Blog

VAT gaps can generally be found in countries that collect indirect taxes. This hiatus has led many tax administrations to implement Continuous Transaction Controls (CTCs), through which transactional and accounting data are monitored in real-time or near real-time. However, even countries with sophisticated CTCs may encounter fraud involving missing traders and non-existent supplies. This creates […]

Earlier this week, Sovos announced the acquisition of Accordance , a U.K.-based value-added tax (VAT) managed services company that has been a Sovos partner since 2018. Accordance adds a leading service provider with unique VAT expertise to our growing European organization, strengthening the foundation we have been building for continued global expansion. This acquisition — our […]

For rules to carry any real weight, the rule-maker must combine compliance with that rule with either a carrot or a stick. In the field of tax legislation, the rule-maker, in this case, the legislator or the tax authority, almost always goes down the route of the stick in situations of noncompliance. And the penalties […]

On 18 June 2020 European officials announced that an EU-wide digital services tax (DST) will be introduced if the US’s recent withdrawal from global tax negotiations stops international agreement. The US’s withdrawal follows the United States Trade Representative’s (USTR) initiation of Section 301 investigations into DSTs adopted or proposed in the EU and nine countries. […]

A touch of CLASS: simplifying access to customs tariff data CLASS – short for Classification Information System – is the new single point access search facility from the European Commission. It provides access to tariff classification data of goods entering or leaving the EU and is the latest step in developing an integrated approach to […]

For the first time in history, international business and governments have come together. Their aim was to define and agree a guiding set of principles for tax compliance in a world where continuous tax controls (CTCs) are becoming the norm. The International Chamber of Commerce‘s (ICC) executive board has now formally approved the first set […]

A new and growing reporting trend in Europe, despite the current pandemic, is the move towards more transaction-based reporting – also known as Continuous Transaction Controls (CTCs). In an economic climate where the protection of government revenue bases is more important than ever, we still see the continuing trend of mandates providing governments with more […]

The General Communiqué no. 509 (communiqué) established the date of transition to the e-delivery note application and the full scope of the mandate. Whilst the communiqué addressed the general use of the application and the basic practices, it didn’t contain all the information businesses require and although the FAQ and information from the Turkish Revenue […]

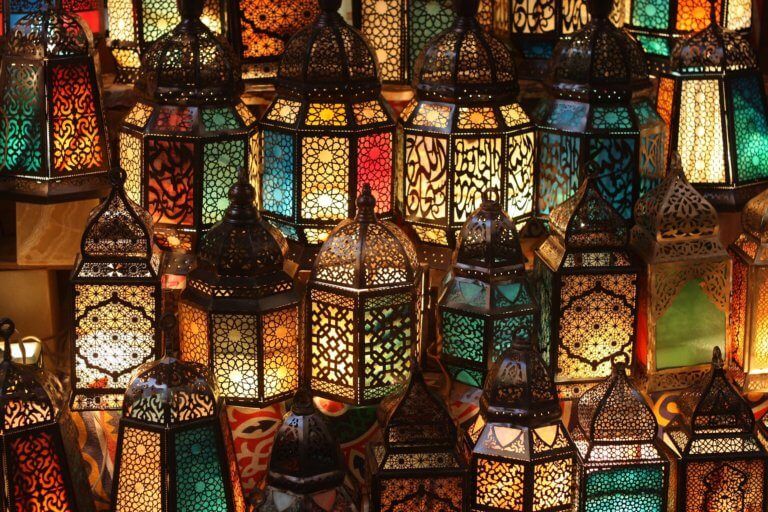

Update: 20 November 2023 by Dilara İnal E-invoicing systems in the Middle East and North Africa are undergoing significant transformations, aiming to modernise the financial landscape and improve fiscal transparency. Recent updates have seen numerous countries implementing electronic invoicing solutions designed to streamline tax collection and reduce VAT fraud. E-invoicing Trends in the Middle East […]

The era of paper invoices is coming to an end. With the e-arşiv invoice system, you can issue an electronic invoice, even to non-registered e-invoice taxpayers. This regulation enables companies to send invoices directly to the end-user via e-mail removing the need for paper invoices. Due to the official statement from the Turkish Revenue Administration […]

Throughout this year, one development we’ve seen substantially increase is the use of targeted VAT rate changes by governments around the world. Given the large proportion of transactions in an economy that attract VAT, these changes are used as a key tool in economic stimulation, especially as economies throughout Europe slowly start to re-open following […]

After a period of solid work around the myDATA framework, with little documentation left to implement the entire scheme in Greece, the IAPR has shifted its attention to e-invoicing. Last week the IAPR and the Ministry of Finance signed the long-awaited myDATA bill, which once turned into law will enforce the myDATA system within Greece. […]

