This blog was last updated on February 28, 2024

The wine market is in greater flux than ever as producers, retailers and consumers navigate the impacts of a global pandemic. Keeping a pulse on marketplace data has never been so important given these shifting dynamics.

Nielsen is collaborating with Wines Vines Analytics and Sovos ShipCompliant to provide a much more comprehensive view of the U.S. off-premise wine category than ever previously available, with a new data product that enables both separate and combined views of retail off-premise sales and direct-to-consumer (DtC) shipments.

Here are some highlights from the most recent data, along with commentary from Nielsen consultant Danny Brager.

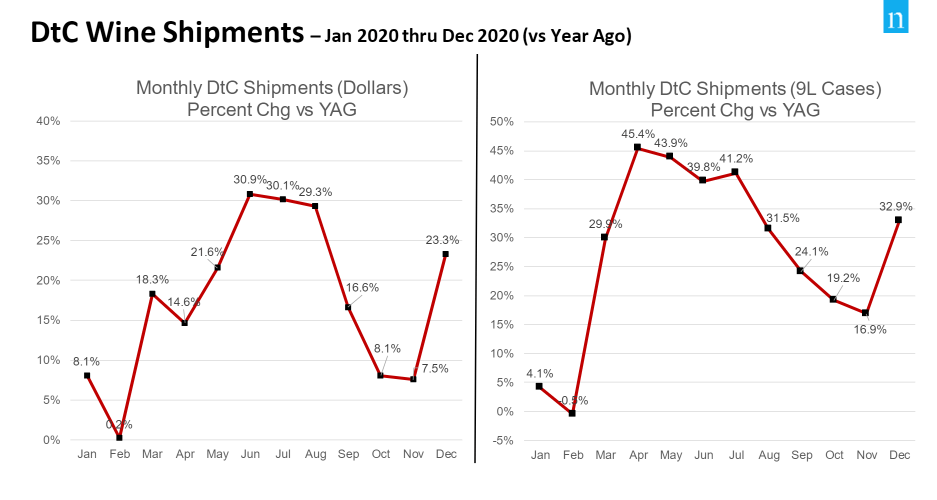

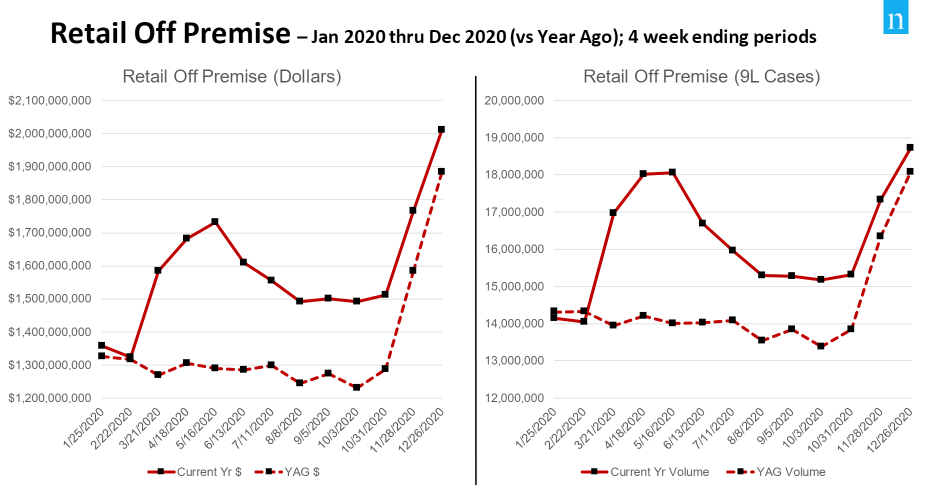

- As of December 2020, DtC shipments reached $3.7B or 8.4M cases and retail off-premise sales hit $20B or 211M cases, continuing its deceleration of growth.

- DtC shipments had a rebound in December, with year-over-year growth increasing 23.3% in value and 32.9% in volume.

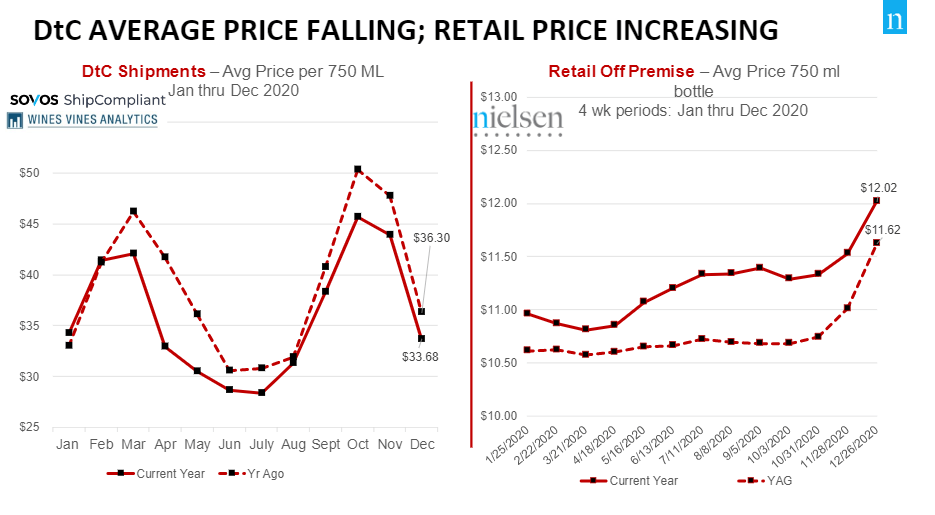

- For DtC shipments, large wineries, those producing over 500K cases annually, continued to have the lowest average price per bottle and the highest growth.

- Limited production wineries, producing 1,000 or less cases annually, also saw increases, though their average price per bottle significantly decreased.

- For off-premise retail, wine bottles priced above $11 continued to grow by double digits—outpacing volume growth and supporting the off-premise premiumization trend.

- Over December, for off-premise retail, Napa and Oregon led regional growth and Sauvignon Blanc and Rosé were the two most popular varietals.

Interested in knowing more (e.g., by price tiers, varietals, origin, winery size, geography)? Contact Danny Brager at danny.brager@nielsen.com.

Take Action

Download our annual Direct-to-Consumer Wine Shipping Reporting released on January 25 for an in-depth look at the 2020 DtC wine shipping market.