Leading compliance solutions provider meets record sales demand with 100% uptime for retail clients

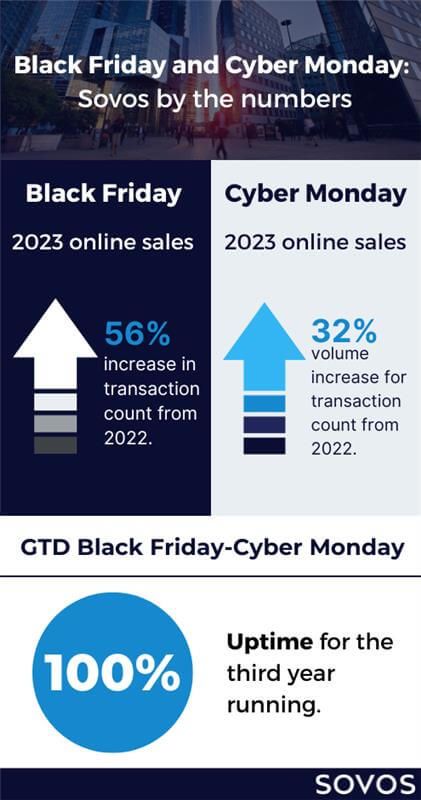

ATLANTA – December 1, 2023 – Global compliance technology solutions and services provider Sovos reports that its global tax rate calculation engine and database continues to provide industry-leading performance and reliability amid increasing sales during the year’s peak shopping days of Black Friday and Cyber Monday. On Black Friday, Sovos experienced a 56% increase in transaction count and a 10% increase in line-item count from 2022. Cyber Monday transaction count followed a similar trend, with a volume increase of more than 32% compared to 2022 numbers.

Sovos has prioritized investing in products and infrastructure to ensure seamless performance during these peak spending periods. From 24/7 monitoring to the state of Active/Active in place, Sovos teams succeed in providing clients with technology they can trust. As shopper turnout in stores and online hit an all-time high, according to the National Retail Foundation, Sovos customers experienced exceptional reliability, with 100% uptime and availability on Black Friday and Cyber Monday.

“Our retail partners rely on us throughout the year to help them process transactions quickly and secure revenue opportunities,” said Steve Sprague, chief product & strategy officer, Sovos. “Everyone understands the significance of these two days, where even small delays can lead to lost sales. It is a testament to our commitment to excellence that even with significant growth in the number of tax calculations processed, that Sovos posted another perfect score for our customers.”

By ensuring faster check out times, Sovos is transforming how the retail industry can enhance the customer experience. Retail sales tax complexities and nuances can often require quick system responses to rate changes, sales tax holidays, flash sales and more. All of these require a system that can keep pace, further protecting the customer relationship and the company’s bottom line.

“Quick and accurate calculations mean our clients can convert more online sales,” said Eric Lefebvre, CTO, Sovos. “Slow response times lead to abandoned carts and can mean that those dollars wind up in the hands of their competitors. With Sovos, our customers can have the confidence needed to meet all business needs.”

About Sovos

Sovos is a global provider of tax, compliance and trust solutions and services that enable businesses to navigate an increasingly regulated world with true confidence. Purpose-built for always-on compliance capabilities, our scalable IT-driven solutions meet the demands of an evolving and complex global regulatory landscape. Sovos’ cloud-based software platform provides an unparalleled level of integration with business applications and government compliance processes.

More than 100,000 customers in 100+ countries – including half the Fortune 500 – trust Sovos for their compliance needs. Sovos annually processes more than three billion transactions across 19,000 global tax jurisdictions. Bolstered by a robust partner program more than 400 strong, Sovos brings to bear an unrivaled global network for companies across industries and geographies. Founded in 1979, Sovos has operations across the Americas and Europe, and is owned by Hg and TA Associates. For more information visit http://www.sovos.com and follow us on LinkedIn and Twitter.