This blog was last updated on January 13, 2020

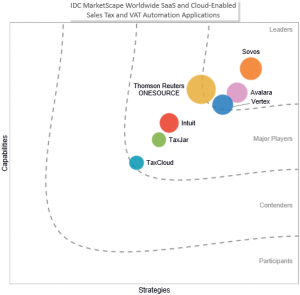

Earlier this week, IDC released its first-ever MarketScape Report, “IDC MarketScape: Worldwide SaaS and Cloud-Enabled Sales Tax and VAT Automation Applications 2019 Vendor Assessment,” focused on global tax compliance software, signaling two things at a crucial moment in the digital transformation of tax:

- Modern tax technology is an important part of the digital financial core for business.

- Traditional tax software wasn’t built for today’s new era of digital tax enforcement.

The report arrives at a crucial moment in the digital transformation of tax.

As governments accelerate their use of big data and technology to close long-standing tax loopholes and remittance gaps, we are moving rapidly to a world where tax enforcement touches every major transactional and purchasing process. The digital transformation of tax presents finance and IT leaders on every continent with a critical challenge:

“How do we prepare the business for the digital transformation of tax?”

This question came into focus for IDC over the last few years, as it experienced a significant uptick in interest. Inquiries came from all corners of the industry, including:

- Businesses with questions about the effects of the Supreme Court’s South Dakota v. Wayfair decision;

- Leading ERP vendors asking for advice on the best global tax compliance solutions; and

- Members of the investor community seeking analysis of companies working to safeguard businesses from the burdens and risk of modern tax.

The resulting first-ever IDC global tax automation software assessment acknowledges both the expanding digital transformation of tax and modern tax technology as an important part of the digital financial core for businesses.

At Sovos, we are committed to helping our customers build tax into the digital financial core of their businesses, so they can thrive in a world where tax is part of every transaction. A complete, modern cloud software solution is an essential part of helping companies Solve Tax for Good so they can focus more time on growing their businesses. Traditional tax software for corporations wasn’t built for modern tax. Sovos was.

We take great pride in the IDC rating and the positive feedback on our complete, continuous and connected solution, ideal for “businesses in search of a sophisticated cloud tax software capable of supporting large, multinational tax and e-invoicing regulatory demands.¹” The report highlights core strengths, where we invested heavily ahead of the evolving landscape – including our S1 cloud infrastructure and digital tax support for customers in more than 60 countries.

IDC Senior Research Analyst, Kevin Permenter summarizes, “Multinational companies are struggling with the shifting tax regulatory landscape. Sovos offers these organizations tremendous value by providing coverage for every form of transaction-level tax compliance in one solution. As a result of this differentiator, we expect Sovos to continue to expand its market presence.”

Take Action

Read the IDC MarketScape brief to learn how Sovos brings value to those looking to Solve Tax for Good.