This blog was last updated on May 13, 2022

Government mandated e-invoicing is continuing its proliferation across the globe as more and more governments are implementing always-on monitoring and enforcement for businesses operating within their jurisdictions. Businesses have been dealing with government mandates for some time, however, managing this new level of imposed transparency is forcing businesses to adapt to how they track and implement e-invoicing mandates.

Historically, organizations were able to manage their processes by legacy, ad hoc reporting with little fear of repercussions for missing deadlines or reporting incorrectly. Due to large scale investments in digitization technology over the past several years, authorities are no longer satisfied with this approach and are demanding real-time accountability.

Failure to comply with government mandated standards affects every aspect of your business from your ability to manufacture goods, ship products, receive timely customer payment, or potentially even pay employees. As countries around the world continue to implement these mandates, IT leaders need to be prepared to drive this global shift.

Led by government authorities in countries such as Brazil and Italy, real-time transparency into your data is now considered the new normal. Administrators have inserted themselves into every aspect of your operation and are an omni-present influence in your data stack. The move to digitization by governments and their new positioning within your systems environment has brought compliance process design to the forefront of IT and operations to ensure continuous commerce. To remain in compliance, companies need a continuous and systematic approach to requirement monitoring. Deciding which technology solution to manage this new approach to compliance can seem like a daunting task.

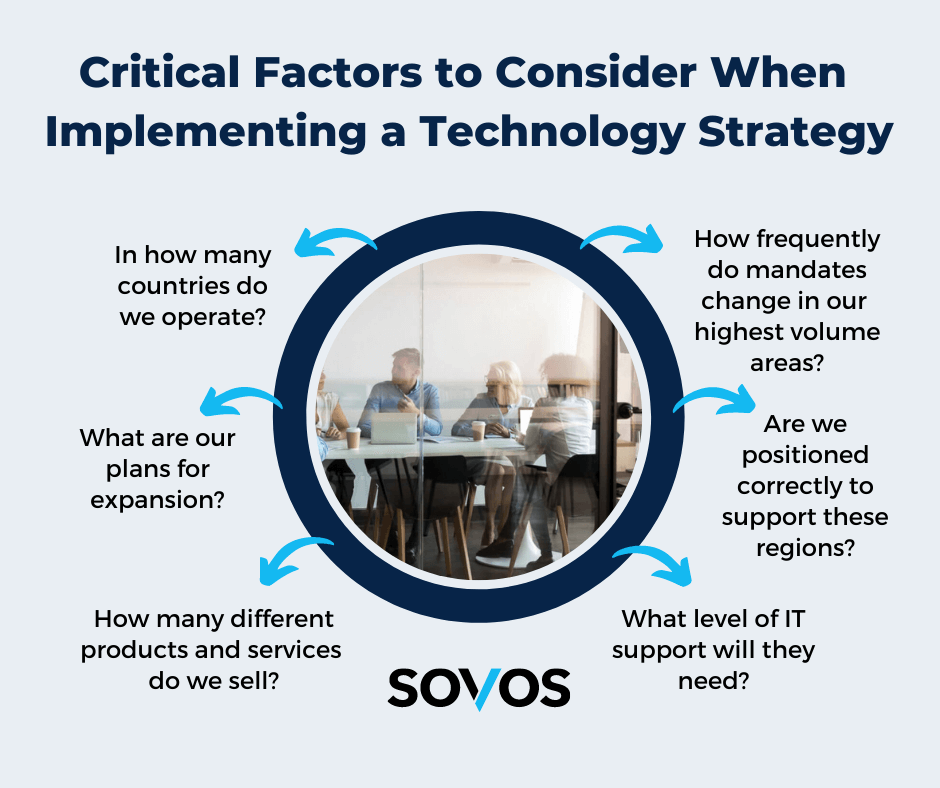

Here are some of the critical factors you should consider when creating your own internal processes:

- What are our plans for expansion?

- How many different products and services do we sell?

- In which regions are we most prominent, and how complex are the local e-invoicing and other

- Continuous Transaction Control (CTC) mandates?

- How frequently do mandates change in our highest volume areas?

- Are we positioned correctly to support these regions?

- How would potential solutions implement and operate with our current systems?

- How do we ensure that security and privacy standards are met consistently with so much highly confidential data being sent to external parties in so many ways across jurisdictions?

- What level of IT support will they need?

There are two main options when it comes to ensuring e-invoicing compliance. The first option is to treat every country that you do business in as a separate entity. Here, you select a local provider that exists exclusively to solve the mandate issues of one particular country. This can be best described as a quick-fix as it matches need and solution fairly seamlessly. However, localized providers drain more IT resources as they are forced to connect to multiple systems. While this solution may seem initially beneficial to companies, it is not sustainable for multinational organizations looking to expand.

The second option for businesses is the single source approach. This allows you to connect to one system with the ability to scale globally and still have the local knowledge to meet all mandates and standards. One contract, one set of SLAs and one infrastructure is the most efficient approach because it combines legal and technical skills in a single, scalable cloud solution that can be seamlessly accessed from any business application that comes within the scope of ever-expanding CTC and e-accounting mandates. This approach represents an opportunity for organizations to put a layer of certainty around their compliance strategy while simplifying their approach from an IT perspective.

With government authorities continuously leveraging technology to facilitate compliance and track tax fraud efficiently, there has never been a more critical time for businesses to remain compliant. Authorities are now deeply rooted in your data (or soon will be) and have real-time access and insight into what is happening across your critical business applications. Real-time monitoring of your data comes with real-time enforcement that can range in severity from significant fines to shutting your business down completely. Remaining complaint while also navigating the world of ever-changing mandates poses a significant challenge to any business. Implementing a technology solution that ensures compliance gives businesses peace of mind and allows for them to focus their time on other business initiatives.

Don’t let government mandated e-invoicing stop your business, work with your IT department to adopt a technological strategy that scales with you as your business expands.

Take Action

If you’re ready to learn more about the benefits of implementing a technology solution, talk to one our experts today.