Blog

What is Intrastat? Intrastat is a reporting regime relating to the intra-community trade of goods within the EU. Under Regulation (EC) No. 638/2004, VAT taxpayers who are making intra-community sales and purchases of goods are required to complete Intrastat declarations when the reporting threshold is breached. Intrastat declarations must be completed in both the country […]

Progress has been made in the roll-out of the Polish CTC (continuous transaction control) system, Krajowy System of e-Faktur. Earlier this year, the Ministry of Finance published a draft act, which is still awaiting adoption by parliament to become law. Draft e-invoice specifications have been released and there has been a public consultation on the […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about new regulatory changes, ensuring you stay compliant. We spoke to Wendy Gilby, […]

More than 170 countries throughout the world have implemented a VAT system, and some of the most recent adopters are the Gulf countries. In a bid to diversify economic resources, the Gulf countries have spent the past decade investigating other ways to finance its public services. As a result, in 2016 the GCC (Gulf Cooperation […]

A current mega-trend in VAT is continuous transaction controls (CTCs), whereby tax administrations increasingly request business transaction data in real-time, often pre-authorising data before a business can progress to the next step in the sales or purchase workflow. When a tax authority introduces CTCs, companies tend to view this as an additional set of requirements […]

While many Latin American countries have begun to implement taxation on digital services, Mexico is currently leading the charge and has established a strong track record that other countries are hoping to match. Chile and Ecuador have both recently passed similar legislation with hopes of finding similar success and attracting more global fintech brands. The […]

Turkey’s e-transformation journey, which started in 2010, became more systematic in 2012. This process first launched with the introduction of e-ledgers on 1 Jan 2012 and has since reached a much wider scope for e-documents. The Turkish Revenue Administration (TRA), the leader of the e-transformation process, has played an important role in encouraging companies to […]

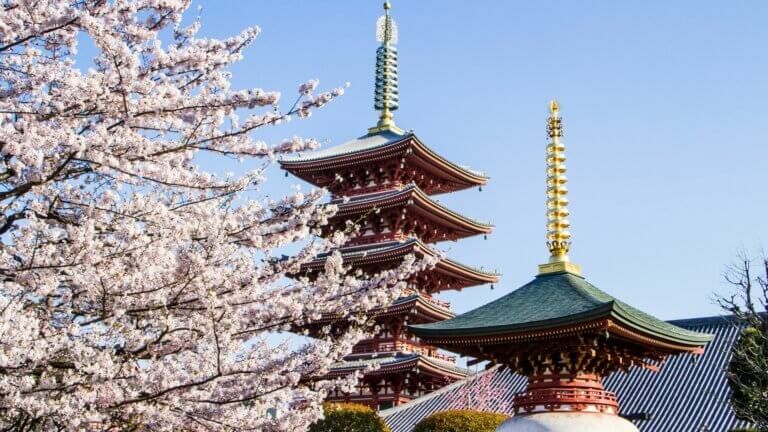

Update: 23 March 2023 by Dilara İnal Japan’s Qualified Invoice System Roll-out Approaches Japan is moving closer to the roll-out of its Qualified Invoice System (QIS), which will happen in October 2023. Under QIS rules, taxpayers will only be eligible for input tax credit after being issued a qualified invoice. However, exceptions exist where taxpayers […]

In this blog, we provide an insight into continuous transaction controls (CTCs) and the terminology often associated with them. With growing VAT gaps the world over, more tax authorities are introducing increasingly stringent controls. Their aim is to increase efficiency, prevent fraud and increase revenue. One of the ways governments can gain greater insight into […]

Since 1993, supplies performed between Italy and San Marino have been accompanied by a set of customs obligations. These include the submission of paperwork to both countries’ tax authorities. After the introduction of the Italian e-invoicing mandate in 2019, Italy and San Marino started negotiations to expand the use of e-invoices in cross-border transactions between […]

France’s 2023 mandate will require businesses to issue invoices electronically for domestic transactions with taxable persons and to obtain ‘clearance’ on most invoices before their issue. Other transactions, such as cross-border and B2C, will be reported to the tax authority in the “normal” way. This will be a major undertaking for affected companies and although […]

In the digital age we live in, speed is essential. For companies wanting to compete on a global scale, acting fast is just as important as having the digital solutions to advance. Taking into consideration the effect of digitalization on globalization, businesses are outsourcing processes to specialists to keep pace and focusing on their core […]

Norway announced its intentions to introduce a new digital VAT return in late 2020, with an intended launch date of 1 January 2022. Since then, businesses have wondered what this change would mean for them and how IT teams would need to prepare systems to meet this new requirement. Norway has since provided ample guidance […]

This blog was updated on December 12, 2023 Sovos recently sponsored a benchmark report with SAP Insider to better understand how SAP customers are adapting their strategies and technology investments to evolve their finance and accounting organizations by utilizing SAP S/4HANA Finance. This blog hits on some of the key points covered in the report […]

Six months after Brexit there’s still plenty of confusion. Our VAT Managed Services and Consultancy teams continue to get lots of questions. So here are answers to some of the more common VAT compliance concerns post-Brexit. How does postponed VAT accounting work? Since Brexit, the UK has changed the way import VAT is accounted for. […]

In Poland, the Ministry of Finance proposed several changes to the country’s mandatory JPK_V7M/V7K reports. These will take effect on 1 July 2021. The amendments offer administrative relief to taxpayers in some areas but create potential new hurdles elsewhere. Poland JPK_V7M and V7K Reports The JPK_V7M/V7K reports – Poland’s attempt to merge the summary reporting […]

As detailed within our annual report VAT Trends: Toward Continuous Transaction Controls, there’s an increasing shift toward destination taxability which applies to certain cross-border trades. In the old world of paper-based trade and commerce, the enforcement of tax borders, between or within countries, was mostly a matter of physical customs controls. To ease trade and […]

Update: 25 October 2023 by Maria del Carmen Mexico releases Carta Porte Version 3.0 On 25 September 2023, the Tax Authority in Mexico (SAT) published Version 3.0 of the Carta Porte Supplement on its portal with some adjustments. The use of Version 2.0 of the Carta Porte became mandatory as of 1 January 2022 in […]