When Real-Time Tax Controls Move from a Trend to the Norm, What Comes Next?

Few experts would disagree with the idea that the global trend towards real-time tax controls on business transaction data has evolved from a ‘trend’ to

Few experts would disagree with the idea that the global trend towards real-time tax controls on business transaction data has evolved from a ‘trend’ to

With just 6 months until e-invoicing becomes mandatory for all domestic Italian supplies, there is still a lot of confusion over the timeline, scope and

The acceleration of regulatory complexity is causing unnecessary strain on IT departments within manufacturing companies, negatively impacting growth. In fact, 31% of companies report that

Mexico’s planned process change for cancellations of electronic invoices will take effect Sept. 1 rather than in July as previously announced. The Mexican tax authority,

Will Spain become the next EU country to follow in Italy’s footsteps by introducing a national mandate for business to business (B2B) e-invoicing? With the

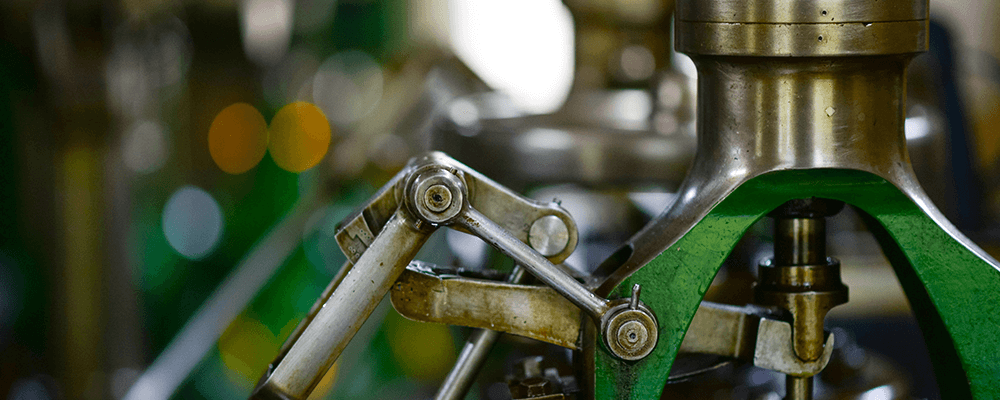

As eInvoicing mandates sweep across Latin America, manufacturing is arguably the single most affected sector. With requirements impacting IT, finance, shipping, inventory management, inbound receiving

Costa Rica is one of the latest countries in Latin America to embrace electronic invoicing, and many companies doing business in the country are under

The governments and tax administrations of South and Central America were among the first in the world to adopt ambitious programmes that mandate the use

Invoicing in Latin America has become complex to the point of being daunting. Businesses that get electronic invoicing processes wrong could quickly grind to a

Italy will soon join Hungary in requiring real-time, transaction-level reporting. With the launch of the first phase imminent (1 July 2018), Italy’s tax authority recently

Ever since the Legge di Bilancio, the law introducing the Italian e-invoicing obligation for all domestic supplies was passed on 27 December 2017, discontented voices

Companies looking to expand internationally or ones already doing business in multiple locations face a complex web of tax regulations and reforms, varying dramatically from

Since the first launch of eInvoicing mandates in Brazil 10 years ago, eInvoice adoption has now spread worldwide. Governments are implementing complex, real-time, transaction-level requirements

The floodgates may be opening. Following the EU’s approval of mandatory e-invoicing in Italy, it appears that Greece will be the next European Union member

By Andy Hovancik – President & CEO Today, we announced the acquisition of Stockholm-based TrustWeaver to create a clear leader in modern tax software. TrustWeaver

Most countries that impose an eInvoicing mandate require taxpayers to report not only issued invoices, but also eInvoices received from their suppliers. With Colombia’s eInvoicing

Singapore was one of the early adopters of e-invoicing in the Asia Pacific region. Since 2008, e-invoicing has been mandated for all e-invoicing business to