Information Reporting and Withholding Suite

Automated Tax Information Reporting and Withholding

Explore the Suite

Explore the SuiteChat with a Specialist

Explore the Suite

Explore the Suite

Delivery and filing of Forms 1099, 1098, 1042-S, 392X, 5498, W-2, W-2G, Puerto Rico, Canada, and Quebec

Digital collection, validation, and management of Forms W-8 and W-9

Centralized automation boosts efficiency and scalability, supporting growth and simplifying compliance.

Agile system keeps companies aligned with evolving, late-breaking regulatory changes.

Detailed reconciliation, data validations and audit trails mitigate risk and reduce audit triggers.

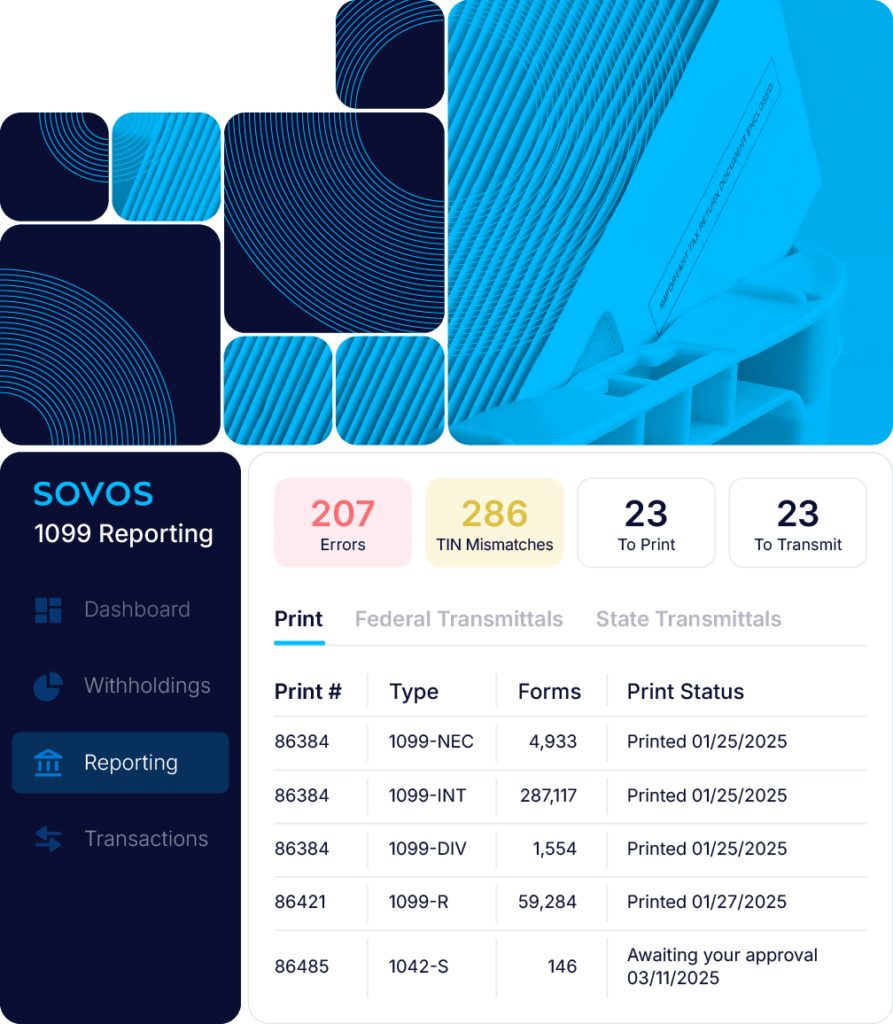

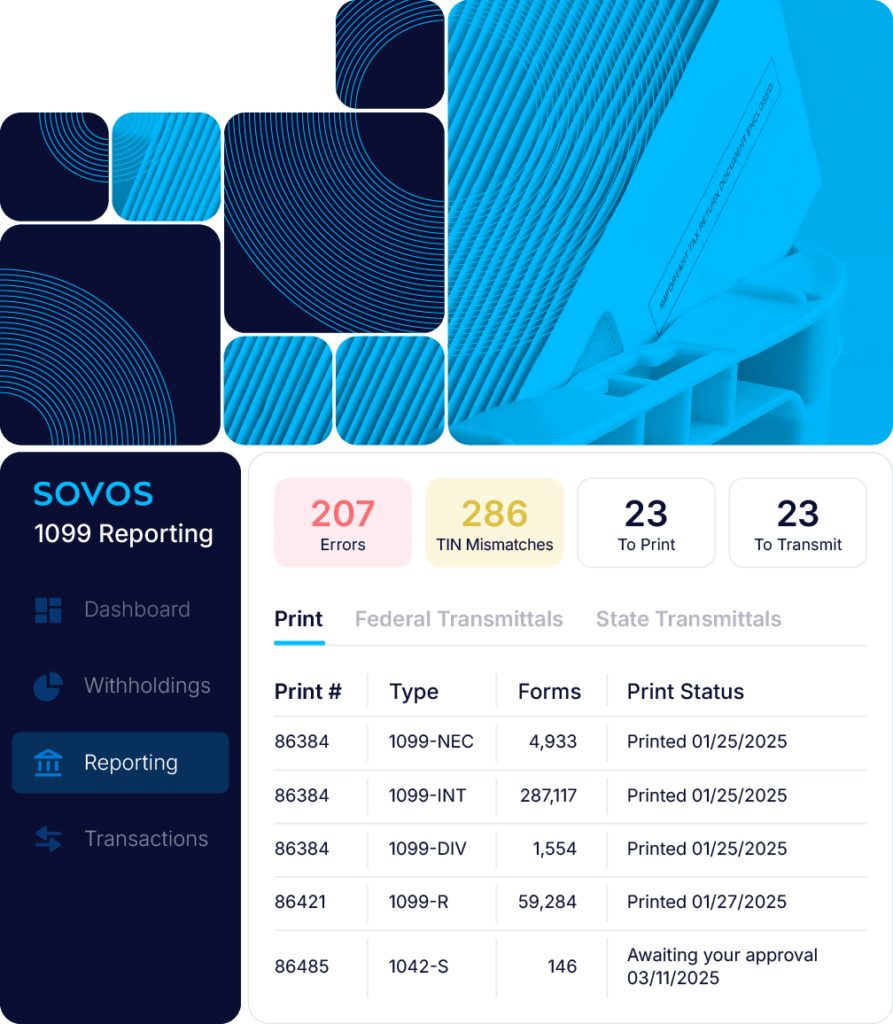

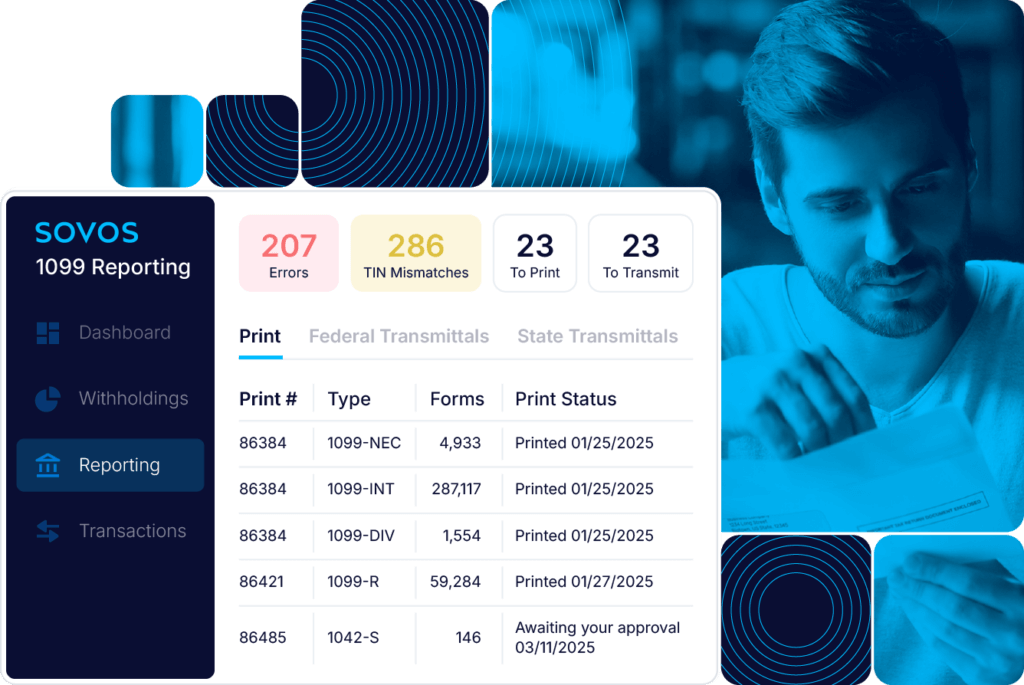

