Blog

Recently, most medium and large retail businesses across Russia shifted to internet-connected cash desks that every day, in real-time, report to the Federal Tax Administration approximately 70 million B2C transactions. According to official sources, since July 1st 2017 when the mandate entered into force, over 6 billion B2C electronic receipts have been issued so far […]

Already known as a worldwide leader in technology-driven tax compliance, Brazil has announced several changes and additions to its requirements starting in 2017. These changes, designed to close reporting loopholes and gather even more information to improve validations, affect Brazil’s e-invoicing and transportation tracking processes, as well as introduce new measures to monitor social security […]

A Closer Look at NFe 4.0 Nota Fiscal (NFe) version 4.0 marks the first new release of Brazil’s e-invoicing schema in two years, and companies can expect a major change from their previous compliance processes. NFe 4.0 requires a new XML structure, new fields, new data, new communication protocols and new web services, impacting both […]

Earlier this year we reported about the soon-to-be Hungarian invoice data reporting export requirement, and more importantly, about unanswered questions at the time. This summer, a draft regulation (modifying Decree 23/2014. (VI. 30.) NGM) was published, shedding some light on many of those questions: When is the obligation entering into force? As expected, the previous […]

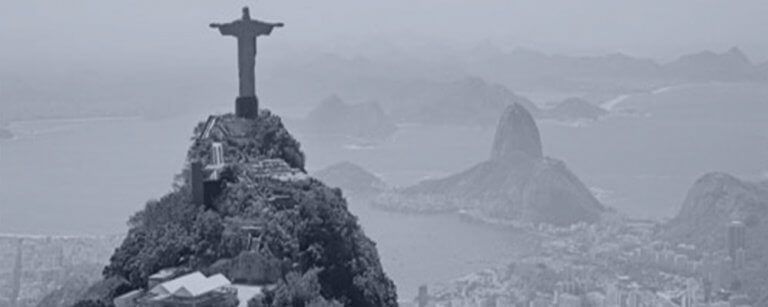

We have been writing about the rapid emergence of ‘clearance’ systems worldwide for some time now. Our annual white paper and the 2017 Billentis market report provide more detailed analysis of different real-time controls that tax administrations are experimenting with. It’s happening everywhere, from Rome to Rio and from Seoul to Saint Petersburg. Some call […]

With the acquisition, Sovos adds eReceipts to its real-time tax reporting solution, expands its presence in Brazil and extends Latin American operations to Chile, Colombia and Peru. Wilmington, Mass. – Global tax compliance and reporting software leader Sovos announced today that it has acquired Chile-based Paperless to expand its real-time government reporting capabilities with electronic […]

To ensure globally compliant e-invoicing on an ongoing basis, you should keep a close eye on the following eight functional domains: Technical and legal document rules: Are there mandatory technical rules for the file format? What is the minimum required content for an invoice? Do you have means to ensure the correct calculation of all […]

We’re excited to announce the acquisition of Paperless, which expands our real-time government reporting capabilities with electronic receipts and consumer point-of-sale tax reporting – and extends our presence in Latin America. Paperless, which is based in Santiago, Chile, is the world’s largest eReceipts and eDocuments company, processing more than two billion transactions last year across […]

Nos complace anunciar la adquisición de Paperless, que amplía nuestras capacidades de informes al gobierno en tiempo real con boletas electrónicas e informes fiscales de puntos de venta al consumidor y extiende nuestra presencia en América Latina. Paperless, con sede en Santiago, Chile, es la mayor compañía del mundo en facturas y documentos electrónicos, procesando […]

Temos prazer em anunciar a aquisição da Paperless, que amplia nossas capacidades de relatórios governamentais em tempo real com Cupom Fiscal Eletrônico eReceipts e relatórios fiscais de pontos de venda do consumidor, ampliando a nossa presença na América Latina. A Paperless, com sede em Santiago do Chile, no Chile, é a maior empresa no segmento […]

The Italian Tax Authorities issued Resolution No. 87/E on July 5, 2017, confirming that a taxable person may amend a previously filed communication even after the 15th day following the day on which the deadline expires. The communication must include sales invoices issued and purchase invoices recorded in the VAT ledger during the period of […]

Hungary has continued to release additional information about its upcoming invoice reporting requirements. Starting on July 1, 2018 VAT registered persons will be required to report B2B invoices of over 100,000 HUF to the government. The National Tax and Customs Authority (NAV) launched the KOBAK program at the beginning of July 2017. Registered persons can use […]

Since e-invoicing became a legal possibility – first in the EU in 2001, then LATAM in 2002, and subsequently worldwide – there have been commentators warning the business community not to overlook the fact that e-invoicing is part of a broader interlocking transaction of documents and processes. Often followed by wise lessons about procure-to-pay or […]

Toda empresa que opere en Latinoamérica está bien familiarizada con las dificultades que involucradas en las Leyes para la facturación y notas fiscales electrónicas y las normas que rigen los impuestos. Desde cambios constantes en la legislación hasta interrupciones de los negocios y penalidades financieras, los desafíos de seguir las normas fiscales en la región […]

Four years ago, we moderated an interesting debate via LinkedIn that revolved around a simple question: what do we mean by compliance? As ever, we had an opinion and offered a detailed definition that kick-started a great discussion thread. We would like to believe that that discussion contributed to heightened awareness among e-invoicing practitioners that […]

Any business with operations in Latin America knows what a burden e-invoicing and tax reporting compliance can be. From constantly changing legislation to business disruptions and financial penalties, the challenges associated with Latin American compliance are profound, and continue to compound with each new mandate.

Starting January 2018, all taxpayers in Ecuador will be required to start invoicing under Ecuador’s new offline schema. Announced by the SRI, Ecuador’s tax authority, in 2015, this new e-invoicing model presents both benefits and challenges to companies operating in Ecuador. On one hand, this new process will give companies a slight buffer for compliance, […]

No one really knows what percentage of today’s invoices are noncompliant with VAT law. Given the complexity and rate of change in VAT law, there is an almost unlimited set of possible nonconformities on the scale between outright fraud and clerical errors. One big problem is that it is often very difficult to gather all […]