This blog was last updated on September 4, 2025

The direct-to-consumer (DtC) wine shipping channel has seen a continuation of the trajectory tracked in the January release of the Sovos ShipCompliant/WineBusiness Analytics Direct-to-Consumer Wine Shipping Report, with the channel experiencing a dip in volume and value. This year’s review of the DtC market at the mid-year digs into those numbers, trends by average bottle price, winery size, destination state and varietal — and also introduces two new data points on basket composition, enhancing this comprehensive examination of DtC wine.

Note: The proprietary data featured in this mid-year report is compiled from an algorithm measuring total DtC shipments based on millions of anonymized direct shipping transactions filtered through the ShipCompliant system and paired with WineBusiness Analytics’ comprehensive data on U.S. wineries, resulting in the most accurate depiction of the DtC wine shipping channel.

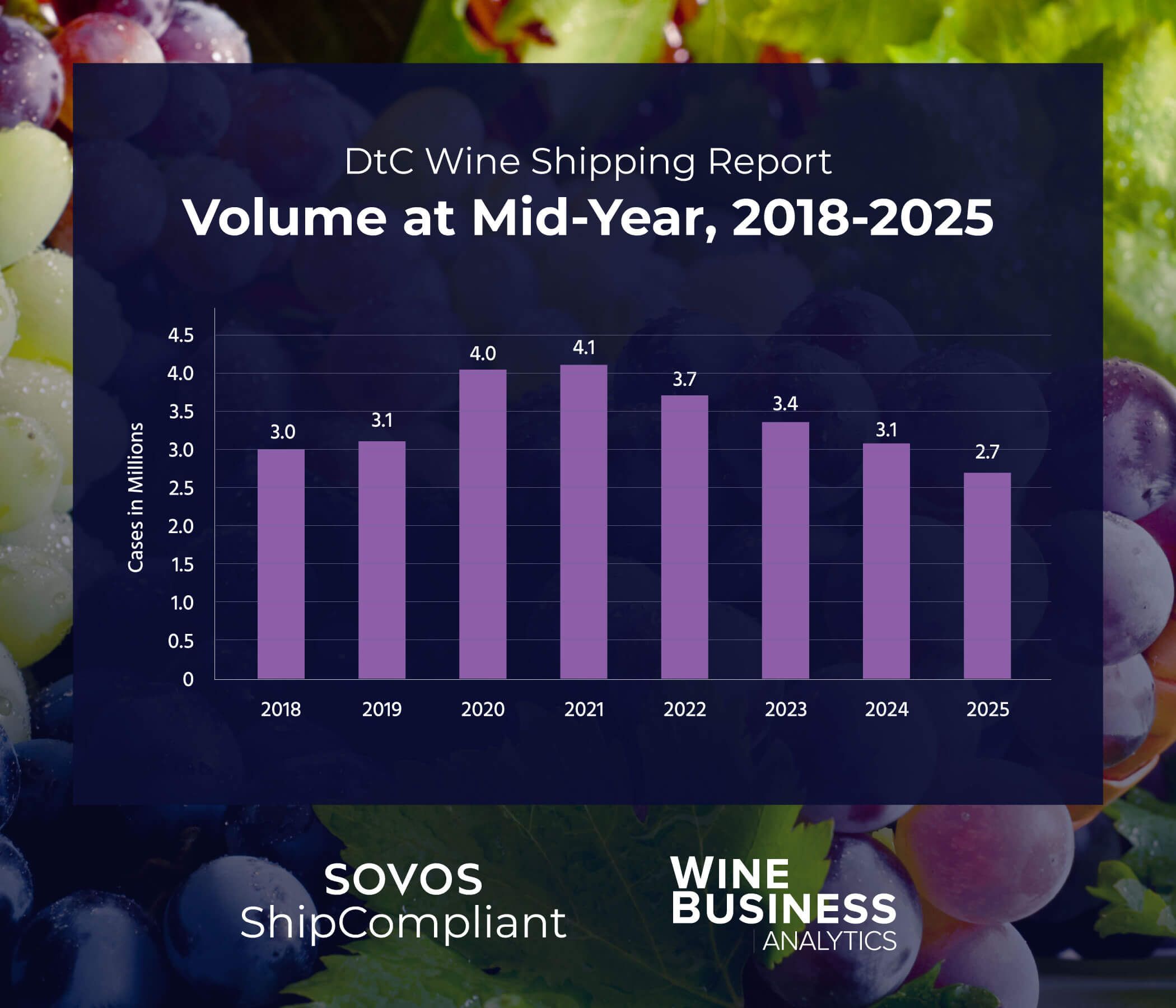

The latest data for the U.S. wine DtC shipping market shows that market value and volume have continued the downward trend seen since 2022. Nationwide, shipment volume has declined by 12% for the January-June 2025 period, amounting to 2.7 million cases sold, while the overall value of these shipments has decreased by 6%, totaling $1.7 billion. Average bottle price has experienced a steady increase over the last three years, with prices rising this year by 8%, reaching $52.68.

“This is definitely not what U.S. wineries were hoping to see in terms of total DtC shipment volume at this time of year,” said Andrew Adams with WineBusiness Analytics. “There was some optimism at the end of 2024 that declines would moderate through this year but that has not been the case. We are seeing the impacts of wine’s bigger challenges in the DtC market.”

Read on for a deeper look at the changes seen in the DtC shipping channel from January through June of 2025.

Average bottle price

The average price of a bottle shipped DtC has climbed to $52.68, an 8% year-over-year increase. Notably, the average price per bottle has increased by $14.38 since 2018, which is a 38% growth, outpacing the Consumer Price Index inflation.