Sovos 1099 Reporting streamlines your reporting process, ensuring compliance, reducing risk, and simplifying data management for accurate and timely filings.

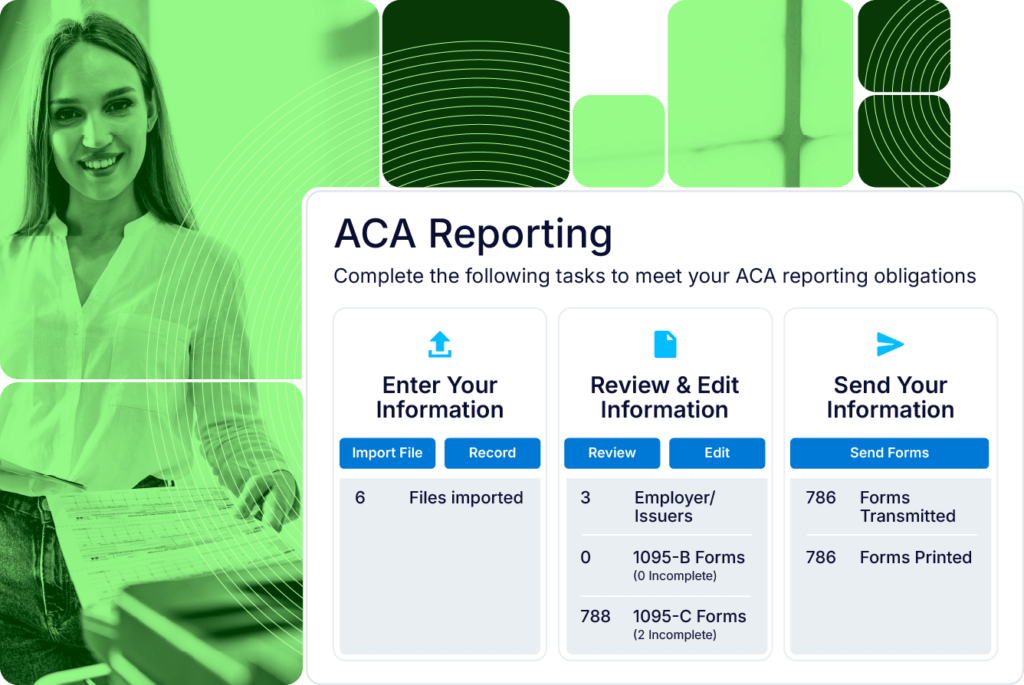

Sovos ACA Reporting helps employers and insurers meet filing obligations by automating reporting, reducing errors, and ensuring compliance for accurate, timely submissions.

