Content Library

Don’t just take our word for it. There’s a reason Sovos products are used by over half the Fortune 500 and the world’s smartest companies.

Because the IRS is underpaid by nearly half a trillion dollars per year, they are taking swift action to reclaim those tax dollars. This could mean steep penalties for your business if you fail to meet the latest regulations. See the infographic below for more facts about enforcement.

IRA withholding remitting, reporting and reconciling can be difficult for organizations to manage at a federal level, but it gets even more complicated when you add states to the mix. Each state has their own remitting and reporting frequencies, thresholds, requirements and penalty structures. Because of this, it can be hard to determine if and […]

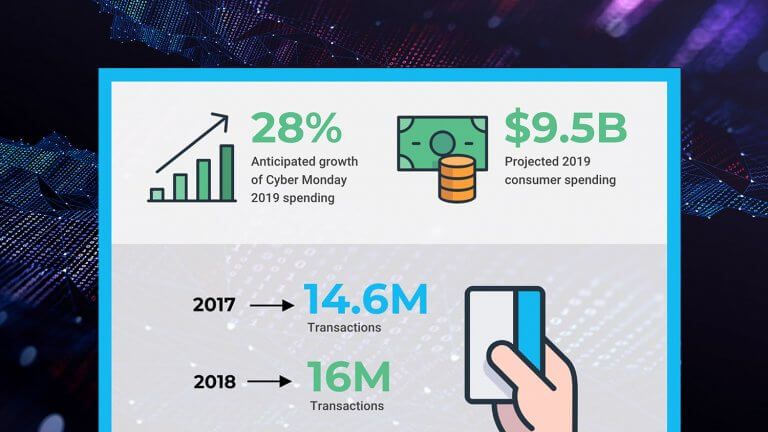

Cyber Monday 2019 is anticipated to be one of the most challenging to date for ecommerce and finance teams. More spending, in fewer days, and many more states imposing economic nexus, may subject more online retailers to sales or use tax collection and remittance responsibilities. 5 steps ecommerce retailers should take to prepare for Cyber […]

Most companies probably don’t understand the risks associated with unclaimed property, but they can be significant. In this eBook, learn: What unclaimed property is and why it presents risks How to manage state-by-state unclaimed property regulations How to deal with unclaimed property compliance efficiently and effectively

With each state, plus a few other areas, having its own rules for compliance, managing unclaimed property is massively complicated. Reporting online can ease a lot of the pain, but the process comes with challenges as well. Learn how to master online processing and stay compliant despite the murky regulations surrounding unclaimed property.

By far, the biggest challenge facing organizations during 1099 reporting season this year was state reporting. With states tightening deadlines and multiple jurisdictions and reporting thresholds to deal with, Sovos customers found state reporting more complex than any other element of reporting season. This updated infographic shows why. The map shows 1099 reporting deadlines by […]

When does tax information reporting season end? At the end of January? Maybe in March? When 1099 forms are finally gone? For organizations that do it right, there is no “season.” Reporting is a year-round process that emphasizes efficiency over panic and minimizes risk. Check out the year-round reporting schedule in this infographic. Download the […]