Switching vs. Suffering: Sales and Use Tax Pain is Avoidable

As one of the more complicated administrative aspects of a retail business, sales and use tax filing processes are ripe for re-evaluation. Begin by asking

As one of the more complicated administrative aspects of a retail business, sales and use tax filing processes are ripe for re-evaluation. Begin by asking

Almost two decades ago when Bruce Respler joined Marjam Building Supply, one of the largest distributors of building materials on the East Coast, he was

When business is booming, the last thing you want to do is focus on tax liability. But as you expand, so does complexity. Moving into

Picture this scenario: You input your sales and use tax data into your automated tax management tool and wait for your filings to be ready.

It’s no secret 2020 was a year of personal and professional disruption, requiring rapid adaptation. So long, office happy hour. Hello Zoom quarantinis! Of course,

The Supreme Court’s 2018 ruling on South Dakota v. Wayfair, Inc. had a ripple effect across the country on how out-of-state businesses must collect and

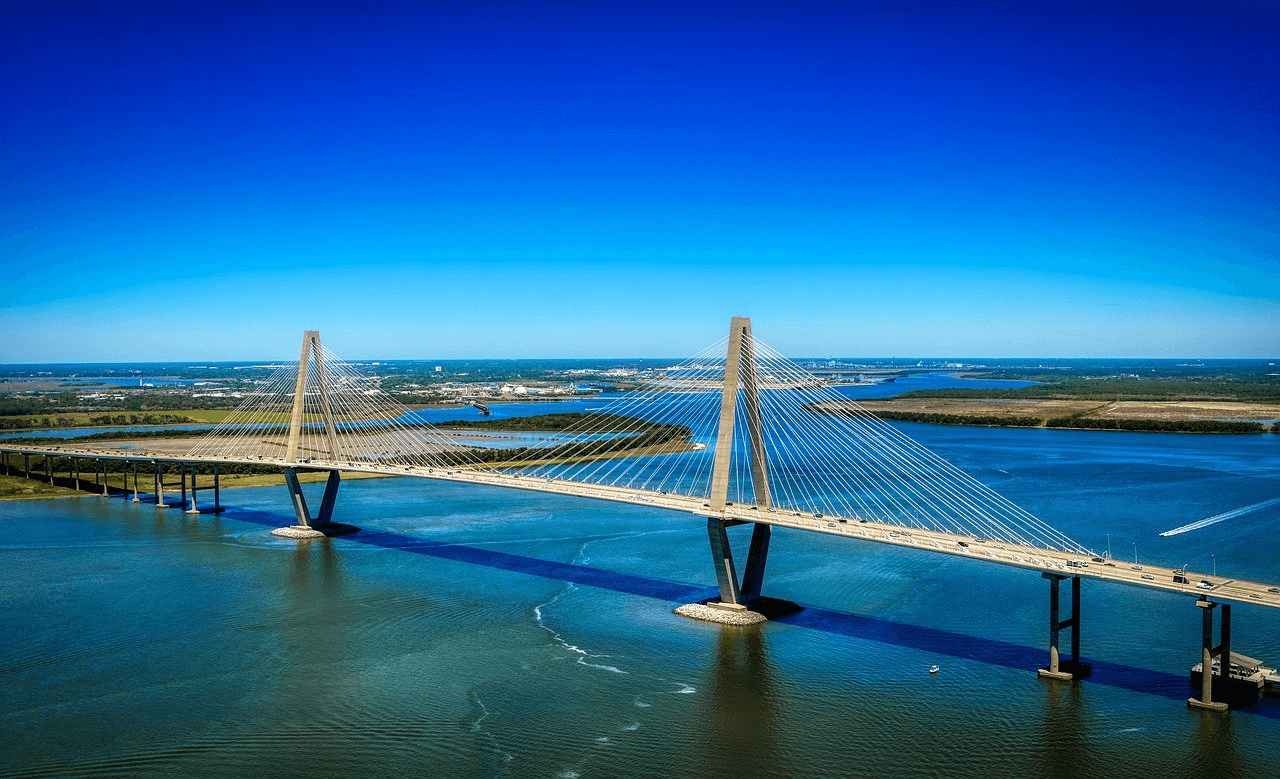

The South Dakota v. Wayfair, Inc. decision pushed changes in many state economic nexus laws, including in South Carolina. The state enacted regulation similar to

