Automate your CTC compliance management

Standardize on tax technology with continuous legal monitoring to power compliance across all business processes.

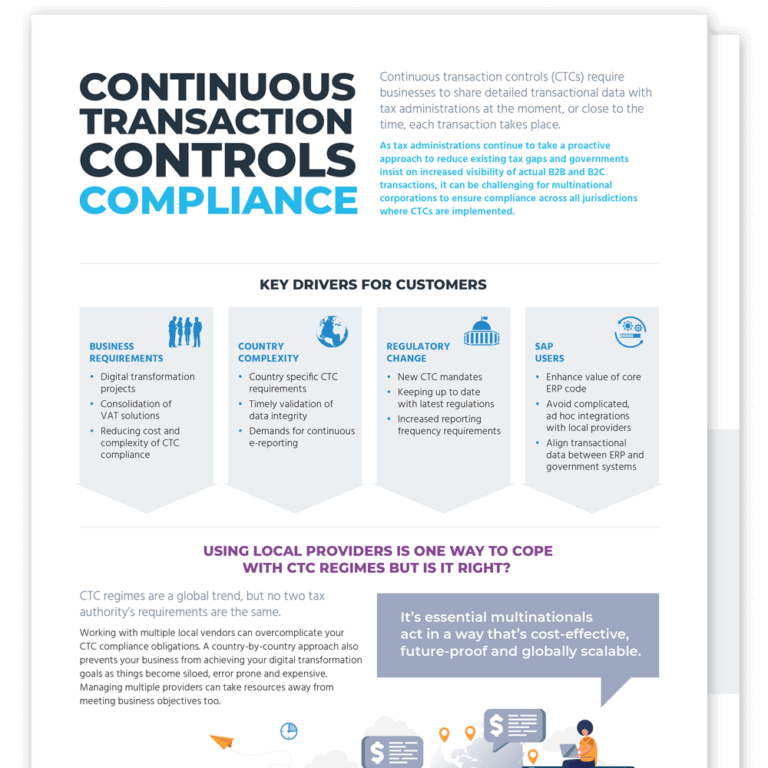

Tax administrations continue to insert themselves into the invoicing process or demand detailed records within a matter of hours or days of transactions. Sovos empowers you to comply with a cost-effective, secure, global solution to withstand the disruption of this global continuous transaction controls (CTC) trend.

Adopt a consistent global compliance strategy that scales across all jurisdictions and enterprise systems by connecting flexibly to a single provider, regardless of legal and business changes. Sovos’ VAT Compliance Solution Suite includes CTC services such as reporting and e-invoicing as integral components of a fully scalable solution suite and includes Sovos Periodic Reporting, SAF-T and Sovos eArchive.