Blog

With the entry into force of resolutions SAT-DSI-1240-2021 and SAT-DSI-1350-2022, most taxpayers in the country are now obliged to issue electronic invoices under the Online Electronic Invoice System (Regimen de Factura Electronica en Linea – FEL). The latest taxpayers to join the mandatory electronic billing system are include taxpayers incorporated into the General Value Added […]

Little by little, we are witnessing how countries in Africa are starting to follow e-invoicing and continuous transaction control trends implemented by many other countries around the globe. Each country in the continent is developing their own variation of a tax digitisation system. Currently there is no compliance standardization, with requirements differing in each jurisdiction […]

New bookkeeping law – Lov om bogføring On 19 May 2022, the Danish Parliament passed a new bookkeeping law – Lov om bogføring – introducing requirements for companies to use a digital bookkeeping system. Section 16 of the Law requires many Danish companies to use a digital bookkeeping system and make their bookings electronically. The final […]

It’s a good year to be an IT leader. After far too many years of the phrase “do more with less” being the mantra of most organizations when it came to technology spending, things are finally looking up. According to research firm Gartner, IT spending will reach an estimated $4.5 trillion in 2022. This represents […]

France is implementing a decentralised continuous transaction control (CTC) system where domestic B2B e-invoicing constitutes the foundation of the system, adding e-reporting requirements for data relating to B2C and cross-border B2B transactions (sales and purchases). Under this upcoming regime, data or invoices can be directly sent to the Invoicing Public Portal ‘PPF’ (Portail Public de […]

The Legislative Assembly of El Salvador has published Decree 487 on reforms to the tax code. The decree enables the use of Electronic Tax Documents (Documentos Tributários Electrónicos – DTE) in the country, introduces new articles to the tax code and reforms existing ones. The decree incorporates new articles to the tax code to regulate […]

Update: 13 March 2023 by Enis Gencer Northern European Jurisdictions: CTC Update The European Commission’s VAT in the Digital Age (ViDA) proposal continues to unfold with the latest details published on 8 December 2022. As a result, many EU countries are stepping up their efforts towards digitizing tax controls – including mandatory e-invoicing. While we […]

Portugal’s state budget entered into force on 27 June 2022 after protracted negotiations. The budget contained an interesting provision: the obligation to present invoice details to the tax authorities was extended to all VAT-registered taxpayers including non-resident taxpayers

Brazil is known for its highly complex continuous transaction controls (CTC) e-invoicing system. As well as keeping up with daily legislative changes in its 26 states and the Federal District, the country has over 5,000 municipalities with different standards for e-invoicing. The tax levied on consumption of services (ISSQN – Imposto Sobre Serviços de Qualquer […]

Update: 8 March 2023 by Kelly Muniz Spain launches public consultation for B2B mandatory e-invoicing The Ministry of Economic Affairs and Digital Transformation (Ministerio de Asuntos Económicos y Transformación Digital) has launched a public consultation on the upcoming B2B e-invoicing mandate. The mandate will enable citizens to participate in elaborating norms before its development. This […]

The Colombian tax authority (DIAN) continues to invest in the expansion of its CTC (continuous transaction controls) system. The latest update proposes an expansion of the scope of documents covered by the e-invoicing mandate. In this article we’ll address the newly published Draft Resolution 000000 of 19-08-2022. This advances important changes for taxpayers covered by […]

Update: 14 February 2023 by Andrés Landerretche Colombian e-invoicing Update: P.O.S. Tickets Threshold Rules Now in Force As of February 2023, new rules came into force in Colombia. These are for the issuance threshold of equivalent documents generated by Point of Sale (P.O.S.) systems. As a result, a ticket issued by cash registers with P.O.S. […]

The European Commission (EC)’s action plan for fair and simple taxation – ’VAT in the Digital Age’- continues to progress. After a public consultation process, the EC has published Final Reports discussing the best options for the European market to fight tax fraud and benefit businesses with the use of technology. The areas covered are: […]

The Italian Customs Authorities recently updated their national import system by applying the new European Union Customs Data Model (EUCDM). These new changes came into effect on 9 June 2022. According to the new procedure, the old model of paper import declarations has been abolished. The import declarations are now transmitted to the Italian Customs […]

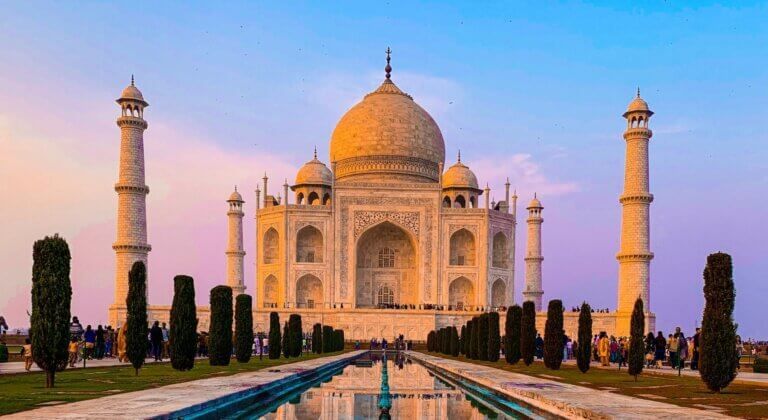

In India, the e-invoicing system has been live since 2020. Taxpayers in the scope of e-invoicing mandate must issue their invoices relating to B2B and B2G transactions through the e-invoicing system, which is a form of continuous transaction controls (CTC). However, B2C invoices are not issued through the CTC system, which means that B2C invoices […]

As previously predicted by Sovos, the threshold for implementing mandatory e-invoicing has been lowered by the Indian authorities. According to the Central Board of Indirect Taxes and Customs Notification No. 17/2022 – Central Tax, from 1 October 2022 compliance with the e-invoicing rules will be mandatory for taxpayers with an annual threshold of 10 Cr. […]

Since 1 January 2019 foreign electronic service providers must issue electronic invoices, a type of e-invoice, for sales of electronic services to individual buyers in Taiwan. Alongside this, Taiwan’s local tax authorities have been introducing incentives for domestic taxpayers to implement e-invoicing despite not being a mandatory requirement. Before diving into the details of the e-invoicing […]

Latest Changes 1 July begins the second half of 2022, and in line with that milestone, changes have started to be implemented in the CTC sphere. In this blog, we highlight vital developments that have taken place in and outside Europe that may influence the continuous transaction controls (CTC) landscape globally. The Philippines: Pilot program […]