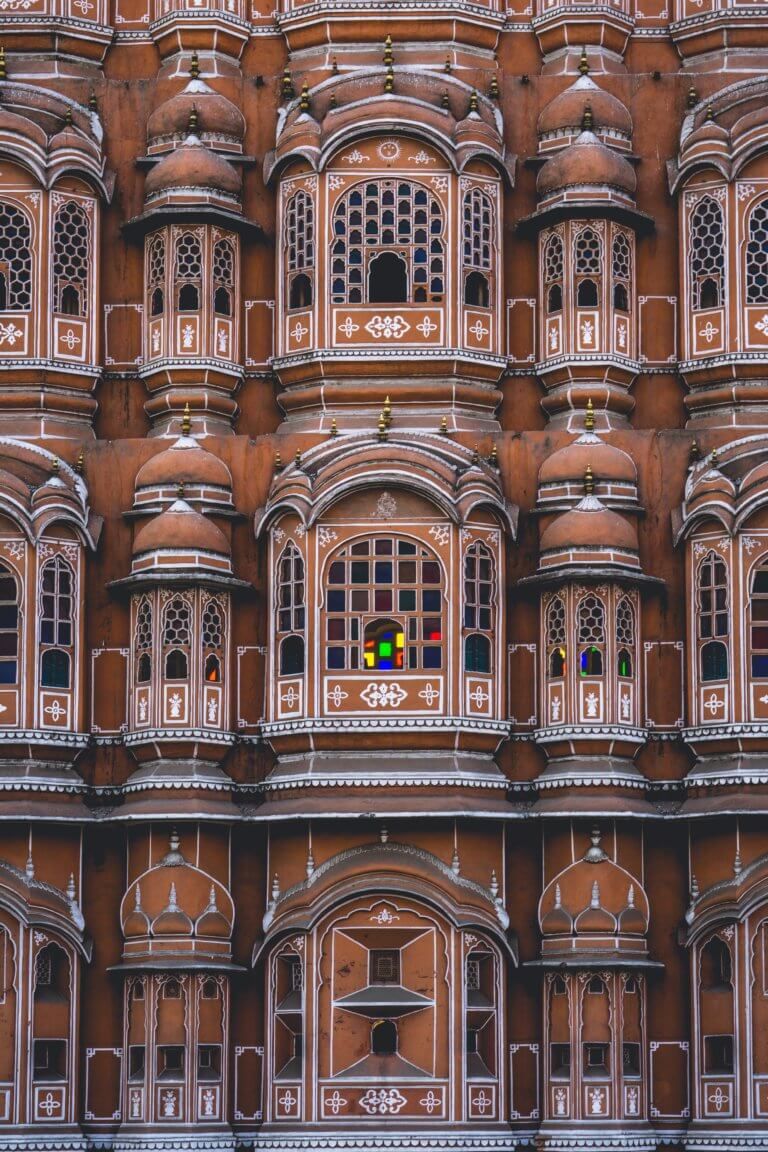

Renowned for its diversity, India is taking the same approach to its e-invoicing framework. There have been several changes and new possibilities included in the required processes and technical (“JSON”) invoice schema since e-invoicing was introduced. Such changes are unsurprising as many of the existing Continuous Transaction Controls (CTC) systems regularly bring new elements to […]

From 1 July 2020, all taxpayers with revenue above 25 million TL in 2018 or subsequent years must switch to the e-delivery note system. E-invoice instead of e-delivery note With the deadline fast approaching, one of the questions on taxpayers’ minds is whether e-invoices can be used to replace e-delivery notes as paper invoices can […]

In the midst of ongoing negotiations following the UK’s exit from the European Union (EU), the Court of Justice of the European Union (CJEU) has ruled that the UK has impermissibly expanded the scope of its 0% VAT rate on futures trading. And, that this has been occurring over a period spanning more than forty […]

In the field of global e-invoicing and tax control, most eyes have been focused on trailblazing initiatives in Asia, as countries such as India, Vietnam and Thailand look set to introduce new reforms in this area. However, even in the home of mandatory digital tax controls – Latin America – where mandatory clearance of B2B […]

As negotiations to determine the future relationship between the EU and UK beyond the end of the transition period resume, after a COVID-19 initiated pause, it’s worth taking a moment to review some of the anticipated VAT implications of Brexit, and in particular the impact on Northern Ireland. Prior to the UK leaving the EU, […]

Following the trailblazing efforts by countries such as Italy, Hungary and Spain, this past year has seen an increase in European countries announcing digital tax control reforms. Earlier this year, Albania joined the ranks of France and Poland by announcing the introduction of a continuous transaction controls (CTC) system, called fiscalization. This scheme requires clearance […]