This blog was last updated on March 11, 2019

Businesses across Europe have been so focused on updating their processes and technologies to ensure they can transmit data under new VAT compliance and reporting regulations that they are often overlooking an important piece of the puzzle: reconciliation.

VAT regulations are becoming more complex, with businesses being required to report and share detailed transactional data, sometimes in real-time. These eAccounting, eLedger and eInvoice filings give governments the ability to accurately assess how much VAT buyers and suppliers must report at the end of the month. Then, tax authorities can easily compare their records against the VAT returns submitted for a complete understanding of a company’s tax position.

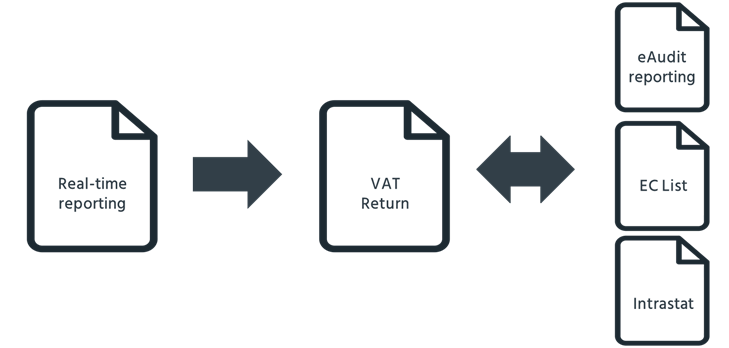

As a result of these new transactional reporting requirements, it’s imperative for businesses to sync their daily data with the reports submitted at the end of the month or end of a given filing period. However, for many companies, the data used for transactional reporting is separate from systems that produce the summary VAT returns filings, which makes reconciliation and determining the source of truth difficult.

Time Is the Biggest Barrier

Time is the biggest hurdle many companies face when it comes to ensuring daily reporting compliance. They simply they don’t have the bandwidth to take care of corrections. And this could be a costly problem.

Companies previously could easily reconcile VAT returns with statistical listings like EC lists or Intrastat returns and SAF-T reporting because they were made in the same period of time.

Spain’s Immediate Information Sharing (SII) VAT mandate, which requests companies to submit sales and purchases invoices in 4 days, and other real-time mandates like Hungary’s, are changing the order. Now companies first submit their transactional data to tax authorities with no time to make corrections, and file VAT returns after. Making this more complex, the Spanish tax authorities may deny the deduction of input VAT if the SII figures do not match VAT return figures. It is therefore crucial to reconcile these figures, but most companies only address this when they are analyzing and preparing their VAT returns.

The results from the first quarter of Spain SII shared by the AEAT, Spain’s tax authority, show how difficult this has been for companies. There was only a 84% correlation between transactions and VAT filings. This translates into consequences: audits and eventually penalties and fines.

Integration Is Key

For businesses in Spain, Hungary, Italy and other countries adopting similar real-time reporting requirements, it’s imperative to integrate processes so that daily transactional data is leveraged when submitting the monthly or end-of-filing period reports. Yet most companies currently only perform reconciliations during period reporting, leaving daily reports uncorrected since they are treated separately.

Instead, companies need to ensure they have reconciliation processes in three key areas:

- VAT returns must reconcile with accounting

- VAT returns must match statistical listings within the European Union

- NEW: Daily data needs to be in sync with periodical VAT returns, listings and accounting

This third level means companies must eradicate their siloed processes and integrate daily reporting with VAT returns and statistical reports.

Three Reasons Reconciliation Is Essential

Companies cannot overlook the importance of reconciliation for several reasons.

- Avoid fines and penalties – as Spain’s move to SII proves, countries will no longer tolerate discrepancies between daily transactions and VAT reporting.

- Improve control – by making sure VAT returns are in sync with real-time shared transactional data, companies avoid risks and surprises

- Streamline VAT returns – once reconciliation becomes routine, preparing VAT returns becomes a much easier and more efficient process.

Take Action

Reconciliation doesn’t have to be time-intensive. Sovos can help businesses combat these problems and take the effort and time out of reconciliation. Using a single platform for all aspects of VAT compliance and reporting, Sovos leverages the daily transactional data for summary filings, ensuring no mistakes slip through. Contact us to learn more.