Blog

According to European Customs Law, non-EU established businesses must appoint a representative for customs purposes when importing goods into the EU. In particular, the Union Customs Code establishes that non-EU resident businesses must appoint an indirect representative. At the end of the Brexit transitionary period, many UK businesses suddenly needed to appoint an indirect representative […]

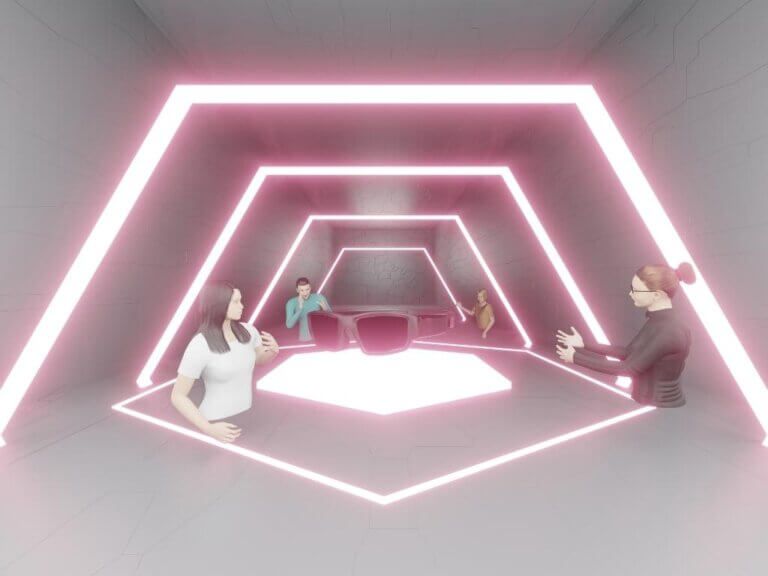

The recent popularity of non-fungible tokens (NFTs) has captivated investors, governments and tax authorities. An NFT is a digital asset that represents real-world objects such as a piece of digital art, an audio clip, an online game or anything else. NFTs are purchased and sold online and are typically encoded with the same software as […]

Over the past decade, the Middle East region has undergone impactful financial and fiscal changes. VAT was introduced as one of the solutions to prevent the impact of decreasing oil prices on the economy after the region’s economic performance started to slow down. After realising the benefits of VAT to the economy, the next step […]

Ensuring Insurance Premium Tax (IPT) compliance can be a complex task. With tax rates and filing varying from country to country, many organisations choose to work with Sovos to ease their IPT compliance workload and for tax peace of mind. We spoke to Neal Bazeley, supervisor of client money about Sovos’ solution for IPT compliance […]

E-businesses have recently been dealing with the change of rules within the EU with the introduction of the E-Commerce VAT Package but it’s also important to ensure compliance requirements are being met globally. In this blog we look at some of the low value goods regimes that have been introduced over the last few years […]

Update: 31 January 2023 by Lorenza Barone Norway extends VAT obligation to Cross-Border Non-Digital Services Norway’s Ministry of Finance has updated legislation involving remotely deliverable services by foreign suppliers. This is effective from 1 January 2023. In 2022, the Ministry proposed to amend the Norwegian VAT Act regarding cross-border business-to-consumer (B2C) sales of non-digital services. […]

It’s been just over nine months since the introduction of one of the biggest changes in EU VAT rules for e-commerce retailers, the E-Commerce VAT Package extending the One Stop Shop (OSS) and introducing the Import One Stop Shop (IOSS). The goal of the EU E-commerce VAT Package is to simplify cross-border B2C trade in […]

E-commerce continues to grow, and tax authorities globally have struggled to keep pace. Tax authorities developed many VAT systems before the advent of e-commerce in its current format and the evolution of the internet. Around the world this has resulted in changes to ensure that taxation occurs in the way that the government wants, removing […]

Insurance Premium Tax (IPT) in Luxembourg moved to online filing from the first quarter 2021 submission. Alongside this, they also changed the authority deadline to the 15th of the month following the quarter. This change caused some upheaval as many insurance companies were already pulling data from the underwriting systems, reviewing the information (sometimes manually), […]

In our earlier article, Optimising Supply Chain Management: Key B2B Import Considerations, we looked at the possibility of UK suppliers establishing an EU warehouse to facilitate easier deliveries to customers. In this article, we look at this one solution in more depth – again from the perspective of B2B transactions. The pros and cons of […]

In the European Union, the VAT rules around supplies of goods, as well as ’traditional’ two-party supplies of services, are well-defined and established. Peer-to-peer services facilitated by a platform, however, do not always fit neatly into the categories set out under the EU VAT Directive (Council Directive 2006/112/EC). There are ambiguities around both the nature […]

Governments throughout the world are introducing continuous transaction control (CTC) systems to improve and strengthen VAT collection while combating tax evasion. Romania, with the largest VAT gap in the EU (34.9% in 2019), is one of the countries moving the fastest when it comes to introducing CTCs. In December 2021 the country announced mandatory usage […]

Making Tax Digital for VAT – Expansion Beginning in April 2022, the requirements for Making Tax Digital (MTD) for VAT will be expanded to all VAT registered businesses. MTD for VAT has been mandatory for all companies with annual turnover above the VAT registration threshold of £85,000 since April 2019. As a result, this year’s […]

In November 2021, a Draft Royal Decree was published by the Chancery of the Prime Minister of Belgium, aiming to expand the scope of the existing e-invoicing mandate for certain business to government (B2G) transactions by implementing mandatory e-invoicing for all transactions with public administrations in Belgium. This obligation was already in place for suppliers […]

On 10 March, the European Parliament (EP) adopted a Resolution to the Commission’s Action Plan on fair and simple taxation supporting the recovery strategy, which set forth 25 initiatives predominantly related to European Union Value Added Tax (EU VAT). The document includes several general considerations and recommendations to the Commission for the VAT Directive revision […]

Update: 22 January 2024 by Tânia Rei Pre-Filled VAT Returns: Updates in 2024 In recent years, tax authorities worldwide have embraced digital transformation to streamline compliance processes, particularly through the increasing implementation of pre-filled VAT returns. Below we explore the countries that currently provide pre-filled VAT returns or are actively working on projects to implement […]

Many businesses will now be involved in “cross border” transactions meaning that a business in one territory will sell and, often, deliver goods to a customer located within another territory. The existence of two or more tax territories in the transaction, and the possibility that there may be a customer in the EU and a […]