Blog

John Sileo, who has spoken at the Pentagon and to Visa, Pfizer and the FDIC – among many other institutions – will headline the Sovos Intelligent Reporting Summit in Denver in October. A leading expert on cybersecurity and identity theft, Sileo draws on his experience as a victim of identity theft to entertain and teach […]

Real-time electronic audits are increasingly common throughout Latin America, requiring companies to maintain 100% accuracy in their electronic documents and record-keeping. This process all starts with the eInvoice – audits are triggered if an invoice isn’t submitted correctly or if it is inconsistent with eAccounting reports and other electronic filings from a company’s buyers and […]

International News EU Proposes An Interim Tax On Certain Revenue From Digital Activities The European Commission recently proposed new rules to ensure the fair taxation of digital business, placing the EU at the forefront in designing tax laws aimed at the modern digital economy. The Commission is seeking to instate an interim tax to generate […]

Brazil’s eInvoicing and electronic reporting measures are undergoing a major overhaul in 2018. Companies that are not already in compliance with the new eInvoicing schema, NFe version 4.0, and REINF, a new digital bookkeeping requirement, need to update their processes immediately, as the deadlines for each are imminent. The new specifications for Brazil’s eInvoicing schema, […]

In just a few short days (on April 17) the United States Supreme Court will hear oral arguments in the case of South Dakota v. Wayfair Inc. At stake is the future of the “physical presence” standard in determining a retailer’s obligation to collect and remit state and local sales tax throughout the country. While […]

Many companies may consider government-mandated eInvoicing regulations a hassle, requiring them to revamp time-tested processes and upgrade to new technologies while adding new responsibilities and risk throughout the organization. However, eInvoicing can ultimately deliver business benefits, reducing costs, streamlining workflows and driving ROI. Consider these top 6 positive impacts of eInvoicing: Reducing costs – In […]

Allocating business profits for audit penalties because your accounts payable process has traditionally incurred sales and use tax fines and penalties is no way to grow a business. In a recent webinar, “Building a Scalable Process for Use Tax Compliance,” experts from both Sovos and Grant Thornton discussed the market trends and risks related to […]

An important part of unclaimed property compliance is sending due diligence letters. Based on your holder type, each state has a specific time window and dollar threshold above which you need to send them. Not only is this an expectation of the state, but it’s also good customer service. If you are a company who […]

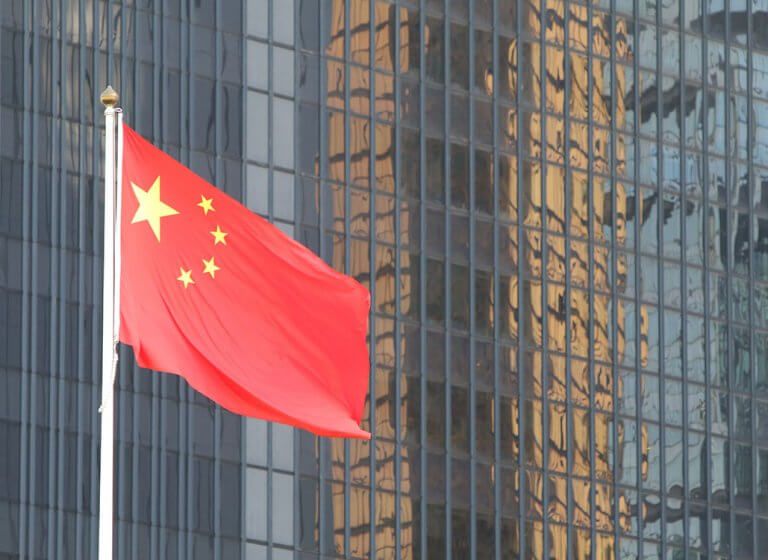

As a part of the Golden Tax System, the well-known tax administration system in China, the Third Stage of this system named ‘Golden Tax III’ has been fully implemented for more than a year. The goal of this stage is to establish a consistent tax administration backed by information technology and to enable highly efficient […]

The Affordable Care Act (ACA) is still in place and carries with it compliance requirements and the potential for steep financial penalties. ACA forms are due to the IRS April 2, 2018 if filed electronically. Penalties for late filing are severe. Failure to file information returns will result in a penalty of $260/return with a […]

In quest’ultimo anno, si è parlato molto, talvolta anche speculando, della situazione della fatturazione elettronica in Italia e, più precisamente, dell’ipotesi che l’Italia potesse o meno rendere obbligatorio l’interscambio di fatture elettroniche per tutte le forniture di beni e servizi. Dopo avere ripetutamente riferito di questi sviluppi man mano che si producevano, Sovos ritiene di […]

These days, if you put two or more sales tax professionals into a room, it won’t be long before the conversation turns to the South Dakota v. Wayfair case currently scheduled for oral arguments before the Supreme Court on April 17. In fact, with 38 Amicus Curiae briefs filed to date, it feels like the […]

In theory, VAT collection should be a neutral event for companies, since the tax is born and paid for by the consumer. However, with a significant value of taxes passing through your company, VAT can be a major liability if it is not claimed, collected and settled properly. Companies often view VAT as nothing more […]

Introduced in 2010, eInvoicing in Peru is undergoing a major shift in 2018, reaching an increasing number of taxpayers and requiring an entirely new technical structure. Summary of the Peru eInvoicing Law Peru’s new and updated regulations expand the universe of taxpayers mandated to comply with electronic invoicing in that country. In this context, Peru […]

Businesses across Europe have been so focused on updating their processes and technologies to ensure they can transmit data under new VAT compliance and reporting regulations that they are often overlooking an important piece of the puzzle: reconciliation. VAT regulations are becoming more complex, with businesses being required to report and share detailed transactional data, […]

Caroline Bruckner is the managing director of the Kogod Tax Policy Center at the Kogod School of Business at American University in Washington, DC. She is heavily involved in consulting with Congress on tax policy and in 2016 published the study Shortchanged: The Tax Compliance Challenges of Small Business Operators Driving the On-Demand Platform Economy. […]

During the past couple of years, Colombia has been implementing a Clearance-type e-invoicing mandate, much in line with trends that we have seen across the world. The speed in which DIAN, the Colombian tax authority, has introduced changes and rolled out the mandate is much higher than average, with momentum only having been overtaken by […]

Procure-to-Pay Challenges Accounts payable within large, distributed businesses can be a complex, disconnected process involving many different departments. Magnify this complexity with the numerous types of business assets and materials your employees are purchasing across the country from various suppliers for multiple locations and uses, and you have a recipe for sales and use tax […]