Blog

Compliant archiving of original invoices and similar tax-relevant documents has long been overlooked. As companies gradually made the move to digitize existing paper processes, invoicing became a prime area for transformation into e-invoicing. However, requirements for long-term electronic archiving in traditional tax law were not always adapted in time to reflect the specific challenges of […]

Finland’s government already receives over 90% of invoices electronically. Aiming to expand the use of e-invoices in B2B transactions, the country has granted B2B buyers the right to receive a structured electronic invoice from their suppliers if requested. The scheme applies to all Finnish companies with a turnover above €10,000 and came into force on […]

On 3 April 2020, storage guidelines for e-ledger were published by the Turkish Revenue Authority (TRA). The guidelines set out the requirements and standards for special integrators, and the requirements for supporting secondary storage services for e-ledgers, e-ledger summary report (Berat) files and other documents created through the e-ledger system. Background The Communique, first published […]

Update: 3 May 2024 by Dilara İnal Israel Continuous Transaction Controls Rollout Postponed The Israeli Tax Authority (ITA) has postponed the rollout of Israel’s continuous transactions controls (CTC) mandate. The deduction of input tax is allowed with this second postponement, even in the absence of an allocation number, until 4 May 2024. The previous cut-off […]

On March 26, 2020, TRA published an announcement that postpones the deadlines for submitting e-Ledgers and e-Ledger summary reports ( berats). While the impact of COVID-19 takes hold around the world, we’ve been watching the different governments adapt to accommodate changes to support businesses and their economies. It is now Turkey’s turn. The General Communique […]

India’s e-invoicing reform has been introduced as a very important step towards digitizing the country´s tax controls. Even though the reform has been under discussion for more than a year, the initial roll-out for the implementation process would have been a challenge for all stakeholders which was finally set to begin mandatorily on 1 April […]

The economic impact and consequences of coronavirus are unprecedented as it spreads across different countries. To protect their markets, many countries have reacted by loosening obligations and lowering rates. While most of these initiatives have an immediate impact on a business’s cashflow and are welcome they also, in many cases, have a long-term impact on […]

In the past five years, transaction automation platform vendors who embraced e-invoicing and e-archiving compliance as integral to their services grew on average approximately 2.5 to 5 times faster than the market. Two decades of EU e-invoicing: many options, different models Until 1 January 2019, when Italy became the first European country to mandate B2B […]

For companies operating in Turkey, 2019 was an eventful year for tax regulatory change and in particular, e-invoicing reform. Since it was first introduced in 2012, the e-invoicing mandate has grown, and companies are having to adapt in order to comply with requirements in 2020 and beyond. According to the General Communique on the Tax […]

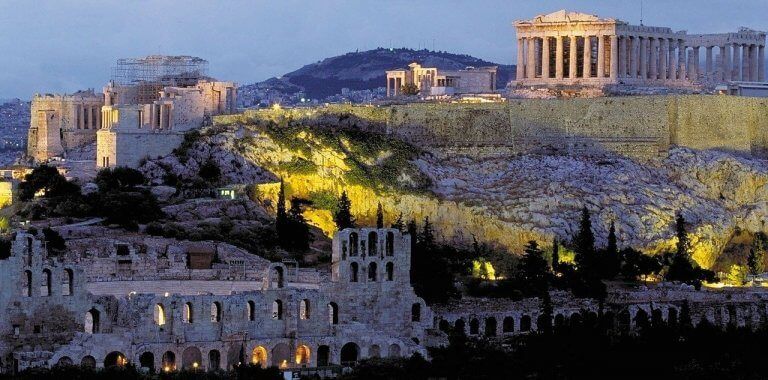

New go-live date for myDATA legislation A new roll-out date for the myDATA e-books mandate was announced by the Greek tax authority, the IAPR, during a recent meeting with local industry groups. While nothing is formal and binding until it’s been codified through law, the tax authority seems to have made up its mind about […]

The expansion of Poland’s new SAF-T report (JPK) barely took effect before Poland is steaming ahead with a more far reaching plan. It aims to introduce a centralized e-invoice system via an exchange platform in 2022. In an interview published on the Polish Ministry of Finance webpage, the Minister of Finance says that implementing mandatory […]

With roughly two weeks to go until the first mandatory phase of India’s e-invoicing reform was set to go live, the GST Council has now decided to slam the breaks and halt the go-live. Or at least, bring it to a significant temporary standstill of 6 months, until 1 October 2020. Following a long list […]

