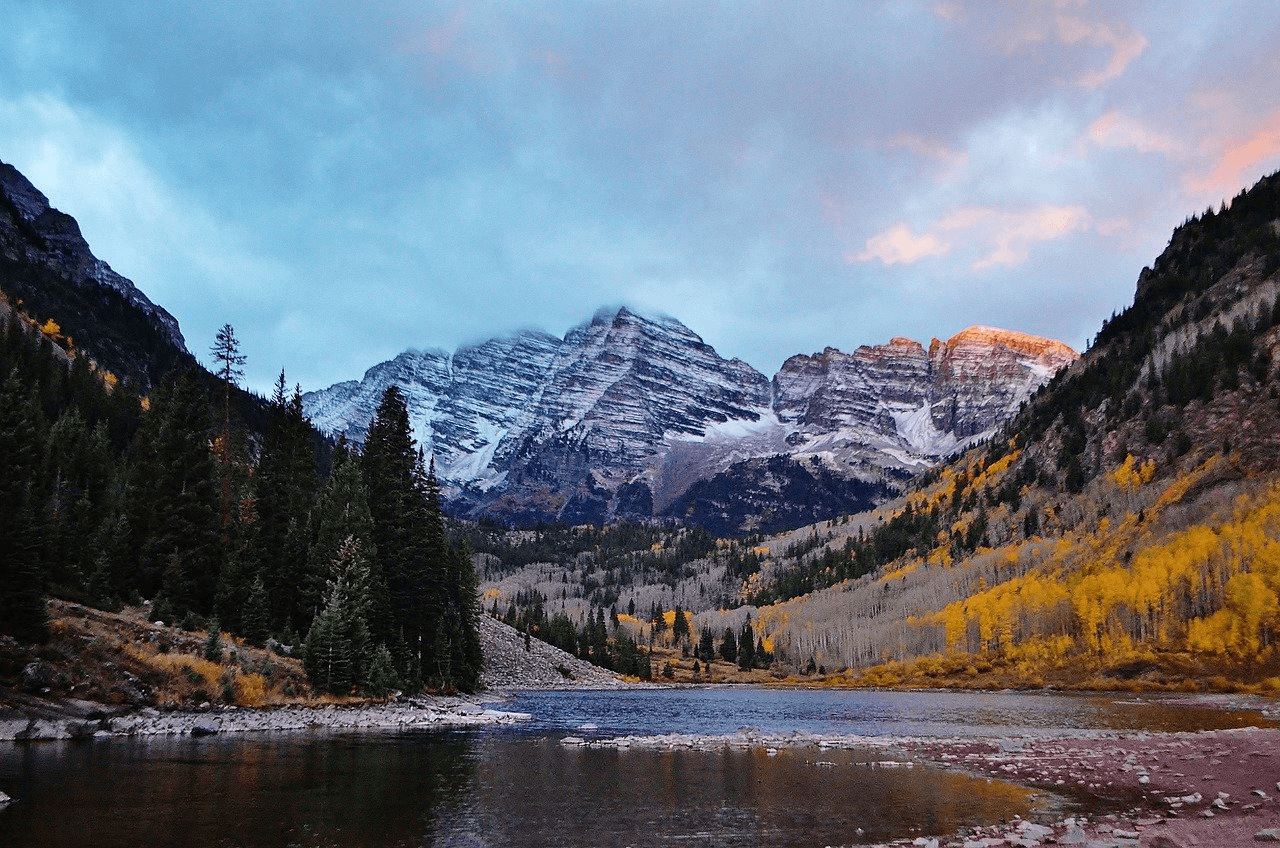

What are the Colorado Economic Nexus Sales Tax Details?

The South Dakota v. Wayfair, Inc. decision impacted the Colorado economic nexus sales tax details. Colorado joined nearly every other state (and Washington, D.C.) in

The South Dakota v. Wayfair, Inc. decision impacted the Colorado economic nexus sales tax details. Colorado joined nearly every other state (and Washington, D.C.) in

When South Dakota v. Wayfair, Inc. was decided, remote sellers across the country had to start ensuring that they were staying compliant with how they

