How Sovos helps companies navigate the new EU e-Commerce VAT OSS Package requirements

Implementing the changes required to comply with the EU e-Commerce VAT Package into your ERP system could take significant time and resources. Sovos can help ease the tax burden and help you prepare for and understand the right solution for your business.

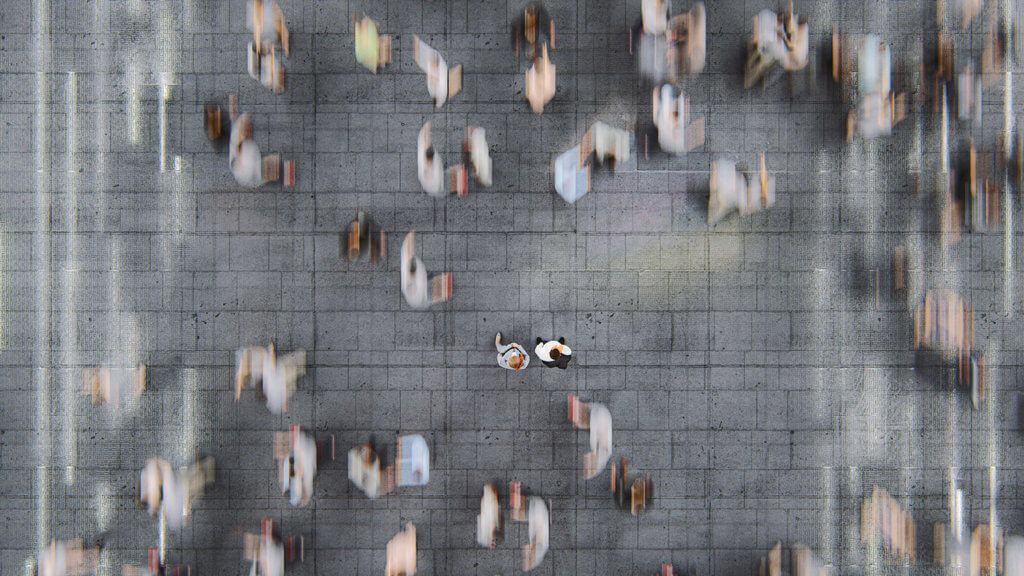

Our large advisory team can help you navigate the complexities of modern VAT compliance.

Contact us to discuss how we can help your company prepare for the digital future of tax.