Anyone predicting clearance model e-invoicing system, Italy’s FatturaPA, would undergo further reform would be right. Agenzia delle Entrate – AdE, the Italian tax authority, has issued new technical specifications and schemas for Italian B2B and B2G e-invoices. But – what do these changes really mean? And what impact do they have on business processes? Technical […]

The Turkish Revenue Administration (TRA) has now published the long-awaited e-Delivery Note Application Manual. The manual clarifies how the electronic delivery process will work and answers frequently asked questions. It addresses the application as well as its scope and structure, outlines important scenarios and provides clarity for companies who are unclear about the adoption of […]

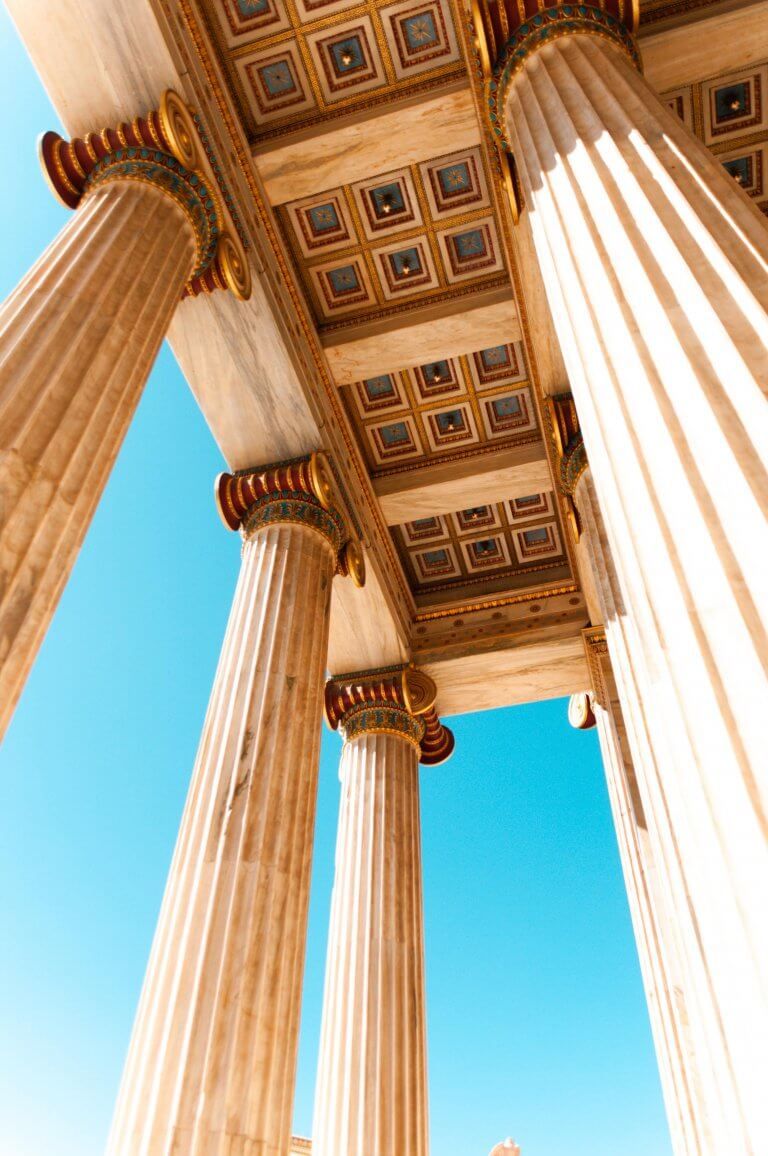

The upcoming tax reform in Greece is expected to manifest itself in three continuous transaction control (CTC) initiatives. The myDATA e-books initiative, which entails the real-time reporting of transaction and accounting data to the myDATA platform which will in turn populate a set of online ledgers maintained on the government portal; Invoice clearance, which is […]

Certification of e-invoice service providers is an important first step and milestone ahead of the implementation of e-invoicing in Greece. The Greek Government has now defined the regulatory framework for e-invoice service providers, their obligations, and a set of requirements needed to certify their invoicing software. Key details and parameters Scope E-invoice service providers are […]

Italy has been a pioneer when it comes to automating e-invoicing processes. It first introduced a B2G e-invoicing system in 2014 which has since evolved into a robust and mandatory platform for the exchange of invoices now also expanded to include B2B and B2C transactions. The Italian central e-invoicing platform SDI was considered revolutionary by […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]