Pre-Filled VAT Returns: The State of Play in 2023

Update: 22 January 2024 by Tânia Rei Pre-Filled VAT Returns: Updates in 2024 In recent years, tax authorities worldwide have embraced digital transformation to streamline

Update: 22 January 2024 by Tânia Rei Pre-Filled VAT Returns: Updates in 2024 In recent years, tax authorities worldwide have embraced digital transformation to streamline

With a new month comes yet another report due in the Insurance Premium Tax (IPT) sphere. Insurance companies covering risks in Greece must report their

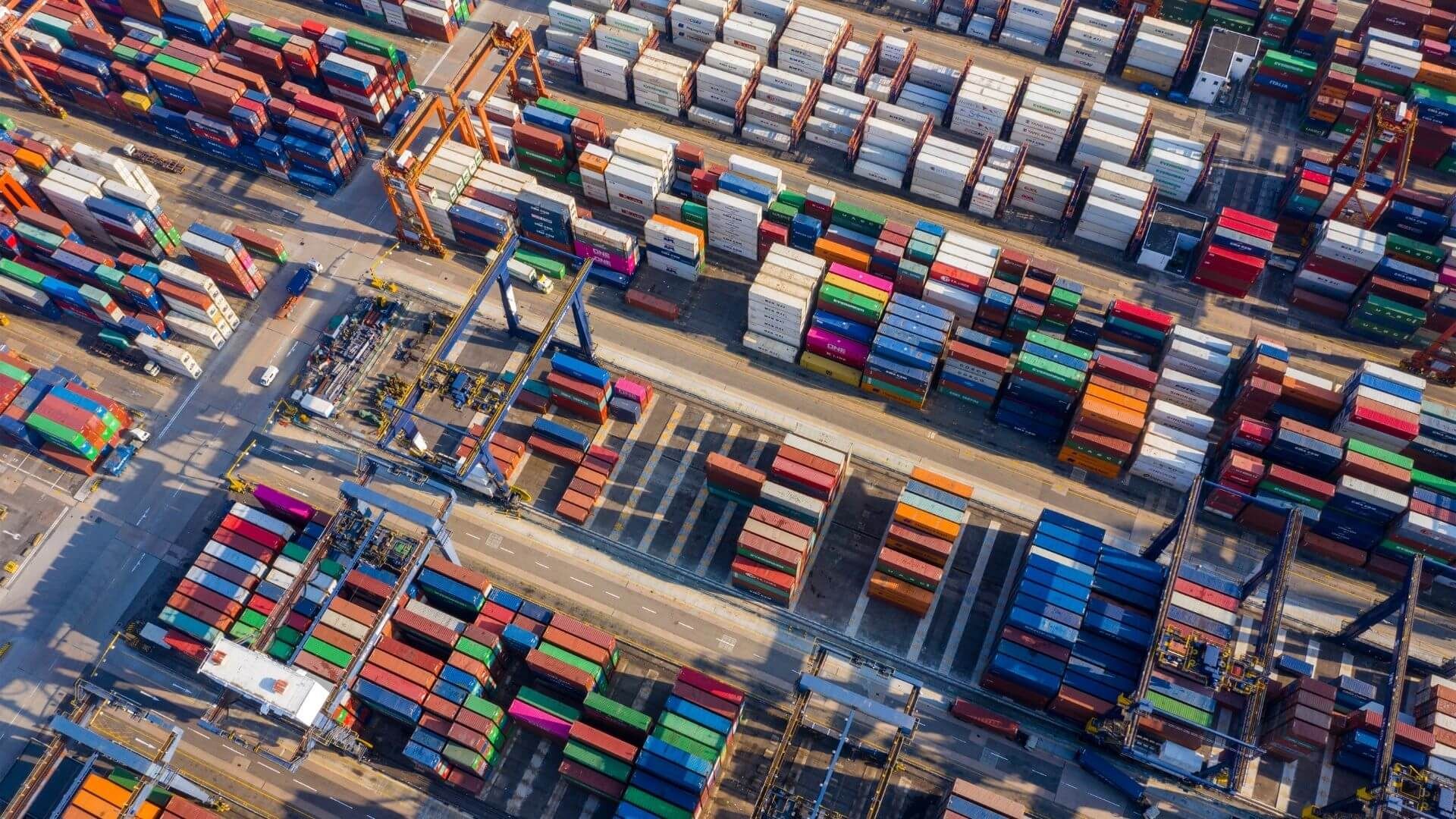

Many businesses will now be involved in “cross border” transactions meaning that a business in one territory will sell and, often, deliver goods to a

IPT in Ireland reflects the dynamic shifts in the global tax landscape. With an increasing number of tax jurisdictions adopting electronic filings, Ireland has joined

Unlike many other country initiatives that we have seen in the e-invoicing space recently, Australia does not seem to have any immediate plans to introduce

Annual reporting requirements vary from country to country, making it complex for cross-border insurers to collect the data required to ensure compliance. Italy has many

Insurance is a dynamic sector in constant flux to accommodate with insured’s needs. An increase in holidays abroad following WWII saw the need for Assistance

During the last decade, the Vietnamese government has been developing a feasible solution to reduce VAT fraud in the country by adopting an e-invoice requirement

Identifying the Location of Risk in the case of health insurance can be a tricky subject, but it’s also crucial to get it right. A

On 30 January 2022, the Zakat, Tax and Customs Authority (ZATCA) published an announcement on its official web page concerning penalties for violations of VAT

Towards the end of 2021, the tax authority in Turkey published a draft communique that expands the scope of e-documents in Turkey. After minor revisions,

Romania’s new SAF-T mandate was implemented for large taxpayers on 1 January 2022. Following the release of specifications in 2021 and subsequent testing phase, information

Sovos’ 13th annual Trends report takes an in-depth look at the world’s regulatory VAT landscape. Governments globally are enacting new policies and controls to close

With the most significant VAT gap in the EU (34.9% in 2019), Romania has been moving towards introducing a continuous transaction control (CTC) regime to

No matter the size of the business, the tax season kicked off this past month with tax reporting professionals tackling the massive task of issuing

We’re addressing Insurance Premium Tax (IPT) compliance in different countries. Written by our team of IPT and regulatory specialists, this guide is packed full of

In a blog post earlier this year, we wrote about how several Eastern European countries have started implementing continuous transaction controls (CTC) to combat tax fraud and

In our previous blog, we completed the compliance cycle with tax authority audits. However, that’s not the end of the challenges businesses face in remaining