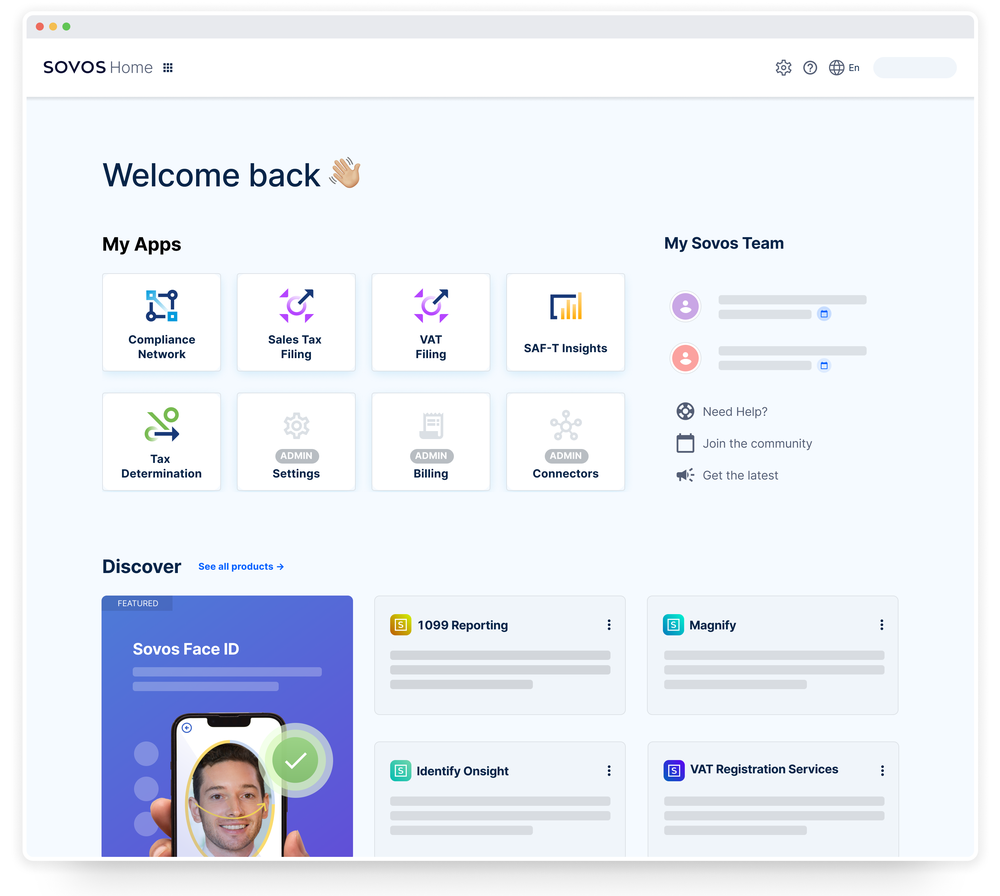

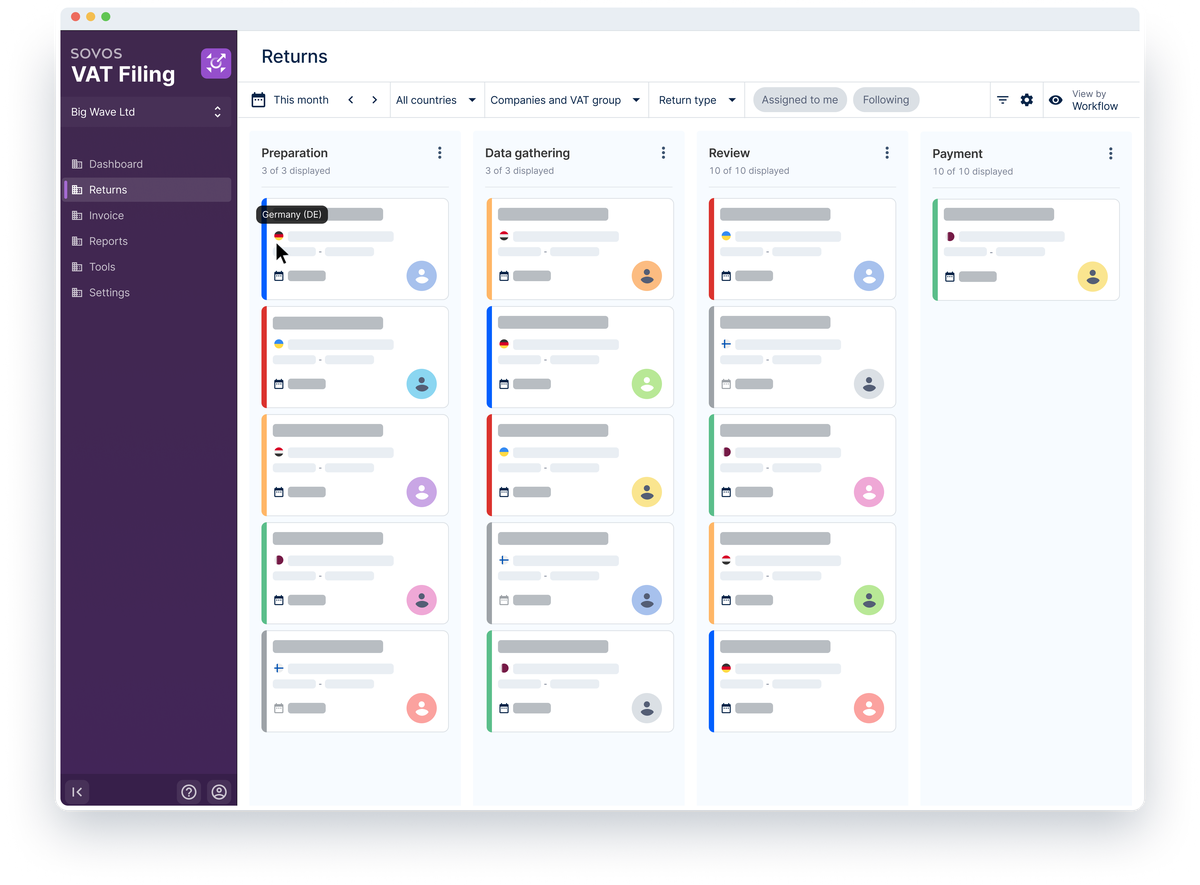

Streamline the tax process alongside ERP transformation

A transformation of your ERP environment isn’t complete without scaling your tax compliance. Don’t let the ever-changing world of tax disrupt your ERP strategy.

Top-performing businesses take their ERP transformation further by unifying the entire tax process—from eInvoicing to tax determination, filing, and reporting—into a single, seamless technology platform.