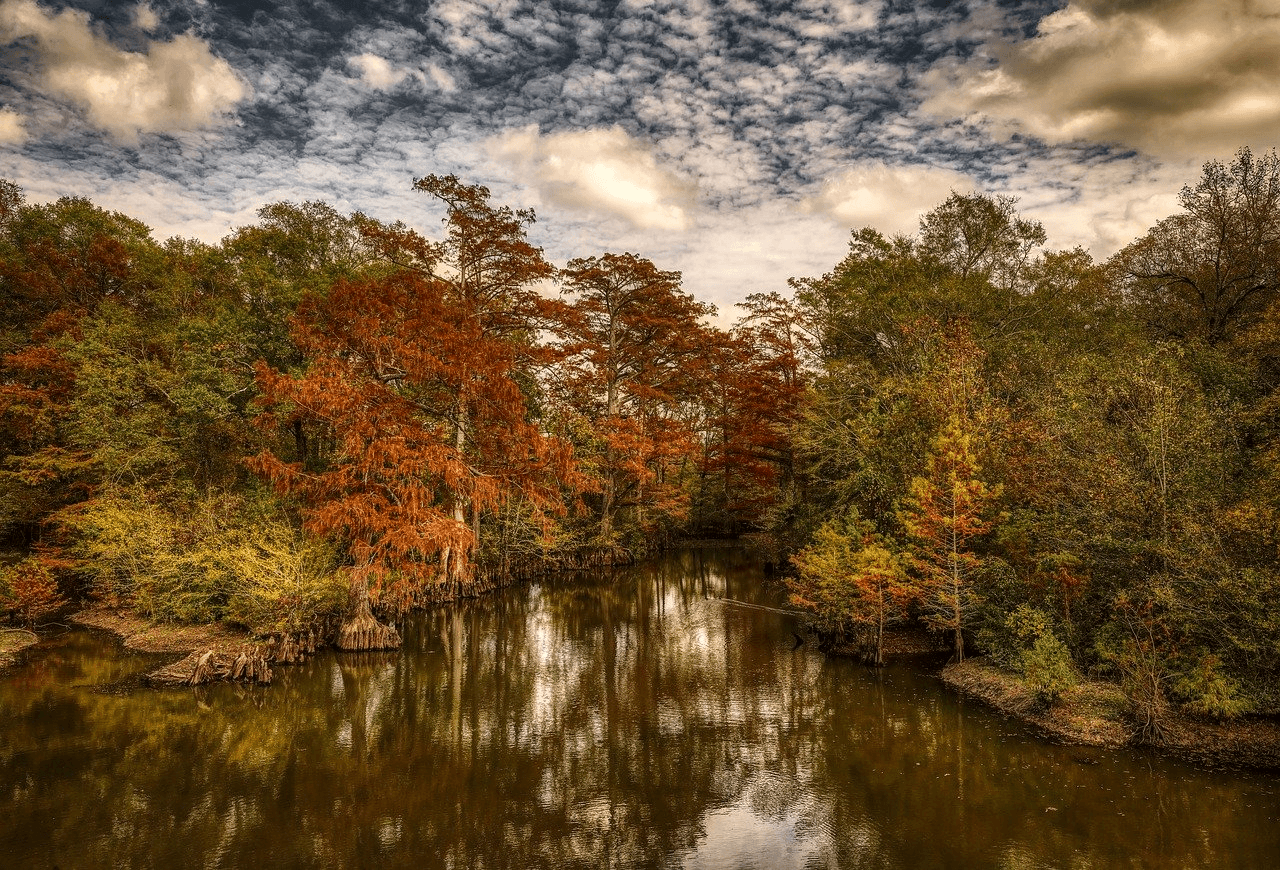

Prior to the South Dakota v. Wayfair, Inc. decision, Nebraska could not require remote sellers to collect sales tax on sales made to customers in

