Blog

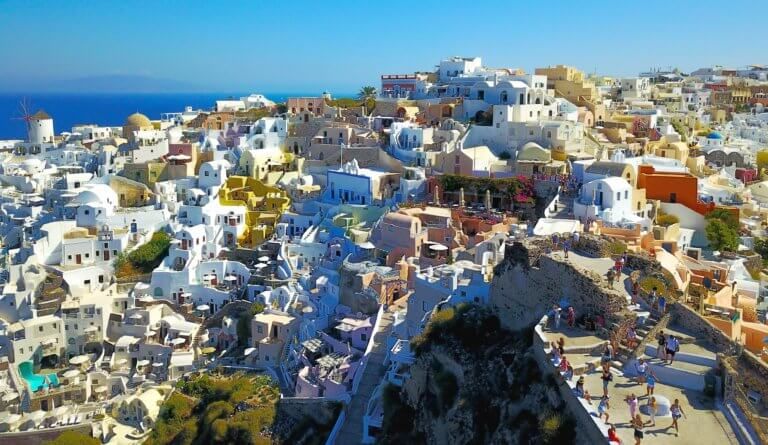

With the 1 October go-live date for myDATA, the first Greek implementation of Continuous Transaction Controls (CTC), fast approaching, legal clarity around the broader tax reform should ideally be close to completion. Greece’s tax reform is expected to not only cover CTC reporting but also e-invoicing. So far, however, we have only seen fragmented documentation […]

As anticipated, further information has been published by the Portuguese tax authorities about the regulation of invoices. Last weeks’ news about the postponement of requirements established during the country’s mini e-invoice reform, and the withdrawal of a company’s obligation to communicate a set of information to the tax authority, culminated in the long-waited regulation about […]

Issuing e-delivery and printed delivery notes together The article (Article 15.5), which was quite confusing in the initial version of the guideline, is now much clearer. If an e-delivery note can’t be issued in the location where the shipment is initiated e.g. the delivery truck, it may be issued within the company. However, a printed […]

In February last year, the Portuguese government published the Law Decree 28/2019 rolling out changes affecting e-invoices. The goal of the Law Decree is to simplify and consolidate pieces of law that are scattered around the Portuguese legal framework. However, the effectiveness of many of those rules is still dependent on further regulation, such as […]

