This blog was last updated on May 1, 2019

Allocating business profits for audit penalties because your accounts payable process has traditionally incurred sales and use tax fines and penalties is no way to grow a business.

In a recent webinar, “Building a Scalable Process for Use Tax Compliance,” experts from both Sovos and Grant Thornton discussed the market trends and risks related to tax compliance on purchases. The webinar covered challenges and various approaches in accurately determining and assessing taxes for use tax compliance and vendor tax validation, and audience polls garnered some interesting results.

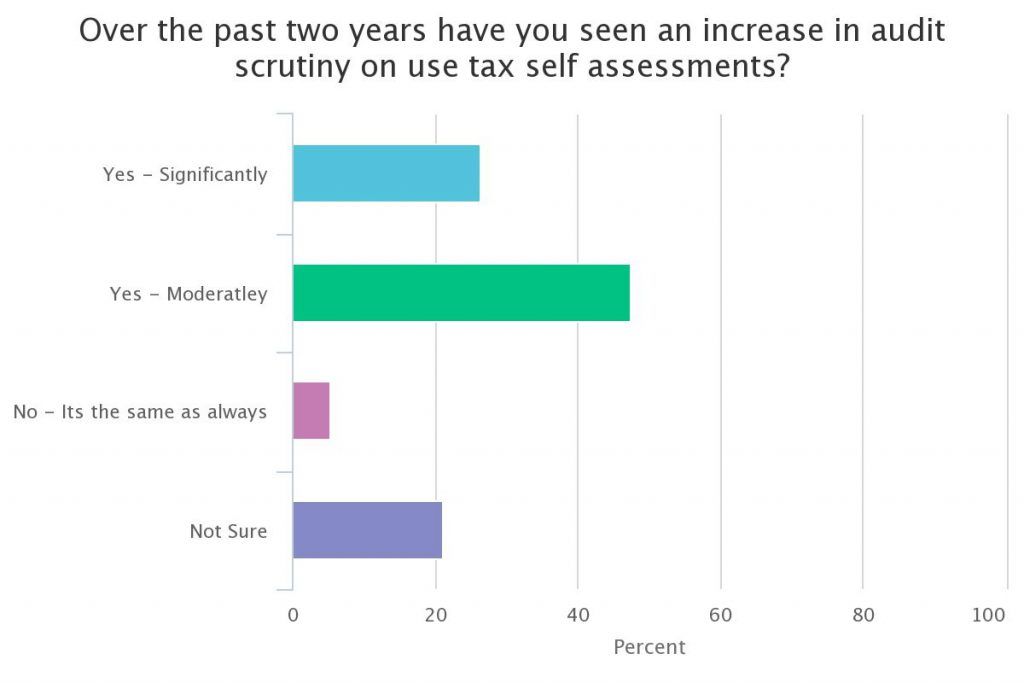

Use Tax on Purchases Comes Under Increased Audit Scrutiny

According to an Aberdeen Group research study in 2017, 40 percent of survey respondents indicated audit frequency and scrutiny has increased over the past two years, while 58 percent believe it will continue to increase over the next three to five.

Webinar poll respondents answered a similar question with a focus on use tax self-assessments, with 45 percent of the audience indicating they had witnessed a “moderate” increase in audit scrutiny and 25 percent indicating a “significant” increase. Companies are increasingly looking to improve their accounts payable process with a focus on the areas auditors are heavily focused, including use tax.

Penalties arising from sales and use tax audits have been known to average over $50,000 according to the same Aberdeen study, with many larger manufacturers spending an average two percent of annual revenues on penalties imposed due to filing errors.

Interestingly, in a recent Americas’ SAP Users’ Group (ASUG) survey of tax, finance, IT and procurement professionals, a staggering 52 percent indicated they “don’t know” or were “not sure” of the percentage of invoices with errors related to sales tax treatment on purchases. And 60 percent of those were from the tax compliance department!