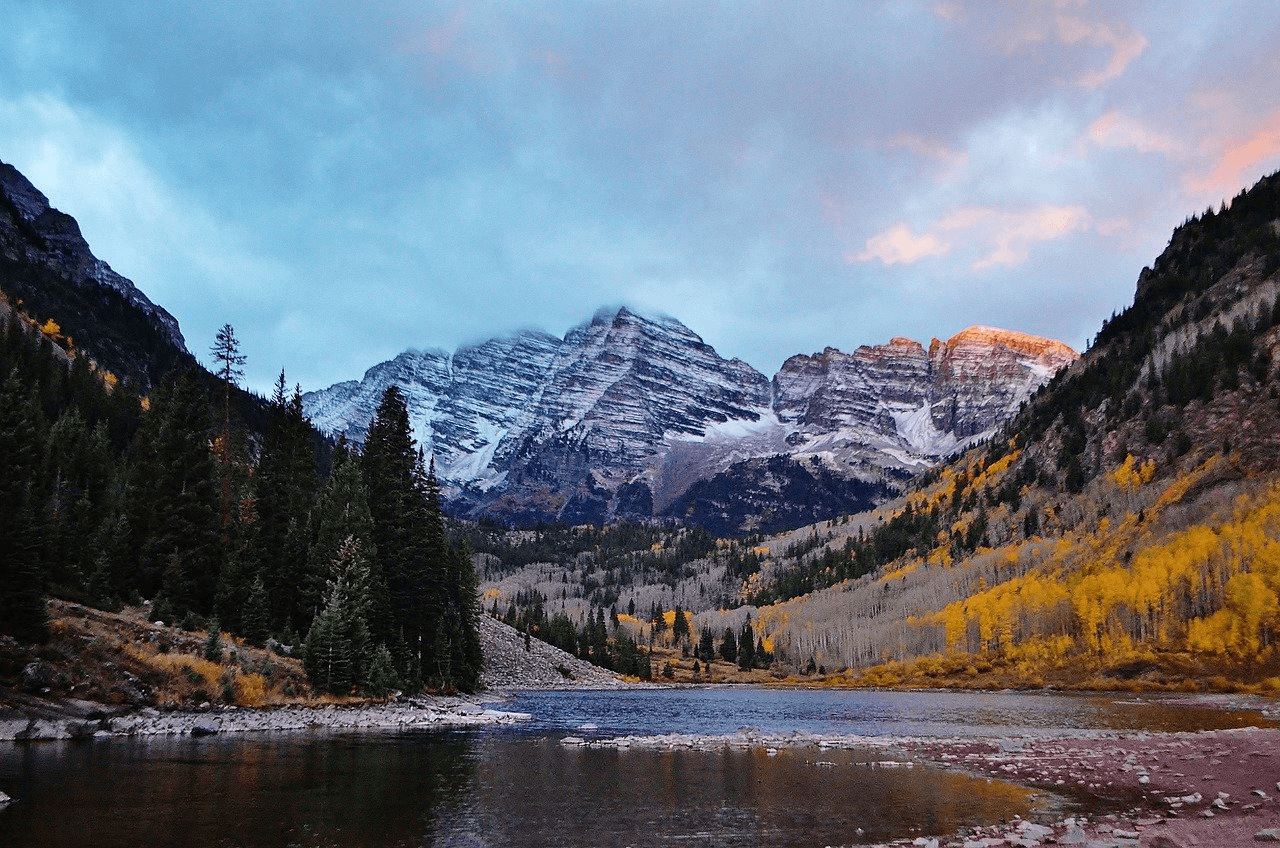

Even with the South Dakota v. Wayfair, Inc. decision, there is no impact to the Delaware economic nexus. Delaware does not have state or local

The Ohio economic nexus was one of many state-specific regulations that changed in the wake of the South Dakota v. Wayfair, Inc. decision. Both remote

After effects of the South Dakota v. Wayfair, Inc. decision swept across the nation and pushed nearly every state to adjust its economic nexus. New