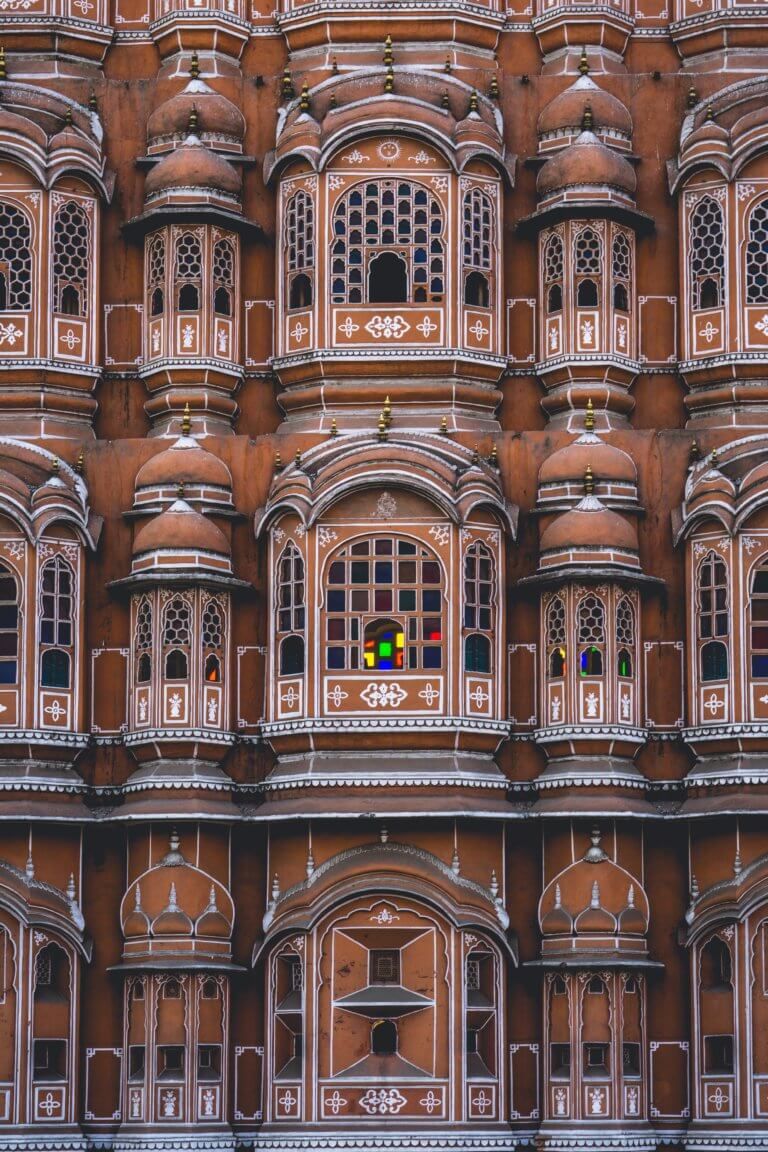

The October deadline is fast approaching for the Indian CTC invoicing mandate, but it remains a moving target. In a swift move that was published just two months prior to go-live, authorities have now changed the scope of India’s e-invoicing system and who is affected by the reform, as well as updated the JSON format. […]

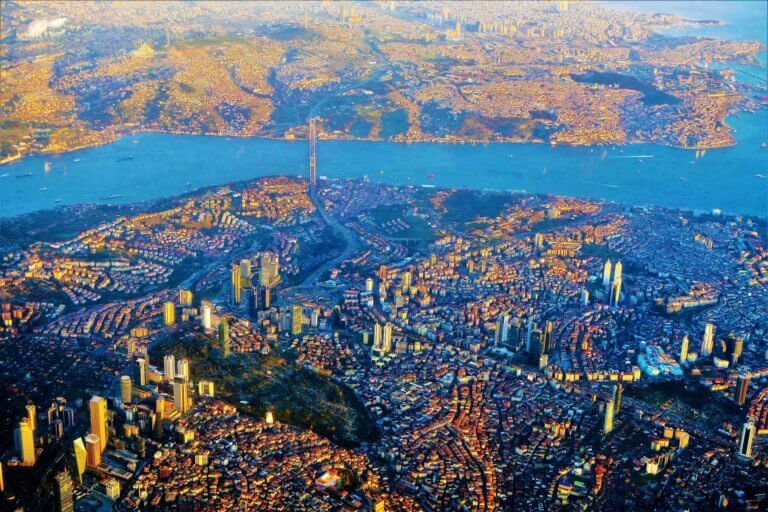

Taxpayers with annual gross sales of TRY 5 million and above are obliged to use e-invoice or e-arşiv invoice from 1 July 2020. Although the e-invoice has the same qualities as a paper invoice, there are occasions where it should be treated differently such as for cancellations and refunds. What is a refund invoice? A […]

For rules to carry any real weight, the rule-maker must combine compliance with that rule with either a carrot or a stick. In the field of tax legislation, the rule-maker, in this case, the legislator or the tax authority, almost always goes down the route of the stick in situations of noncompliance. And the penalties […]

myDATA updates On 22 June, the joint Ministerial Decision that sets forth the myDATA framework was published. The decision specifies, among other things, the scope of application and applicable exemptions, the data to be transmitted, transmission methods and procedures, applicable deadlines and how transactions should be characterized. Starting from January 2021, the required data must […]

For the first time in history, international business and governments have come together. Their aim was to define and agree a guiding set of principles for tax compliance in a world where continuous tax controls (CTCs) are becoming the norm. The International Chamber of Commerce‘s (ICC) executive board has now formally approved the first set […]

