This blog was last updated on February 28, 2024

Wine direct-to-consumer (DtC) shipments continue to shift as the marketplace works to regain stability after a difficult economic year. Staying mindful of marketplace data will ensure the industry can properly adjust to any ebbs and flows, helping wine producers, retailers and consumers alike.

Nielsen is collaborating with Wines Vines Analytics and Sovos ShipCompliant to provide a much more comprehensive view of the U.S. off-premise wine category than ever previously available, with a data product that enables both separate and combined views of retail off-premise sales and DtC shipments.

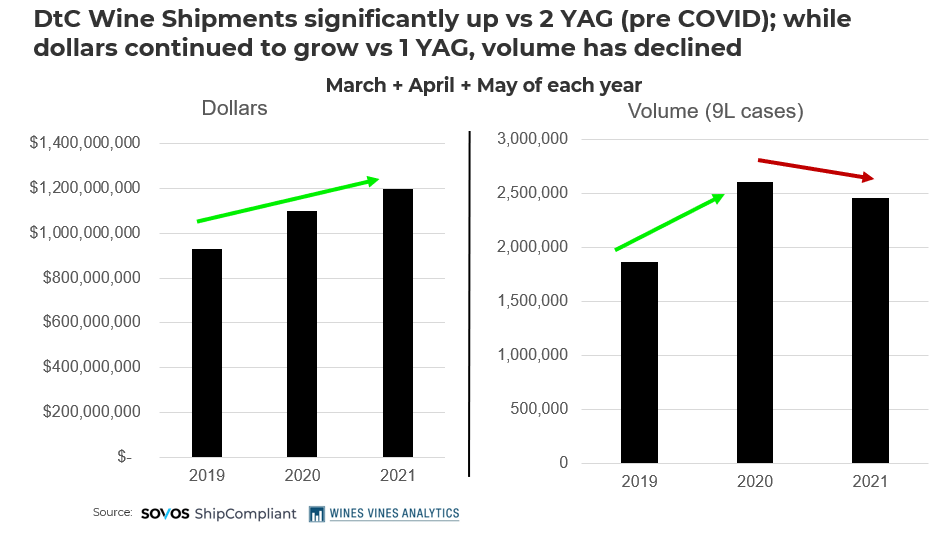

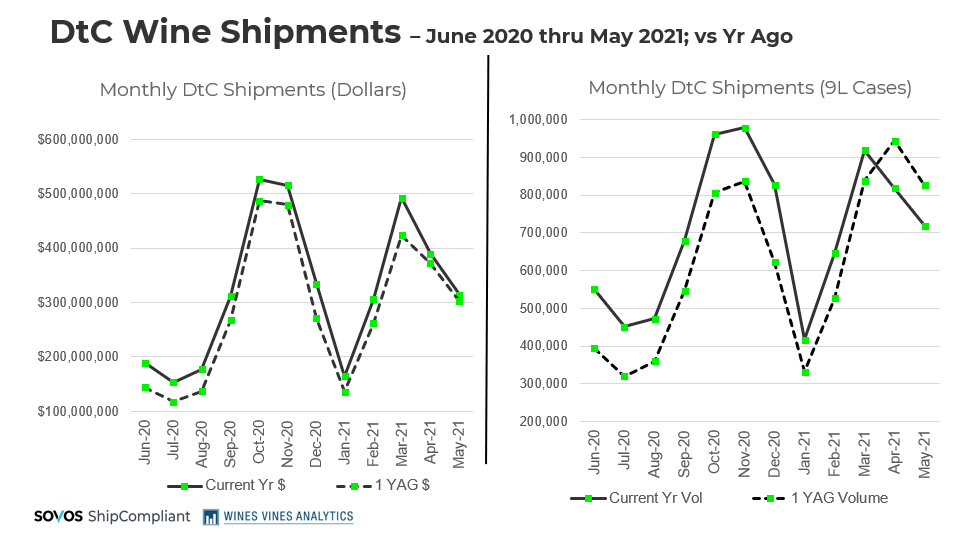

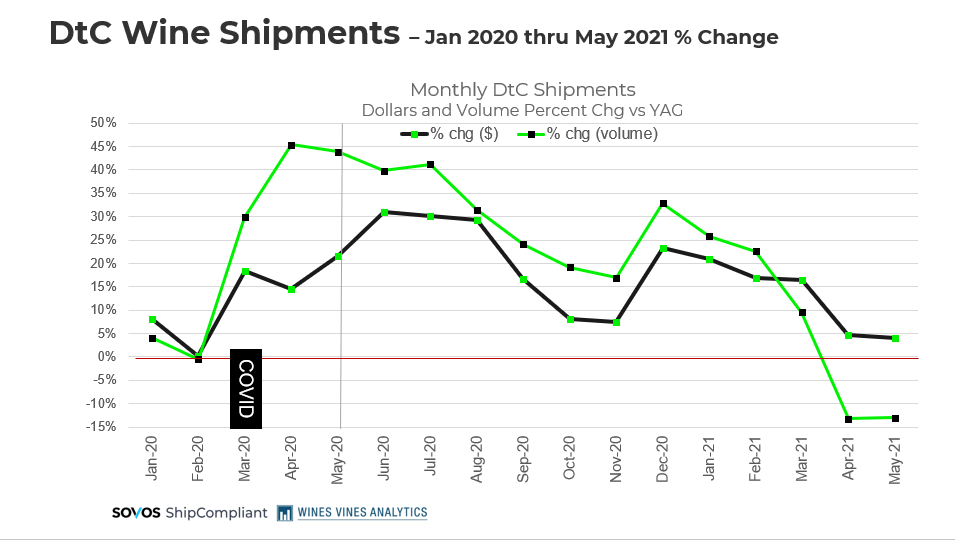

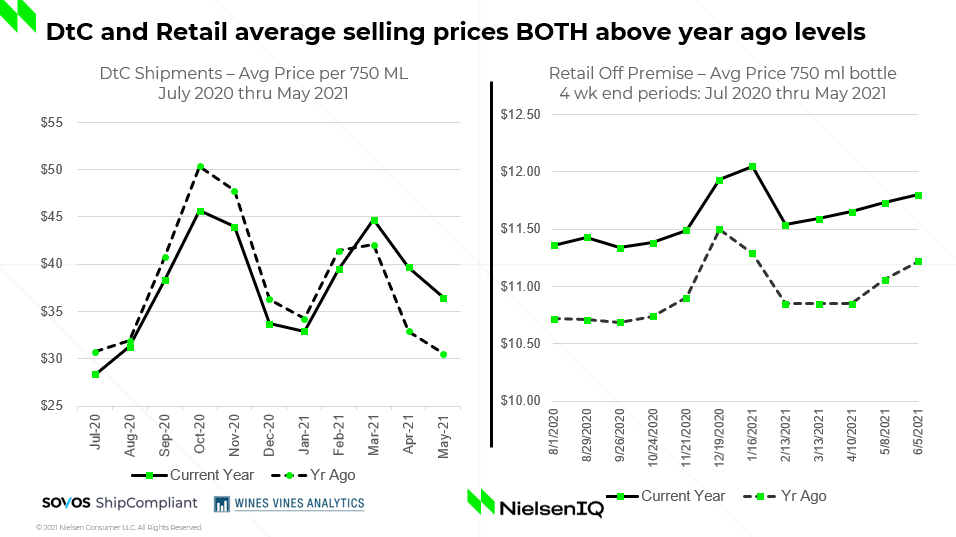

Similar to last month, we are now comparing to COVID-impacted periods from last year and the on-site tasting room business continues to return. Volume growth fell double digits versus a year ago for the second consecutive month. Like April though, May dollar growth was still positive. Consequently, the average bottle price shipped rose almost $6 versus levels from one year ago.

Here are some highlights from the most recent data, along with commentary from Nielsen consultant Danny Brager.

DtC Shipments

- In May, DtC shipments reached $302.6M and 718K cases shipped.

- Versus two years ago (pre-COVID), DtC shipment growth continued to be very robust – in the +25% percent range on both dollars and volume. This is likely a result of both on-site tasting room business not yet being where it was pre-COVID, and wineries having adapted in expanding the effectiveness and efficiency of their DtC business beyond the tasting room during COVID.