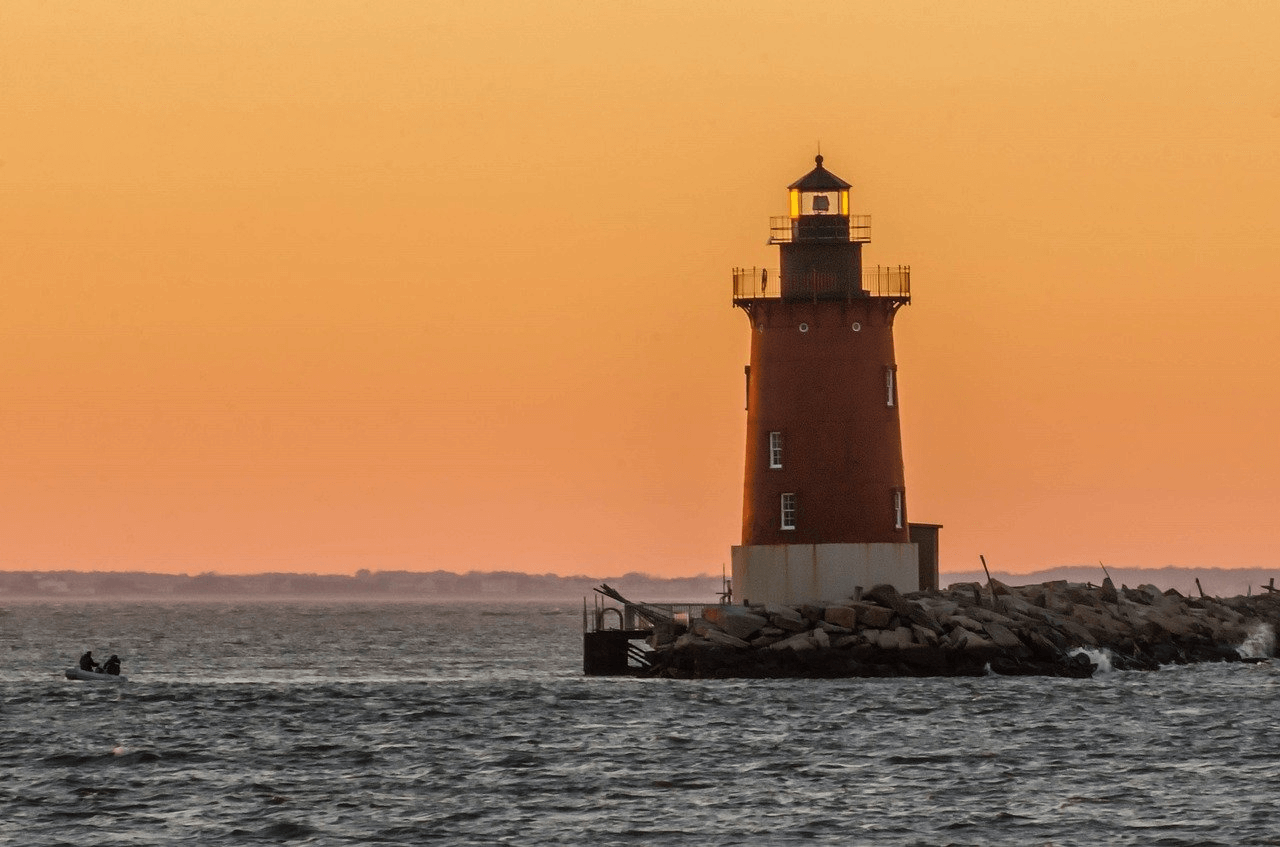

Following the South Dakota v. Wayfair, Inc. decision, economic nexus laws began to change around the country. Sales tax nexus in Hawaii was one of

Connecticut was one of many states that quickly implemented sales tax nexus rules in response to the South Dakota v. Wayfair, Inc. decision. In fact,

Following the South Dakota v. Wayfair, Inc. decision, Arizona, like many other states, enacted economic nexus standards that required sellers without a physical presence in

The Maryland sales tax nexus was impacted by the South Dakota v. Wayfair, Inc. decision. The Maryland General Assembly’s Joint Committee on Administrative, Executive, and

The Georgia economic nexus requirements have changed because of the South Dakota v. Wayfair, Inc. decision. The Peach State has also made adjustments from 2019

Arkansas was one of many states that updated its sales tax nexus after the South Dakota v. Wayfair, Inc. decision. The Arkansas Legislature enacted Act

This blog was last updated on July 18, 2024. South Dakota helped create a new standard for economic nexus threshold with the groundbreaking South Dakota

Following the South Dakota v. Wayfair, Inc. decision, nearly every state started updating their nexus tax laws. The Minnesota economic nexus is just one example

This blog was last updated on July 15, 2024. Prior to the South Dakota v. Wayfair, Inc. decision, the Commonwealth of Massachusetts had updated its

Many states, as well as the District of Columbia, have started implementing economic nexus sales tax laws for out-of-state or remote sellers because of the South

Prior to the South Dakota v. Wayfair, Inc. Supreme Court decision, Washington state had already enacted rules for remote sellers and marketplace facilitators on how

Should we move our tax engine to the cloud or keep it on-premise? This conversation is taking place in many organizations as they assess their

The Virginia sales tax nexus requirements changed in 2019, following the South Dakota v. Wayfair, Inc. decision. The Commonwealth passed its own legislation to specify