The General Communiqué no. 509 (communiqué) established the date of transition to the e-delivery note application and the full scope of the mandate. Whilst the communiqué addressed the general use of the application and the basic practices, it didn’t contain all the information businesses require and although the FAQ and information from the Turkish Revenue […]

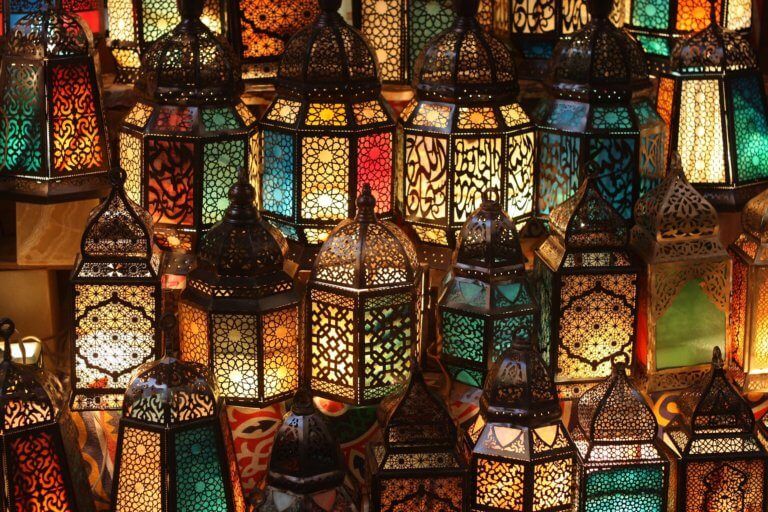

Update: 20 November 2023 by Dilara İnal E-invoicing systems in the Middle East and North Africa are undergoing significant transformations, aiming to modernise the financial landscape and improve fiscal transparency. Recent updates have seen numerous countries implementing electronic invoicing solutions designed to streamline tax collection and reduce VAT fraud. E-invoicing Trends in the Middle East […]

The era of paper invoices is coming to an end. With the e-arşiv invoice system, you can issue an electronic invoice, even to non-registered e-invoice taxpayers. This regulation enables companies to send invoices directly to the end-user via e-mail removing the need for paper invoices. Due to the official statement from the Turkish Revenue Administration […]

After a period of solid work around the myDATA framework, with little documentation left to implement the entire scheme in Greece, the IAPR has shifted its attention to e-invoicing. Last week the IAPR and the Ministry of Finance signed the long-awaited myDATA bill, which once turned into law will enforce the myDATA system within Greece. […]

Renowned for its diversity, India is taking the same approach to its e-invoicing framework. There have been several changes and new possibilities included in the required processes and technical (“JSON”) invoice schema since e-invoicing was introduced. Such changes are unsurprising as many of the existing Continuous Transaction Controls (CTC) systems regularly bring new elements to […]

From 1 July 2020, all taxpayers with revenue above 25 million TL in 2018 or subsequent years must switch to the e-delivery note system. E-invoice instead of e-delivery note With the deadline fast approaching, one of the questions on taxpayers’ minds is whether e-invoices can be used to replace e-delivery notes as paper invoices can […]

On October 19, 2019, the Turkish Revenue Administration (TRA) published a communique making the e-ledger application mandatory for e-invoice users, companies subject to an independent audit, and companies identified by the Presidency to have poor tax compliance. The e-ledger application enables businesses to create the legally mandated general journals and ledgers and submit e-ledger summary […]

Following the trailblazing efforts by countries such as Italy, Hungary and Spain, this past year has seen an increase in European countries announcing digital tax control reforms. Earlier this year, Albania joined the ranks of France and Poland by announcing the introduction of a continuous transaction controls (CTC) system, called fiscalization. This scheme requires clearance […]

Following the successful implementation of the e-invoicing mandate that has gradually expanded its scope, Turkey introduced a new mandate to track the movement of goods in a more technology-efficient way. Like many other countries, Turkey has already been able to retroactively track the movement of goods by obliging taxpayers to issue delivery notes. Having seen […]