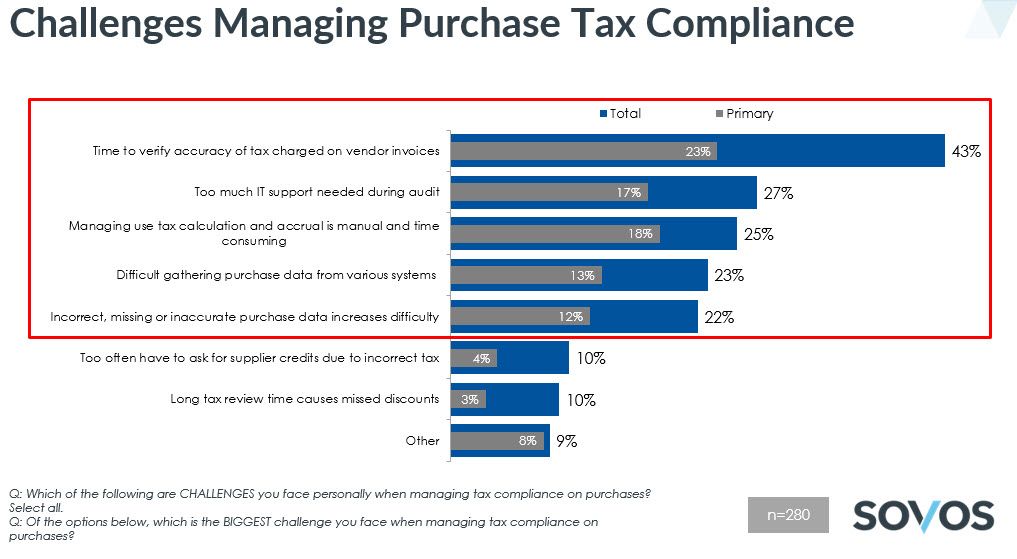

Accounts Payable Process Challenges in Managing Tax Compliance

In today’s fast-growing businesses, there is so much focus on the sales side of the house that Accounts Payable process can often become a secondary priority. This not only tends to put a lot of strain on accounts payable, but also finance, tax and IT, who are often involved in the manual processes and gathering purchase data from various systems necessary to determine if the tax charged was correct, or to self assess if there was no tax charged and there is still a tax obligation, all while paying suppliers accurately and on time.

Recent survey results from ASUG indicated that the time to verify the accuracy of tax charged on vendor invoices is the number one personal challenge for 43 percent of respondents when managing tax compliance on purchases, and 23 percent marked it as their biggest challenge.

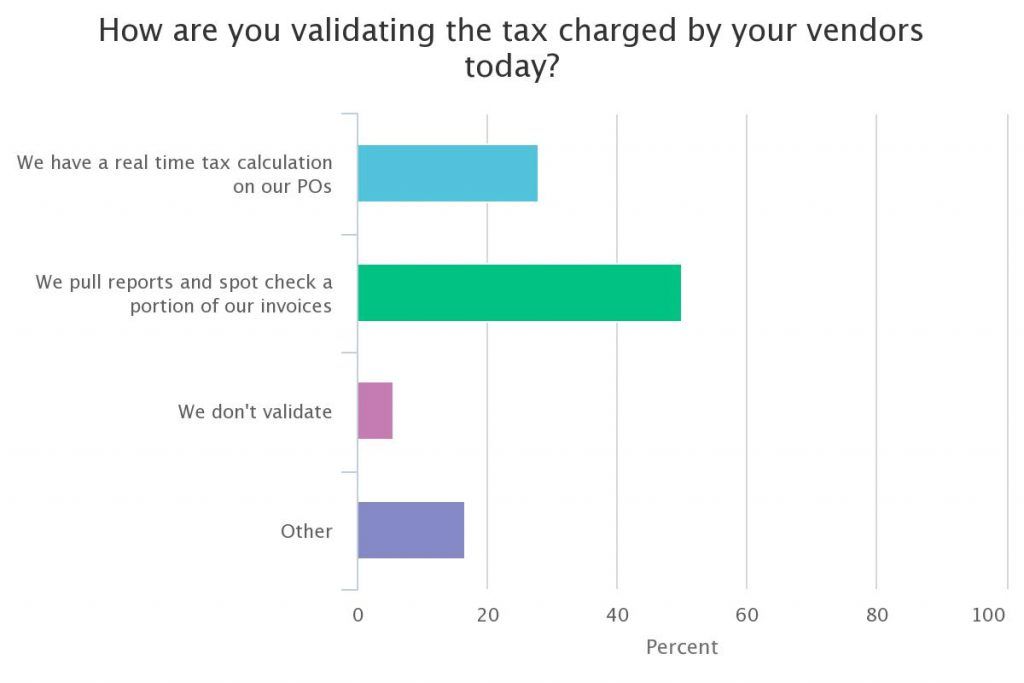

Often this results in only spot checking invoices over a certain threshold and increased audit risk, penalties and fines. Substantiating this claim, 50 percent of webinar attendees indicated only pulling reports and spot checking a portion of invoices (see the poll result below):

Data Analytics, ERP and Purchasing Systems

According to Mark Rems, partner, Indirect Tax Automation, Grant Thornton, auditors no longer come on site and just ask for some sales data and a fixed asset list to determine what tax wasn’t paid to a vendor. They now want entire data sets, as they have data analytics solutions that can determine where an organization has dropped the ball on self-assessing tax, where they haven’t paid tax to a vendor and where that tax is due.

Another significant challenge noted was merger and acquisition activity and pulling the necessary purchasing data from multiple sources to determine if you even have to assess use tax. These sources may include P-Cards and digital marketplaces, such as Ariba or Coupa. Those marketplaces can contain key transaction-related data, sometimes connected to several ERPs, such as Oracle, SAP or JD Edwards. Data that’s important to evaluate tax on transactions but is not centralized for tax evaluation. Organizations may also have separate invoice management or inventory management systems that may contain the data needed to determine what was bought and how it was used in order to help determine the tax treatment.

In my next post, I’ll compare two different approaches, real-time and batch sales tax evaluation, and use tax accrual processes to help you determine which is best for your situation.

Miss this webinar? Watch the on-demand replay at your leisure.

Take Action

Learn how Sovos Use Tax Manager can safeguard your business against the burden and risks of procure-to-pay sales and use tax compliance, give your tax team the visibility and control needed over tax data on every purchase – without slowing down your Accounts Payable process.