an e-invoicing solution you basically have two choices in the approach you take. You can build your own tools on SAP architecture or select an end-to-end provider. These are […]

Thailand has permitted e-invoicing since 2012. From 2017 – following regulations issued on e-tax and e-receipts – taxpayers may prepare, deliver, and keep their invoices and receipts electronically, subject to prior approval from the Thai Revenue Department. Currently, the Revenue Department and the Electronic Transactions Development Agency (ETDA) are working together to improve the e-tax […]

Electronic invoicing in Poland via KSeF has undergone a long journey. Providing new expectations for B2B and B2G transactions alike, it is vital for taxpayers to understand what’s to come – though that can be tough when rules and regulations change frequently. This blog provides a comprehensive timeline of Poland’s advancement towards its e-invoicing mandate, […]