Pennsylvania’s economic nexus rules were impacted by the South Dakota v. Wayfair, Inc. Supreme Court decision. Pennsylvania passed Act 13-2019, which suspended its previous Marketplace

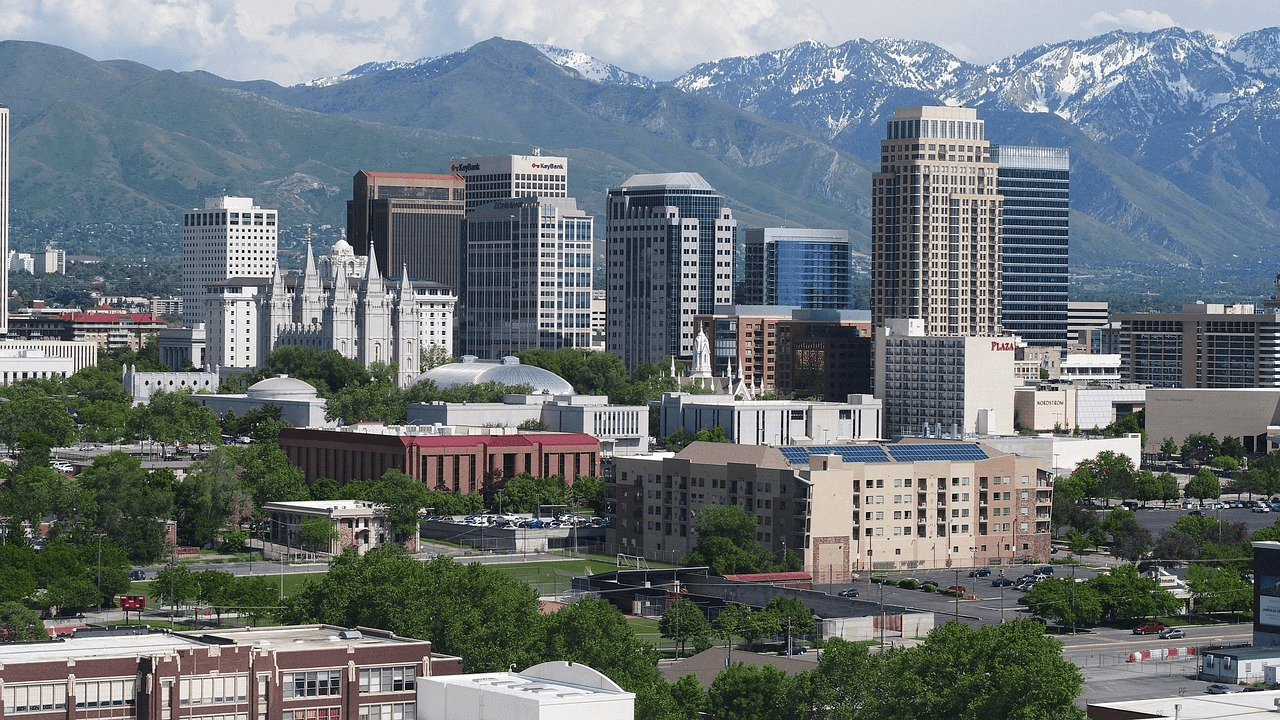

The Utah economic nexus sales tax was adjusted following the South Dakota v. Wayfair, Inc. Supreme Court decision. Utah now requires remote sellers to register,

Almost every state has updated its sales tax nexus requirements following the South Dakota v. Wayfair, Inc. decision. Wisconsin followed suit with the majority of

