Blog

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to known about new regulatory changes, ensuring you stay compliant. We spoke to Edit Buliczka, […]

The number of continuous transaction controls (CTC) jurisdictions worldwide is increasing at a high speed. What’s equally interesting to note is a parallel development: countries that already have CTCs in place are expanding the scope of their CTC regimes by introducing new obligations around related document types, notably for transport documents. We are witnessing a […]

In a blog post earlier this year, we wrote about how several Eastern European countries have started implementing continuous transaction controls (CTC) to combat tax fraud and reduce the VAT gap. However, it’s been an eventful year with many new developments in the region, so let’s take a closer look at some of the changes on the […]

The EU e-commerce VAT package was introduced in July 2021. The new schemes, One Stop Shop (OSS) and Import One Stop Shop (IOSS) bring significant changes to VAT treatment and reporting mechanisms for sales to private individuals in the EU. In the last of our series of FAQ blogs, we answer some of the more […]

The EU Council approved a proposed directive to amend rules governing reduced VAT rates at the ECOFIN meeting held on 7 December 2021. The new rules grant EU Member States more options and flexibility in determining the reduced VAT rates to apply to certain goods and services through amendments to the EU VAT Directive. New […]

In our previous blog, we completed the compliance cycle with tax authority audits. However, that’s not the end of the challenges businesses face in remaining compliant in the countries where they have VAT obligations. VAT rules and regulations change as do a business’s supply chains – these need to be carefully reviewed and appropriate action […]

The EU e-Commerce VAT Package is nearly six months old and businesses should have submitted their first Union One Stop Shop (OSS) return by the end of October 2021. Union OSS provides a welcome simplification to the requirement to be registered for VAT in multiple Member States when making intra-EU B2C supplies of goods and […]

Since earlier this year, when the first draft continuous transaction controls (CTC) legislation was published in Poland, there’s been good progress in the development of the CTC framework and system, the Krajowy System e-Faktur (KSeF). After several reiterations, the CTC legislation was finally adopted and published on the Official Gazette on 18 November 2021. Implementing […]

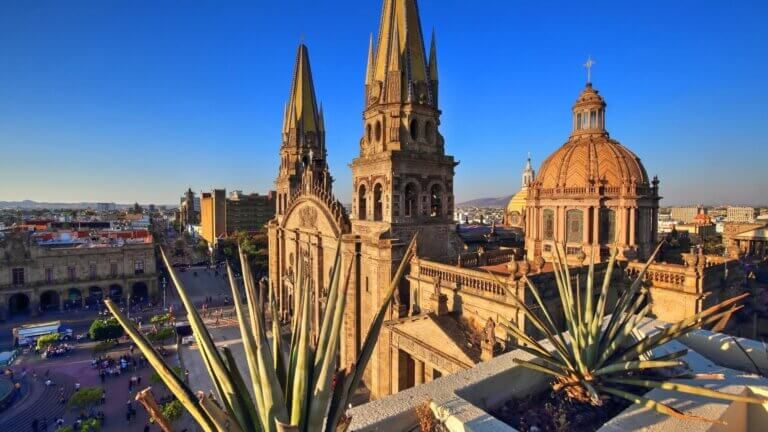

On 1 May 2021, the Mexican tax administration (SAT) enacted a new requirement via the new Bill of Lading Supplement (locally known as Complemento de Carta Porte), making it mandatory for taxpayers moving goods between addresses within the country to inform and receive authorisation from the SAT. This Complemento is required whenever taxpayers move goods within Mexico via […]

E-commerce in the EU saw a VAT revolution on 1 July 2021, introducing the e-commerce VAT package. One of the package’s aims is to ensure that VAT is accounted for in the Member State where consumption takes place for B2C cross-border supplies of goods – this equates to where the goods are delivered. There […]

Earlier today, Sovos announced the acquisition of TLI Consulting, a German company that serves companies with transaction and tax determination needs that are too complex or costly to configure and maintain via native SAP functionality and in-house tax experts. This is a strategic acquisition with immediate and long-term implications for the customers we serve. Immediate […]

In our previous blog, we looked at the challenges that businesses face in submitting VAT and other declarations on an ongoing basis. However, the compliance cycle doesn’t end there as tax authorities will carry out audits for a variety of reasons to validate declarations. Why do tax authorities carry out audits? When VAT returns consisted […]

As we inch closer to the implementation date of 1 January 2022 for Norway’s new digitized VAT return, let’s take a second look at the details. Norway announced its intentions to introduce a new digital VAT return in late 2020, with an intended launch date of 1 January 2022. With this update comes the removal […]

As of 1 January 2022, the Declaration of Exchange Goods (DEB) will be replaced by two new declarations, a statistical survey and a VAT summary statement. Current requirements Currently, taxpayers must complete the DEB, which is a single declaration that merges a statistical section and a tax section. Taxpayers must fill out both sections of […]

In our recent webinar, the team at Sovos discussed the upcoming Saudi Arabia e-invoicing mandate. The webinar covered the finalised rules for Phase 1 of the e-invoicing regime which is due to go live on 4 December 2021 as well as updates to phase 2. There were plenty of questions we didn’t have time to […]

The European Commission (EC) introduced the Import One Stop Shop (IOSS) on 1 July 2021 to simplify the accounting for VAT on goods imported into the EU with an intrinsic value below EUR 150. It is not compulsory, and there are alternative methods of accounting for import VAT on such imports. As with any new […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team is often the first to know about new regulatory changes and the latest developments on tax regimes worldwide to […]

In previous blogs, we’ve taken a deep dive into Romania’s new SAF-T requirements. In the latest guidance released this week, the tax authority has provided updated implementation timelines for different sizes of taxpayers and information on the grace period. In addition to clarifying timelines, the tax authority also issued a new version of the schema […]