Your Guide to Form 1042 eFiling

Businesses must understand the requirements for electronically submitting Form 1042 eFiling returns.

The IRS released changes to electronic filing requirements for information returns effective with tax year 2024 returns for U.S. Withholding Agents.

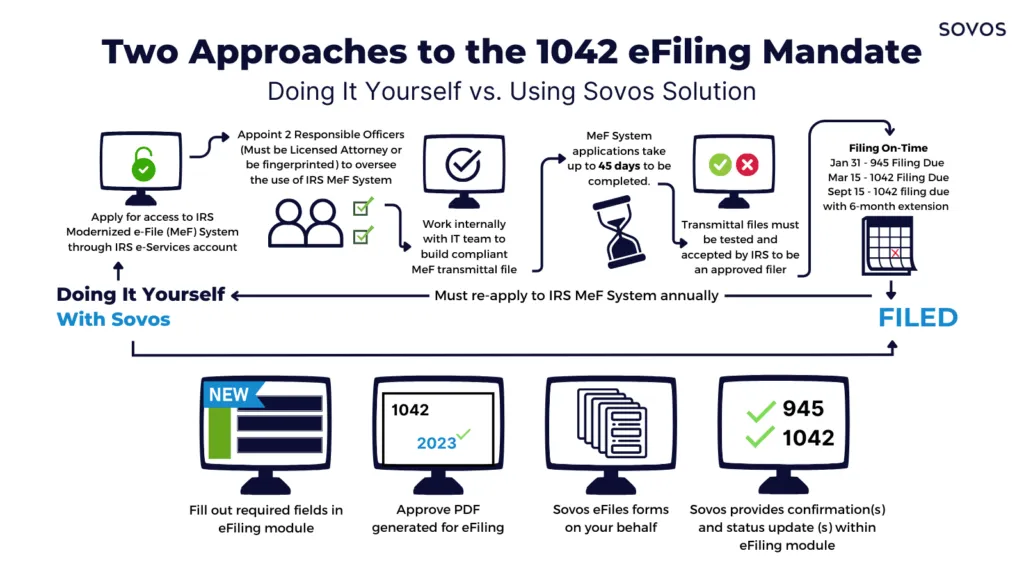

Businesses will no longer be allowed to submit paper returns for Form 1042 and must electronically file through the IRS’ Modernized e–File (MeF) system.

This guide will help businesses:

Better understand the new eFiling requirements for Form 1042

Learn the detailed, step-by-step registration process with the IRS MeF system

Comprehend the ramifications of failing to account for the eFiling updates

Understand compliance best practices for IRS filing requirements

Utilize the right solutions and services for 1042 eFiling needs

What is Form 1042?

Form 1042 (different from Form 1042-S) is an “Annual Withholding Tax Return for U.S. Source Income of Foreign Persons.” The form is used to report tax withheld on certain income of foreign persons. Unlike Form 1042-S, this form only needs to be submitted to the IRS, not to payees. Form 1042 is required to be reported anytime a 1042-S form is issued, regardless of if taxes were withheld.

Historically, the IRS did not allow electronic filings for Form 1042, forcing companies to file via paper mailings. However, since Tax Year 2022 allowed electronic filings through the IRS’ Modernized e-File (MeF) system. Starting with Tax Year 2024 reporting, the IRS will require US Withholding Agents to file Form 1042 electronically.

Updates on electronic filing requirements for Form 1042 returns

How will the Form 1042 eFiling requirements impact businesses? What will help to ensure compliance? There are several key things to keep in mind for electronically submitting returns in the upcoming filing season (and beyond).

Learn more about Form 1042 eFiling requirements.

Filing Form 1042 electronically requires access to the IRS’ MeF system. The registration process is not an easy or quick process – in fact, it can take months to complete from beginning to end and has to be renewed each year.

Pay attention to Form 1042 changes now

What exposure will your organization have if you continue to file Form 1042 via paper? We break down the importance of understanding that the IRS made changes to the reporting requirements for Form 1042 by no longer accepting paper filings starting with tax year 2023 filings.

Learn more about why Form 1042 changes are a big deal.

Evaluating your provider’s electronic 1042 filing readiness

Businesses must ensure that they are working with a provider that is prepared to handle the IRS updating the filing requirements for Form 1042 to be electronic. There are several things to keep top of mind when evaluating your provider’s electronic 1042 filing readiness.

Learn more about ensuring your provider is approved for MeF.

How Sovos helps with Form 1042 returns

Ensuring compliance with IRS requirements for Form 1042 electronic filing should be a top priority for businesses. Getting this process wrong could lead to financial penalties or audits.

Learn how with Sovos’ tax withholding process.

Frequently Asked Questions

Congress made the change to the eFile requirements in the Taxpayer First Act of 2019, which included provisions for IRS Modernization. The IRS’ latest tax gap estimates indicate that underreporting of taxes makes up $542 billion of the federal tax gap, comprising nearly 80% of the total projected gap of $688 billion. Transitioning more of the IRS’ operations to modernized, electronic systems allows the IRS to expedite and enhance the accuracy of tax calculations and refunds, aiming to narrow the growing tax gap while reducing fraudulent activity.

You can learn more by reading final regulations amending the rules for filing returns electronically from the Department of the Treasury and from the IRS.

No, in addition to Financial Institutions being required to file all 1042 filing returns electronically, any withholding agent filing at least 10 returns of any type during the calendar year in which the Form 1042 is required to be filed must file Form 1042 electronically. Filing return types include information returns (for example, Forms W-2, Forms 1099, Forms 1042-S), income tax returns (for example, Form 1042), employment tax returns, and excise tax returns. Withholding agents that are individuals, estates or trusts are not required to file Form 1042 electronically.

As it currently stands, the IRS does not allow for attachments of supplemental paper documents, including copies of 1042-S forms (in compliance with Line 67) or any supplemental supporting documents.