- In the less expensive price tiers ($20 and below) volume has declined compared to last year, whereas more expensive price tier ($50 and above) volume is up double digits. It’s likely that some consumers who may have come into the DtC market at lower price tiers may have now shifted back to the retail market for their wine purchases.

- Smaller wineries (50K and below) performed better than larger ones (over 50K) in May 2021.

Retail Off-premise

- In May, retail off-premise sales reached $1.4B and 14.7K cases.

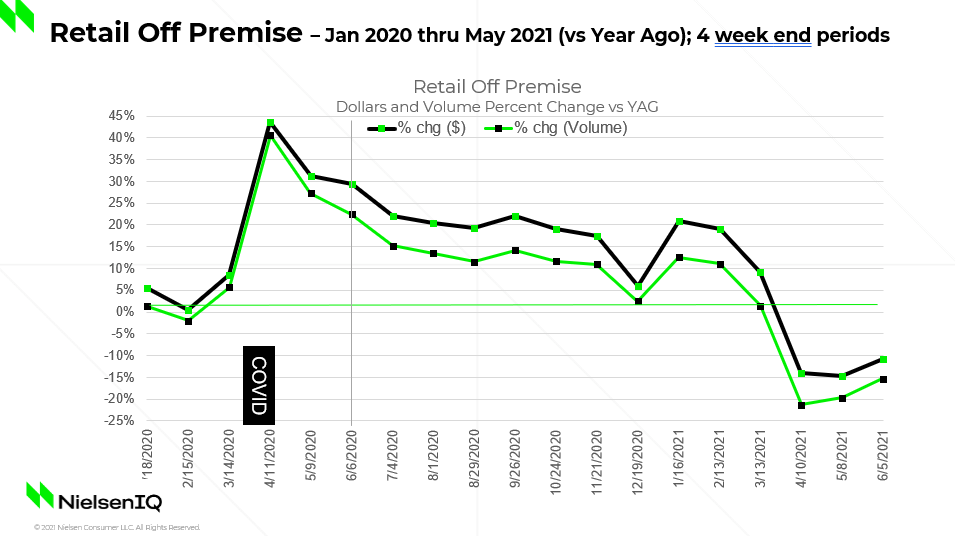

- With comparisons against COVID-impacted months a year ago and some channel shifting back to on-premise, it again is not surprising that wine off-premise retail sales fell significantly versus one year ago – it is down double digits on dollars, and even larger volume declines.

- Higher end wines continue to perform well in retail off-premise, with sales expanding even further versus the hypered levels from one year ago. It’s likely that some Napa and other premium wineries had shifted allocations to the off-premise during COVID, and both retailers and consumers were delighted to sell and buy them.

- Sparkling was once again the best performing wine type.

Interested in knowing more (e.g., by price tiers, varietals, origin, winery size, geography)? Contact Danny Brager at danny.brager@nielseniq.com.

Take Action

Download the Direct-to-Consumer Wine Shipping Reporting for an in-depth look at the 2020 DtC wine shipping market.