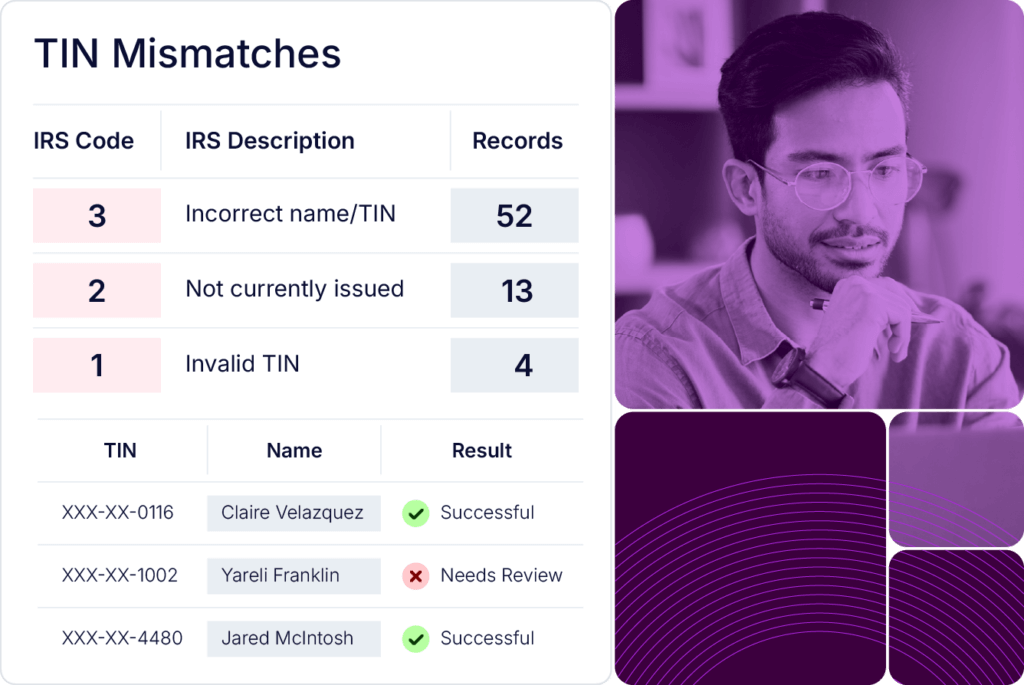

Avoid IRS penalties with proactive TIN matching, and if notices appear, save time with automated solicitation and response handling for end-to-end protection.

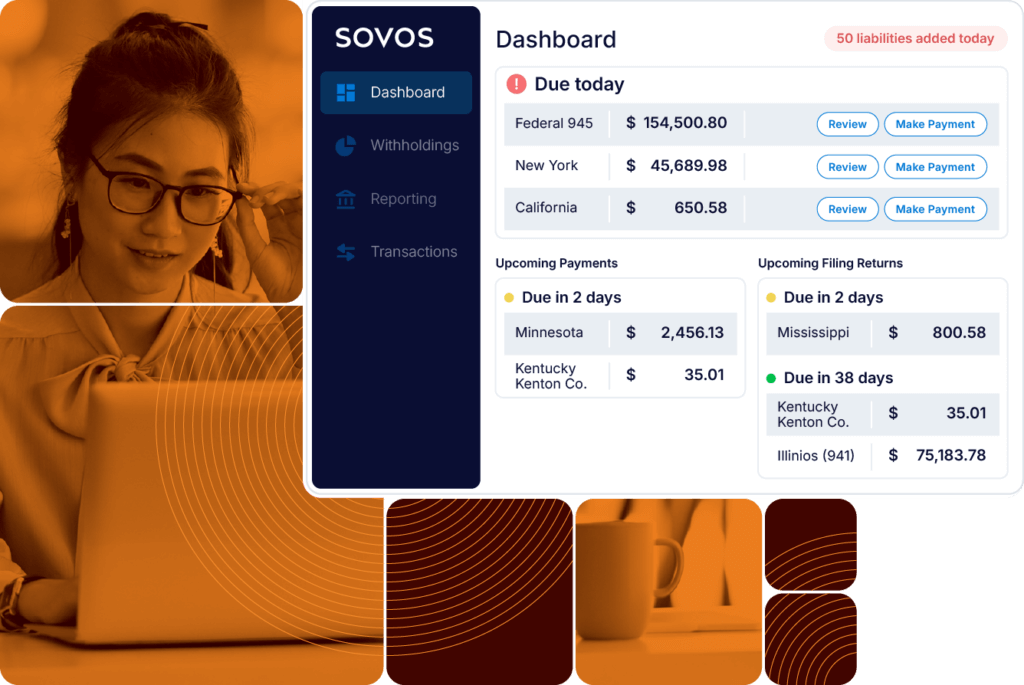

Eliminate manual tax withholding processes with automated remittances, electronic filing returns, and detailed reconciliation—saving time and reducing errors, penalties and audit risk.