Blog

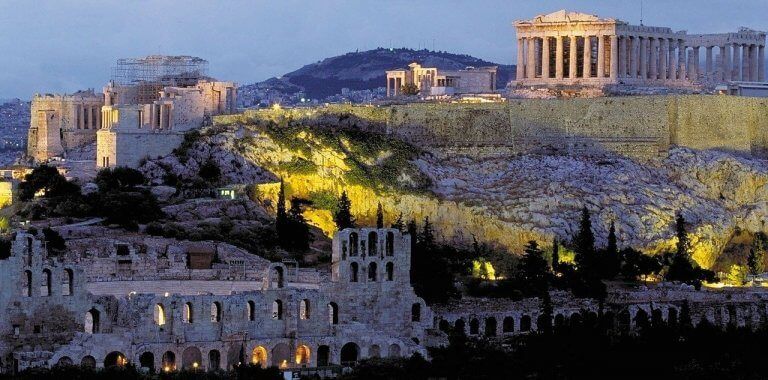

New go-live date for myDATA legislation A new roll-out date for the myDATA e-books mandate was announced by the Greek tax authority, the IAPR, during a recent meeting with local industry groups. While nothing is formal and binding until it’s been codified through law, the tax authority seems to have made up its mind about […]

Countries worldwide are introducing indirect tax measures intended to mitigate the economic consequences of the coronavirus pandemic. Prospective measures by EU Member States include: Austria Austria has announced that taxpayers can seek elimination of default interest and penalties for late submissions resulting from coronavirus. Belgium Belgium has announced that businesses encountering financial difficulties can […]

In the last several weeks, we have monitored many efforts by federal, state and local governments to provide relief to both businesses and individual taxpayers impacted by the COVID-19 pandemic. As they relate to indirect tax (VAT/Sales Tax/GST), the measures enacted to-date have followed varying paths. Here are a few examples of the types of […]

Originally posted: March 18, 2020, at 5:00 p.m. ET. Last Updated: June 29, 2020, at 5:00 p.m. ET. The impact of COVID-19 on businesses across the globe has been swift and severe. In response, many federal, state and local governments are working to provide relief to both businesses and individual taxpayers impacted by the pandemic. […]

The expansion of Poland’s new SAF-T report (JPK) barely took effect before Poland is steaming ahead with a more far reaching plan. It aims to introduce a centralized e-invoice system via an exchange platform in 2022. In an interview published on the Polish Ministry of Finance webpage, the Minister of Finance says that implementing mandatory […]

Anyone predicting clearance model e-invoicing system, Italy’s FatturaPA, would undergo further reform would be right. Agenzia delle Entrate – AdE, the Italian tax authority, has issued new technical specifications and schemas for Italian B2B and B2G e-invoices. But – what do these changes really mean? And what impact do they have on business processes? Technical […]

A keystone of HMRC’s Making Tax Digital for VAT (MTD) regime is that the transfer and exchange of data between what HMRC define as “functional compatible software” must be digital whenever that data remains a component of the business’s digital records. This is to maintain a wholly digitally linked audit trail between systems. Soft landing […]

Certification of e-invoice service providers is an important first step and milestone ahead of the implementation of e-invoicing in Greece. The Greek Government has now defined the regulatory framework for e-invoice service providers, their obligations, and a set of requirements needed to certify their invoicing software. Key details and parameters Scope E-invoice service providers are […]

Italy has been a pioneer when it comes to automating e-invoicing processes. It first introduced a B2G e-invoicing system in 2014 which has since evolved into a robust and mandatory platform for the exchange of invoices now also expanded to include B2B and B2C transactions. The Italian central e-invoicing platform SDI was considered revolutionary by […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

The Hungarian Ministry of Finance had a productive end to the decade. As outlined in an earlier article, the MoF announced a package of measures and proposals as part of its Economic Action Plan for 2020. The aim of the plan is to improve VAT compliance and reduce fraud. A bill to amend the laws […]

Pivotal projects in the development of EU VAT The EU’s Economic and Financial Affairs Council (“ECOFIN”) issued a report in December. This followed its review of EU tax policies and developments since Finland took over Presidency of the Council of the European Union in July 2019. In a previous article we summarised their status review […]

Value-added tax (VAT) does not exist in the United States, but American companies are increasingly having to deal with VAT mandates in Latin America, Europe and Asia. Seeking to make up a massive gap in revenues, tax administrations are mandating strict policies to digitize VAT collection. American companies that fail to comply could see their […]

The wording of the EU Directive 2018/1910, effective since 1 January 2020, suggests that EU suppliers must check that other businesses they are trading with within the EU are properly VAT registered. The Directive has triggered concerns about the obligation and the timing of when these checks must be done. What is VIES? VIES, the […]

With today’s announcement that SAP is extending support for its Business Suite 7 software suite until the end of 2027 many are breathing a sigh of relief. But are they falling victim to a false sense of security? While SAP adjusted its timeline, largely due to increasing customer pressure, know that governments have no such […]

2019 was an exciting year for VAT and, given the ever-increasing pressure on governments to increase revenues, it’s likely that 2020 will be just as eventful. Although VAT is an ever-shifting landscape, below are three recent trends that we believe are poised to continue in 2020 and beyond: 1. VAT obligations for remote sellers Globally, […]