This year’s rise is largely propelled by significant gains in several key regions. Notably, the Rest of California* segment experienced the largest percent change, up 14% to $32.12. Sonoma also posted a substantial increase, with its average bottle price climbing 9% to $37.96. Meanwhile, Napa continues to be the outlier, maintaining its position as the most expensive region, with its average bottle price nearing the $100 mark at $92.29, up 8% from last year. Napa’s elevated pricing pulls the overall national average upward, as it is the only region consistently above the average benchmark. In contrast, Oregon was the sole region to report a decline in average bottle price at the mid-year, dropping 3% to $49.43.

* Rest of Calif. = Wineries in Mendocino, Lake, Livermore and Temecula counties and the Sierra Nevada Foothills region, plus all other areas outside the Central Coast, Napa County and Sonoma County.

State and Regional Shipping Trends

California remains the leading destination state for DtC wine shipments, though its volume share slipped to 28% from 29%. Winery shipments to California fell 14% in volume to 765,000 cases and 10% in value to $482 million year-over-year.

The top ten destination states by volume at the mid-year are:

- California

- Texas

- Washington

- Florida

- New York

- Oregon

- Pennsylvania

- Illinois

- Colorado

- Virginia

Growth in Michigan and Alaska

Michigan stands out as one of only two states to register positive volume growth, with a 1% increase. Michigan’s volume share climbed to 3%, up from 2% the previous year, while value grew by 3%.

Alaska also recorded growth, posting a remarkable 46% jump in volume, though this is from a small base as the state still accounts for less than 1% of total volume. An impressive 93% increase in shipment value can be attributed to a new winery licensing requirement that took effect in January of 2024.

In total, eight states achieved positive value growth: Alaska (+93%), Arkansas (+7%), Idaho (+7%), Kentucky (+6%), Michigan (+3%), South Carolina (+5%), Tennessee (+3%) and Wyoming (+8%).

Winery Performance by Location and Size

Regional Winery Trends

Across the board, all regions reported declines in both volume and value. Notably, the Rest of California’s share of volume (10%) dipped below both the Rest of U.S. (11%) and the Central Coast (11%) for the first time, driven by the segment’s most dramatic volume decrease (-24%) and largest value decline (-14%) among tracked regions. The Central Coast, meanwhile, experienced the smallest reduction in shipment volume, down just 6% year-over-year.

