This blog was last updated on April 12, 2024

Continuing our blog series looking at specific IPT-related tax acts around the world, we head to Denmark.

This insight is shared in Sovos’ Guide on IPT Compliance. Written by our team of IPT and regulatory specialists, this guide is packed full of insight to navigate the ever-changing regulatory landscape.

Non-life insurance tax registration and reporting

First, a primer.

Insurance policies with a risk located in Denmark are subject to Danish insurance tax, if taxable under the Danish Non-Life Insurance Tax Act (Skadeforsikringsafgiftsloven).

Registration applications must be submitted to the Danish Central Business Register before Danish and foreign insurers can legally settle tax in Denmark.

Foreign insurers located within EU Member States or other permitted countries can choose to register in Denmark with a representative (individual or business) residing in Denmark.

Once registration criteria has been met, a tax identification number equivalent to a VAT Number (CVR number) is issued.

This number is used for an online portal administered by the Danish tax authority (SKAT), where various tax returns can be submitted.

The non-life insurance tax model, rate, and exceptions

The tax model and rate in Denmark for most non-life insurance classes is the taxable premium and 1.1% respectively.

Exemptions and exceptions to this treatment include:

- Pleasure craft insurance tax. This is applicable on pleasure crafts, such as windsurfers and houseboats, registered in Denmark. A reduced rate of 1% of the sum insured was introduced in the 2019 Finance Act and is still effective as of 1 February 2021. Separate registration documentation and returns are to be submitted to report pleasure craft liabilities.

- Motor vehicle liability insurance tax. This is applicable on insurance premiums relating to statutory motor vehicle liability insurance. Examples include liability insurance for registered motor vehicles, tractors and trailers. Insurers can elect to use one of two methods to calculate the tax on motor liability insurance. Separate registration documentation and returns need to be submitted to report motor vehicle liabilities.

- The Danish Guarantee Fund. This was recently implemented and is currently administered by Topdanmark Insurance A/S. As of 1 January 2019, a fixed contribution of DKK 40.00 per policy for specific private line insurance policies must be paid to the Danish Guarantee Fund for non-life insurance companies. An enrolment fee of DKK 50.00 per policy in force as of 1 January 2019 is required. In addition, the minimum contribution upon enrolment is DKK 100,000 (approx. GBP 12,000) regardless of the volume of business being written.

- Flood and Storm Levy. This applies to all fire insurance policies relating to buildings. This levy is reported to the Danish Storm Council and the previous rate of DKK 60.00 per policy was reduced to DKK 40.00 effective from 1 July 2021.

Additional taxes to be aware of in Denmark

Whilst the majority of commonly reported non-life taxes are mentioned above, additional taxes may be applicable to policies located in Denmark and therefore cannot be disregarded.

For example, an Environmental Contribution is applicable to third party liability insurance of large transport vehicles, while the Danish Terrorism Scheme contribution is due annually on policies which cover specific fire risks, implemented to compensate damages caused by terrorist acts.

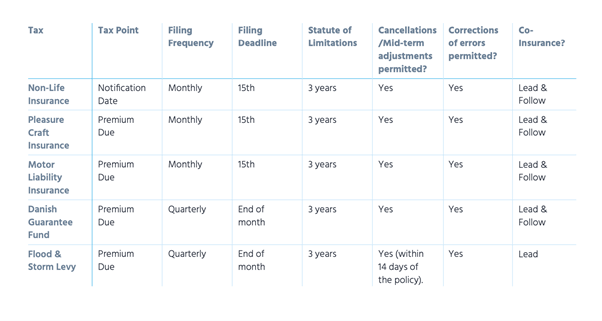

Key filing frequencies, deadlines and statute of limitations

Insurance policies may be subject to none or all of the above taxes in Denmark, depending on the type of coverage. It’s therefore essential that both the insurer and its representative understand when each tax is applicable.

Key information for non-life insurance tax and all of the exceptions is outlined below:

How Sovos can help

Sovos helps ease the burden of IPT compliance through a blend of regulatory knowledge and expertise, and best-in-class software built to handle compliance obligations now, and in the future.

Take Action

Download our IPT compliance guide for help with navigating the changing regulatory landscape and deadlines successfully, across the globe.