This blog was last updated on November 22, 2021

Tax is a critical component of your business’ success and should never feel inaccessible. You don’t want your approach to tax to become a black hole where information disappears and is difficult to find. You and your teams deserve full visibility of your data and tax engine information, with self-service tools at your fingertips to understand ongoing tax obligations. Sovos works to empower business teams and reduce the reliance on IT to troubleshoot and conduct research on tax systems.

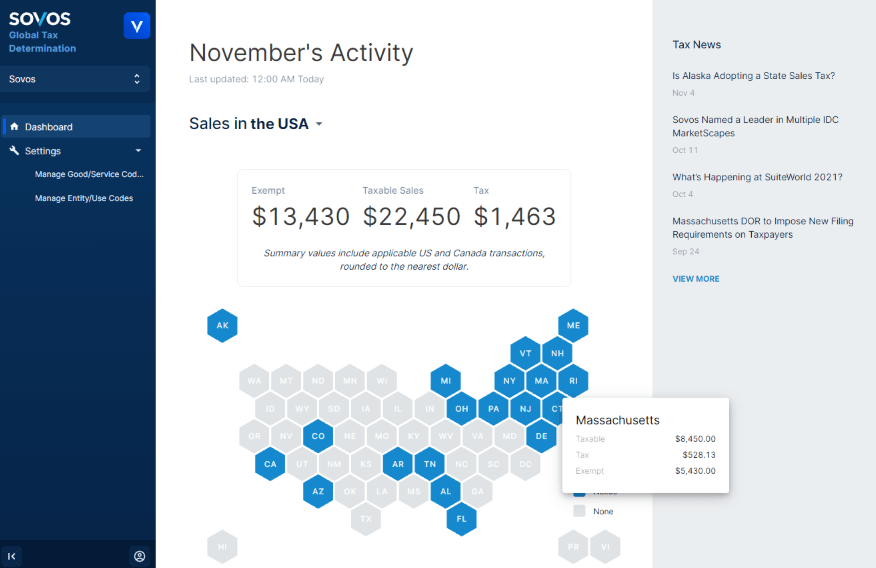

Our goal is to create a transparent, accessible tax engine. That’s why we’d like to highlight Sovos’ intuitive dashboard as a part of the Global Tax Determination (GTD) solution.

What’s included in the dashboard?

From day one as a Sovos client you are able to realize value immediately. Before even being fully implemented you gain access to a tax calculator for rates and geocodes, and can experiment or research new products. If you are considering going to market with a new product and want to better understand the impact to your tax liability in different jurisdictions, the tax calculator gives you the ability to do so.

During implementation, and on an ongoing basis as needed, utilize our easy-to-use mapping tools for good service codes and entity use codes. Self-service mapping tools streamline the process to accelerate onboarding and make taxability mapping for new products and services even easier as you grow and expand over time.

Once fully implemented, the system takes your data and you can see month-to-date totals of your filing tax data organized by state across the U.S. When you hover over a state, you get easy access to tax amounts, transaction counts and performance numbers. The map also highlights states in blue for where you have nexus.

The dashboard includes a section that features top regulatory news and links to articles for you to learn more about the topics you’re interested in.

What this increased tax engine visibility can do for you

Reduce the amount of time you spend trying to understand the state of your data with these easy-to-use tools at your fingertips:

- The self-service mapping tool will help you always stay in the know when it comes to the taxability of your SKUs and product categories.

- The interactive map can help you stay aware of approaching nexus thresholds as you gain insight to your monthly sales volume.

- Empower you and your teams with up-to-the-date information and regain control of your tax compliance process.

Sovos has invested in our user experience to offer a seamless end-to-end experience and timely information for your compliance and/or filing needs.

Take Action

Check out our Global Tax Determination offering to learn more about gaining control of your tax engine.