Blog

The Turkish Revenue Administration (TRA) has now published the long-awaited e-Delivery Note Application Manual. The manual clarifies how the electronic delivery process will work and answers frequently asked questions. It addresses the application as well as its scope and structure, outlines important scenarios and provides clarity for companies who are unclear about the adoption of […]

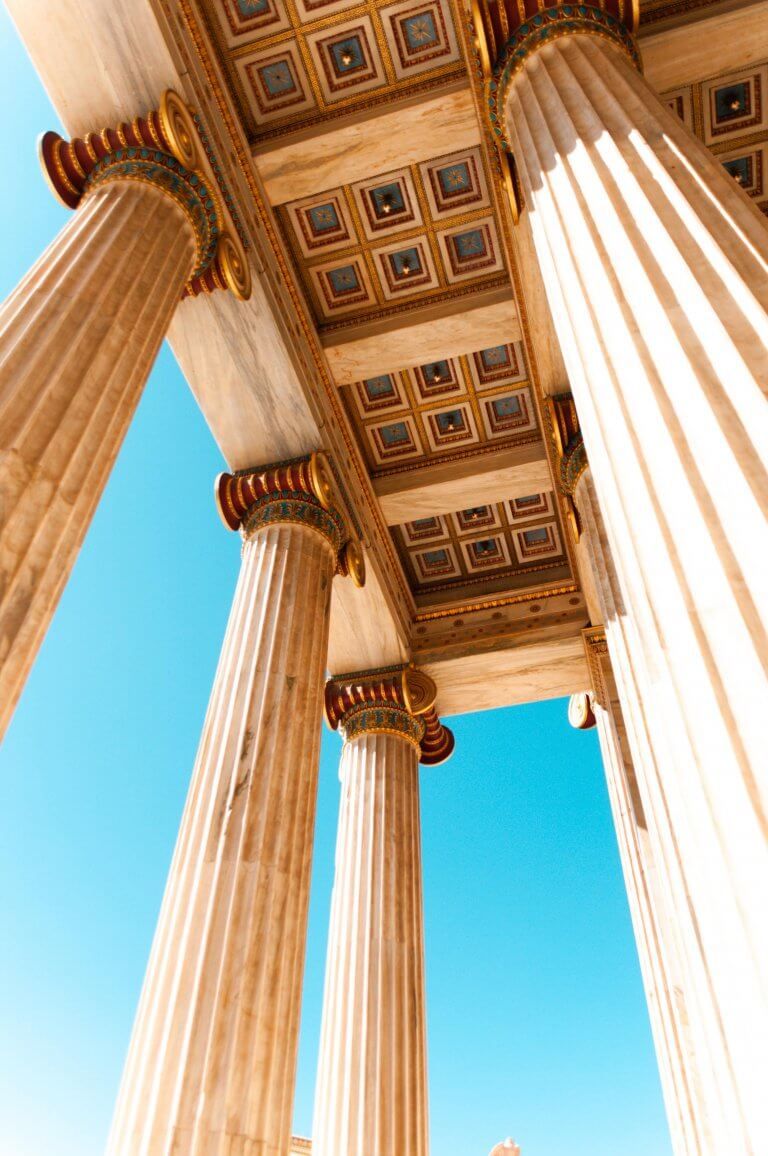

The upcoming tax reform in Greece is expected to manifest itself in three continuous transaction control (CTC) initiatives. The myDATA e-books initiative, which entails the real-time reporting of transaction and accounting data to the myDATA platform which will in turn populate a set of online ledgers maintained on the government portal; Invoice clearance, which is […]

Certification of e-invoice service providers is an important first step and milestone ahead of the implementation of e-invoicing in Greece. The Greek Government has now defined the regulatory framework for e-invoice service providers, their obligations, and a set of requirements needed to certify their invoicing software. Key details and parameters Scope E-invoice service providers are […]

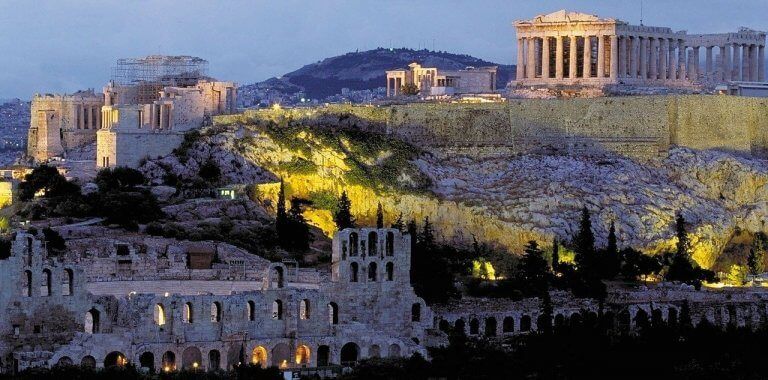

Italy has been a pioneer when it comes to automating e-invoicing processes. It first introduced a B2G e-invoicing system in 2014 which has since evolved into a robust and mandatory platform for the exchange of invoices now also expanded to include B2B and B2C transactions. The Italian central e-invoicing platform SDI was considered revolutionary by […]