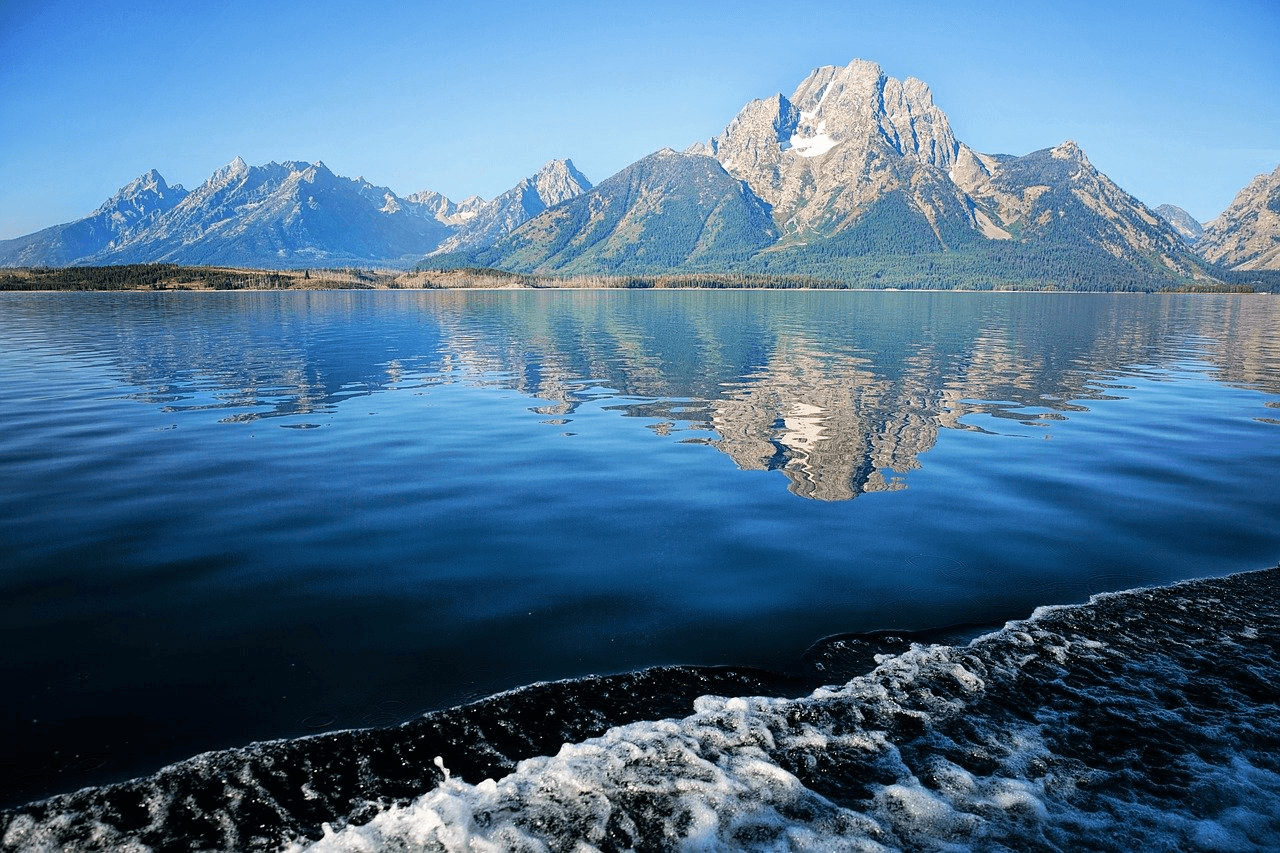

This blog was last updated on July 19, 2024. When it comes to sales tax nexus updates, Wyoming was ahead of the curve. The Cowboy

After the South Dakota v. Wayfair, Inc. decision, Vermont expanded sales tax collection requirements to include remote sellers. The Green Mountain State largely followed suit with

The South Dakota v. Wayfair, Inc. decision pushed many states – including North Dakota – to adjust their economic nexus laws. North Dakota had previously

Sovos recently hosted a webinar with Joe Hillstead, a tax and advisory partner with Squire & Company (Squire). Squire works with Sovos to support the

Are you ready to submit and file a compliant sales tax return? Think you already know everything there is to know about the process? Whether

Annual reconciliations can be a critical aspect for businesses as they work to achieve tax compliance. They are used to resolve all payments made to

Black Friday and Cyber Monday 2020 were record-breaking shopping days, further showing that e-commerce is not “a phase” and will likely continue to be a