Blog

Sovos recently participated in a roundtable discussion facilitated by the IRS regarding digital asset reporting requirements. This session provided valuable insights into the upcoming 2025 reporting landscape and clarified several critical points for digital asset businesses preparing for compliance. IRS Position on 2025 Digital Asset Reporting Timeline Based on recent industry roundtable discussions with IRS […]

As some countries either introduce or consider introducing mandatory natural catastrophe insurance (e.g., Italy this year), France is ahead of the curve. This is because France already has a specific compensation scheme in place for coverage of property against natural disasters, and has had one since 1982. The importance of the scheme is clear, as […]

Hungary’s tax penalty consequences of non-compliance with tax requirements are governed by the Act on Rules of Taxation. The law outlines a range of sanctions for non-compliance, including tax penalties, default penalties, late payment interest and self-revision fees. This blog will provide an overview of each sanction and summarize recent changes in this area. Types […]

VAT in the Digital Age (ViDA) aims to modernize and simplify the European VAT system. ViDA was officially adopted by the EU on 11 March 2025. The package took 27 months to be approved and adopted, with the initiative initially being proposed by the European Commission in 2022. The path to adoption included many versions […]

From groceries to clothing, consumers expect convenience—and that includes how they purchase alcohol. While direct-to-consumer (DtC) shipping is widely available for wine, beer lags far behind, with legal shipping allowed in only 11 states and Washington, D.C. On National Beer Day, there’s no better time to highlight why beer trails behind in DtC access and […]

As governments worldwide continue to shift to Continuous Transaction Controls (CTC) systems, such as e-invoicing and real-time e-reporting, another trend organically unfolds as part of this move towards tax digitisation: pre-filled returns. With access to real-time transactional level data – and other types of data, such as payroll, inventory and other accounting data transmitted at […]

Believe it or not, there’s more to life than beer. There’s wine, spirits, cider, kombucha, hard seltzers—even non-alcoholic products. But just because a brewery has mastered beer does not mean it’s ready to begin making and selling other types of alcoholic beverages. When a brewery moves to expand its offerings and enter new markets, new […]

In a previous blog, we provided an overview of the current and proposed natural disaster-related measurements in some European countries and Australia. In this blog, we will focus on the possible EU-level solution proposed by the European Central Bank (ECB) and the European Insurance and Occupational Pensions Authority (EIOPA) in their latest discussion paper, issued […]

Craft beer drinkers want more choices. Brewers want more opportunities. And yet, legal barriers still stand in the way of direct-to-consumer (DtC) beer shipping. The 2025 Direct-to-Consumer Beer Shipping Report, produced by Sovos ShipCompliant in partnership with the Brewers Association, reveals how consumer demand, regulatory restrictions and potential revenue opportunities continue to shape the DtC […]

The 2025 Direct-to-Consumer Wine Shipping Report offers more than just data—it provides valuable insights into the trends shaping the industry and the factors driving change. To delve deeper into these findings, industry experts Andrew Adams from WineBusiness Analytics and Alex Koral from Sovos ShipCompliant joined forces in a recent webinar, unpacking the key takeaways. Their […]

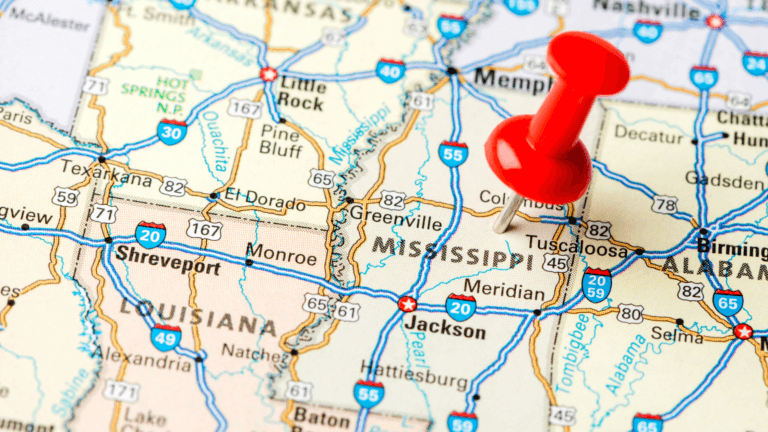

In a shockingly quick turn of events, the Mississippi governor has signed a bill that will enable the direct-to-consumer (DtC) shipping of wine, making it the 48th state to grant its residents greater access to the national wine market. The bill, SB 2145, is set to take effect on July 1, 2025, which should mean […]

In the fall of 2024, New York became the latest state to open its doors to direct-to-consumer (DtC) spirits shipping, marking a significant milestone for the industry. As one of the most populous states with a thriving market for craft and high-end spirits, the shift was expected to create substantial new opportunities for distilleries nationwide. […]

Mark your calendars – April 11, 2025 and August 15, 2025 are this year’s anticipated release dates for the Delaware’s Secretary of State (SOS) VDA program invitations. In the event that an organization receives an invitation to participate in the Voluntary Disclosure Agreement (VDA) program , companies must seriously consider what it means and act […]

Talk of tariffs dominates the current news cycle with some commentators suggesting that tariffs will spell disaster for our economy while others say the exact opposite. We’ve seen the stock market sometimes fluctuate as tariffs are announced but later suspended, leaving us to wonder whether an aggressive tariff policy is good, bad or something in […]

By Tom Wark, Executive Director, National Association of Wine Retailers We are often reminded by the media and those in the wine industry—as well as by wine enthusiasts—that the three-tier system of alcohol distribution in most states hinders consumer access to the expansive number of wines available in this country. Some would argue that the […]

Reporting digital asset transactions on Form 1099-DA just got a little more complicated. For 2025 transactions, crypto brokers that file Form 1099-DA with the IRS will be required to file the 1099-DA with the State of Montana. This makes Montana the first state to introduce a 1099-DA reporting requirement in its guidance. For background, every […]

The direct-to-consumer (DtC) wine shipping channel faced a storm of challenges in 2024, navigating some of the toughest market conditions in over a decade. As inflation tightened wallets and consumer behaviors shifted, the industry recorded its steepest declines in shipment volume and value since the inception of the Direct-to-Consumer Wine Shipping Report in 2010. The […]

The U.S. Department of the Treasury and the Internal Revenue Service (IRS) have finalized regulations under Internal Revenue Code § 6045, extending information-reporting obligations to transactions involving digital assets. Beginning with calendar-year 2025 activity (to be reported in 2026), brokers must file Form 1099-DA, Digital Asset Proceeds from Broker Transactions, and furnish corresponding payee statements […]