With little over a month left to go before the first phase of Indian invoice clearance reform goes live, authorities are still busy finalizing the technical framework and infrastructure to support it. Just a few days ago, changes were made to the explanatory schema of the JSON file that will report data to the tax […]

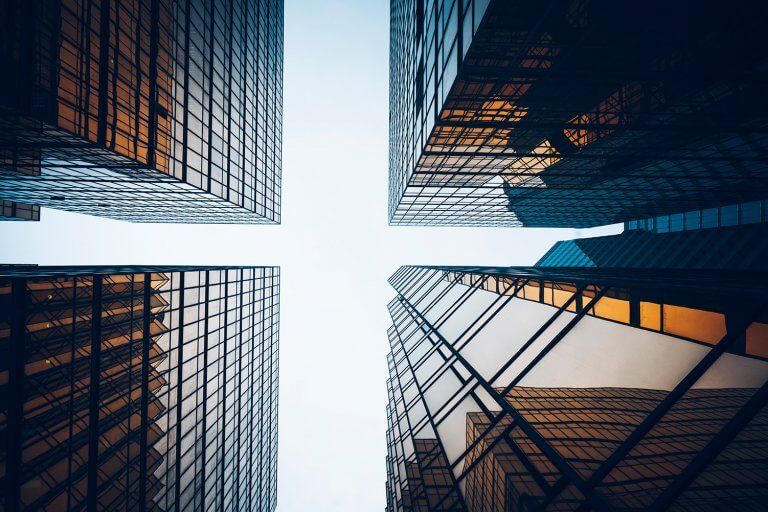

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

Whilst Vietnam has allowed the issue of electronic invoices since 2011, this has not proved popular with domestic businesses. This is mainly due to the lack of an efficient framework for commercial processes and the technical capabilities required to issue e-invoices compliantly. During the last decade, the Vietnamese government has developed a more robust legal […]

Value-added tax (VAT) does not exist in the United States, but American companies are increasingly having to deal with VAT mandates in Latin America, Europe and Asia. Seeking to make up a massive gap in revenues, tax administrations are mandating strict policies to digitize VAT collection. American companies that fail to comply could see their […]

The new framework for invoice clearance in India is a hot topic that concerns many companies. This is not unexpected considering the size of the Indian economy and the number of companies that will be obliged to comply with the new framework. As outlined and confirmed in the Notification numbered 68/2019 published in the Indian […]

On 27 December 2019, the Italian government issued a decree delaying and establishing new dates for when the NSO platform would go live. The Electronic Purchase Orders Routing Node platform (Nodo di Smistamento degli Ordini, NSO) had initially been scheduled to be effective on 1 October 2019. The NSO is the Italian government owned platform […]

First legislation of the myDATA The requirement for the mandatory submission of tax data to the Independent Authority for Public Revenue (IAPR) has finally been established in law, specifically in the new tax bill approved by the Greek parliament just a few days ago. The tax bill further mandates the IAPR to finalize, by way […]

Companies are dealing with a fundamental shift in the way they do business with trading partners. In a rapidly increasing number of countries, there’s a third party inserting itself into every transaction. It’s the government, and it’s wedging its way into every order a company ships or receives. In an effort to close a massive […]

The value of data is rising The value of data is becoming more precious than oil. Technology has transformed market dynamics across all sectors and the way businesses operate. Big data has grown in importance and data-based platforms are today’s new technology giants. On one hand; Facebook, Google and other data-based platforms are collecting data […]

Two months after closing the public consultation on the myDATA scheme, the Greek tax authority, IAPR, has yet to share the feedback received from the industry on the proposed scheme or make any official announcement in this regard. However, local discussions indicate that, the IAPR may reintroduce its initial agenda proposed back in August 2018, […]

Brazil is often viewed as one of the most complex tax jurisdictions in the world. But, at the same time, it has been very successful in automating tax authority controls, and in doing so has replaced paper invoices with electronic invoices automating their exchange through clearance platforms. While the ambitious Brazilian plans to simplify the […]

Following India’s recent public consultation looking at the proposed introduction of an e-invoicing regime, the GST council has now released a white paper on the architecture of the new framework and also provided answers to a number of outstanding questions. From 1 January 2020, taxpayers in India can start to use the new e-invoicing framework, […]