Italy Publishes New Specifications for the FatturaPA

Anyone predicting clearance model e-invoicing system, Italy’s FatturaPA, would undergo further reform would be right. Agenzia delle Entrate – AdE, the Italian tax authority, has

Anyone predicting clearance model e-invoicing system, Italy’s FatturaPA, would undergo further reform would be right. Agenzia delle Entrate – AdE, the Italian tax authority, has

The Turkish Revenue Administration (TRA) has now published the long-awaited e-Delivery Note Application Manual. The manual clarifies how the electronic delivery process will work and

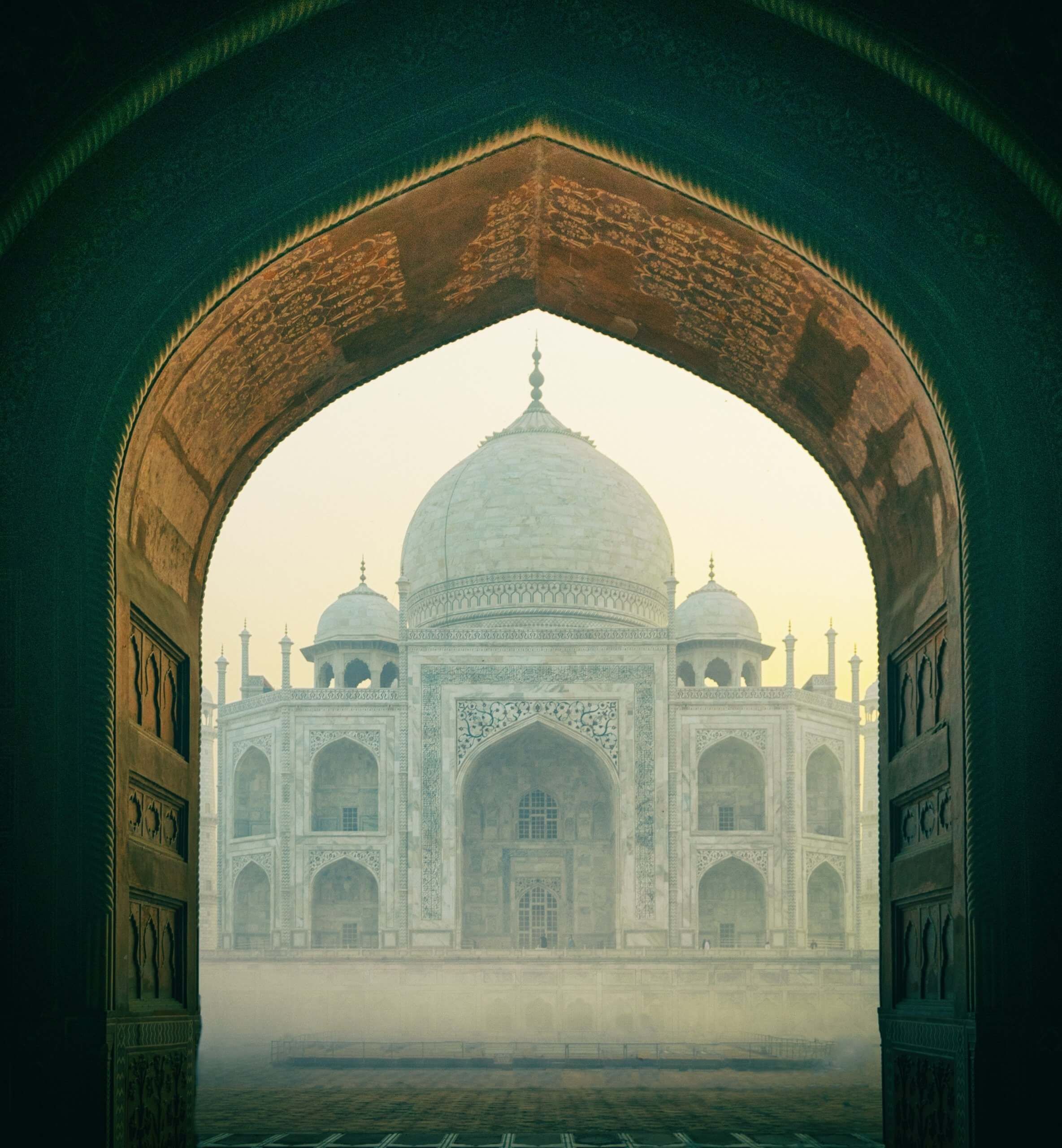

For more than a year, India has been on the path to digitizing tax controls, with the first mandatory go-live for transmission of invoice data

A keystone of HMRC’s Making Tax Digital for VAT (MTD) regime is that the transfer and exchange of data between what HMRC define as “functional

The upcoming tax reform in Greece is expected to manifest itself in three continuous transaction control (CTC) initiatives. The myDATA e-books initiative, which entails the

Certification of e-invoice service providers is an important first step and milestone ahead of the implementation of e-invoicing in Greece. The Greek Government has now

Italy has been a pioneer when it comes to automating e-invoicing processes. It first introduced a B2G e-invoicing system in 2014 which has since evolved

With little over a month left to go before the first phase of Indian invoice clearance reform goes live, authorities are still busy finalizing the

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may

Whilst Vietnam has allowed the issue of electronic invoices since 2011, this has not proved popular with domestic businesses. This is mainly due to the

The Hungarian Ministry of Finance had a productive end to the decade. As outlined in an earlier article, the MoF announced a package of measures

Pivotal projects in the development of EU VAT The EU’s Economic and Financial Affairs Council (“ECOFIN”) issued a report in December. This followed its review

Value-added tax (VAT) does not exist in the United States, but American companies are increasingly having to deal with VAT mandates in Latin America, Europe

The new framework for invoice clearance in India is a hot topic that concerns many companies. This is not unexpected considering the size of the

The wording of the EU Directive 2018/1910, effective since 1 January 2020, suggests that EU suppliers must check that other businesses they are trading with

With today’s announcement that SAP is extending support for its Business Suite 7 software suite until the end of 2027 many are breathing a sigh