Winery Size and Average Bottle Price Shifts

All winery size categories experienced declines in shipment volume, yet every segment reported an increase in average bottle price (ABP). Notably, very small wineries (1,000–4,999 cases annual production) were the only group to register an uptick in shipment value, leading to a remarkable 15% rise in ABP to $79.34 as shipment volume slipped by 12%. The largest wineries (500,000+ cases) faced the steepest declines, with volume plummeting by 24% and value dropping by 14%; however, they still recorded the third-largest ABP increase at 14%. Limited production wineries (producing fewer than 1,000 cases/year) surpassed the $100 ABP mark, reaching $112.76 after a 15% jump, tied for the largest ABP change among all segments, while seeing both volume (-18%) and value (-6%) contract within the period.

Varietal Trends in DtC Wine Shipping

Cabernet Sauvignon maintained its lead with a 16% share of total volume despite a notable 13% decline in shipment volume compared to last year. The varietal’s dominance in value is even greater, representing 29% of total DtC shipment value despite a 4% decrease YoY. Cabernet Sauvignon remains the highest-priced varietal, with the average bottle price climbing to $98.35.

Pinot Noir followed with a 15% share of volume, down 12% YoY, and accounted for 16% of value, reflecting a 10% decrease. Its ABP reached $55.59, making it the third highest among major varietals. Red Blend shipments represented 13% of volume (down 17%) and 16% of value (down 7%), with the second highest ABP of $63.69. Chardonnay saw a 10% share of volume (down 9%) and 9% share of value (down 4%).

Among notable trends, Riesling—while holding just 2% of volume share—was the only major varietal to post positive volume growth, increasing by 2%. Reflecting the greater diversity of wines in the DtC market, the Other category also recorded growth, and together they contributed to an 11% rise in value, though Riesling accounted for the larger share of that increase. Cabernet Franc posted the fourth highest ABP at $53.90. Impressively, average bottle prices increased across all varietals (excluding unspecified wines), highlighting a continued shift toward higher value in the DtC channel.

Basket Composition Insights

A close examination of shipment baskets reveals consumer preferences in the DtC wine shipping channel. Orders containing four to six bottles are the most popular, making up 25% of all shipments. Following closely behind, large orders of 12 or more bottles account for a substantial 22% share. In contrast, single-bottle orders are the least common, comprising just 13% of total shipments.

This year, the average number of bottles per shipment has edged upward, rising from 9.5 bottles in 2024 to 9.9 bottles in 2025, an increase of 5%. “It appears consumers and wineries may be moving more wine in fewer shipments to save money and that could explain some of the decline in shipments,” Adams said. “We’ve also seen data that suggests more consumers are picking up their wine club allotments at the winery. These trends don’t account for the full decline in total shipment volume but reaffirm the opportunities in direct sales.”

The average order value of DtC shipments has also seen significant growth, jumping from $463 to $521, which represents a 13% increase. “The increase in average order value aligns with the ongoing stability in the DtC market for more expensive wines,” Adams noted. “It also reflects the increased cost of selling and shipping wine direct as well as declining shipment volumes across the entire channel.”

What’s next for DtC wine shipping?

With economic uncertainty, a turbulent U.S. political climate and evolving consumer preferences in beverage alcohol, forecasting the future of the DtC wine shipping channel remains complex. Still, no matter how the market adjusts, we remain committed to providing timely observations and insights. Our full 2026 report will be released in January, but in the meantime, you can explore the latest trends and performance metrics by downloading your complimentary copy of the 2025 Direct-to-Consumer Wine Shipping Report.

This data was compiled in partnership with WineBusiness Analytics, a leading source for wine industry data.

FAQ

What is DtC wine shipping?

DtC wine shipping is when a winery sells and ships its wine directly to the consumer, outside of the three-tier system that includes distributors and retailers.

What were the top DtC wine shipment destination states?

So far in 2025, the top five DtC wine shipping destination states by volume were California, Texas, Washington, Florida and New York.

What varietals dominate DtC wine shipping?

Cabernet Sauvignon and Pinot Noir had the largest share of volume in the first half of 2025.

How is average bottle price changing in DtC shipments?

The average price per bottle shipped has been increasing since 2018 and is now $52.68.