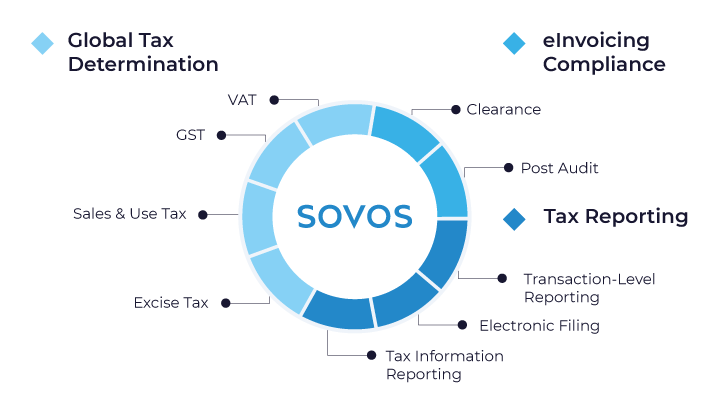

Sovos helps ensure seamless SAP tax integration

Technology has transformed your business and your products, and it’s about to change your ERP. Tax is also transforming and it could have a significant impact on your plans for S/4HANA.

Governments are pushing for greater transparency in tax reporting, with more jurisdictions requiring real-time submission of financial data, invoices, and tax filings.

Companies that don’t keep up face potential financial penalties, loss of reputation and costly disruption to their most important SAP tax compliance initiatives.