Content Library

Don’t just take our word for it. There’s a reason Sovos products are used by over half the Fortune 500 and the world’s smartest companies.

Because the IRS is underpaid by nearly half a trillion dollars per year, they are taking swift action to reclaim those tax dollars. This could mean steep penalties for your business if you fail to meet the latest regulations. See the infographic below for more facts about enforcement.

As governments and regulators around the world are embarking on their digital transformation, organizations need to ensure they keep their indirect tax transformation one step ahead. In this series of articles from leading journalists, learn how digital tax is evolving globally and what the changes mean for your business.

IRA withholding remitting, reporting and reconciling can be difficult for organizations to manage at a federal level, but it gets even more complicated when you add states to the mix. Each state has their own remitting and reporting frequencies, thresholds, requirements and penalty structures. Because of this, it can be hard to determine if and […]

In 2008, Brazil adopted a clearance electronic invoicing model in which the country’s tax authority must receive and clear an invoice before a supplier can issue it to a payer. More than a decade later, the Brazilian tax administration’s digitization has evolved so much that other tax administrations call Brazil the Google of fiscal goods. Current regulations include electronic invoices for: supplies of goods (NF-e), services (NFS-e), transport services (CT-e), freight (MDF-e), SPED, REINF and, more recently, for the supply of electricity (NF3e). This document provides an overview of the mandates and regulations in Brazil.

Mexico is a pioneer in electronic invoicing and VAT enforcement, having begun its digitization journey in 2010. Today, Mexico has

one of the most technologically advanced tax administrations in the world. Companies unaware of or unprepared for Mexican

e-invoicing mandates could face significant fines and penalties, along with supply-chain disruptions and cash-flow issues. This

document provides an overview of mandates and regulations in Mexico.

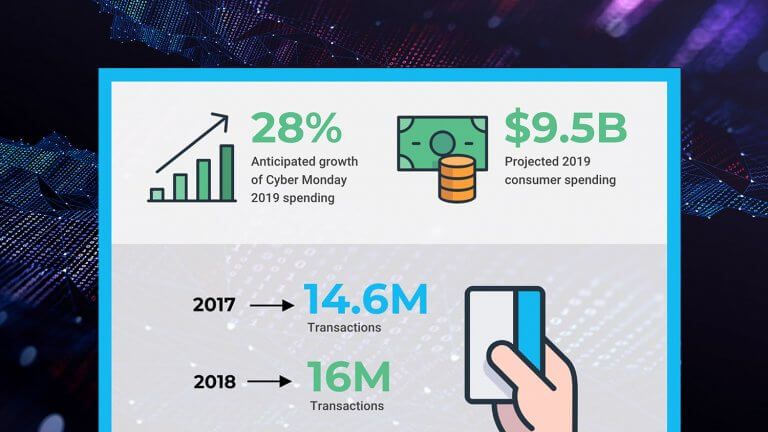

Cyber Monday 2019 is anticipated to be one of the most challenging to date for ecommerce and finance teams. More spending, in fewer days, and many more states imposing economic nexus, may subject more online retailers to sales or use tax collection and remittance responsibilities. 5 steps ecommerce retailers should take to prepare for Cyber […]

Most companies probably don’t understand the risks associated with unclaimed property, but they can be significant. In this eBook, learn: What unclaimed property is and why it presents risks How to manage state-by-state unclaimed property regulations How to deal with unclaimed property compliance efficiently and effectively

With each state, plus a few other areas, having its own rules for compliance, managing unclaimed property is massively complicated. Reporting online can ease a lot of the pain, but the process comes with challenges as well. Learn how to master online processing and stay compliant despite the murky regulations surrounding unclaimed property.

Failure to comply with business-to-government regulations in Latin America can impact critical business functions, not only resulting in millions of dollars in fines and penalties, but also shipping delays and operational shut-downs. In the most complex regulatory environments, such as Brazil, these mandates even affect sales, procurement and HR functions. Though the end goal of […]