Blog

Singapore’s new Low Value Goods (LVG) rules came into effect at the beginning of the year. As of 1 January 2023, private consumers in the country must pay 8% GST on goods valued up to SGD 400 imported via air or post from GST-registered suppliers. From 1 January 2024, the GST will increase to 9%. […]

The Philippines continuous transaction controls (CTC) Electronic Invoicing/Receipting System (EIS) has been officially kicked off for the 100 large taxpayers selected by the government to inaugurate the mandate. Although taxpayers were still struggling to meet the new e-invoicing system’s technical requirements just before the go-live date, the Philippines upheld its planned deadline and went live […]

During the last decade, the Vietnamese government has been developing a feasible solution to reduce VAT fraud in the country by adopting an e-invoice requirement for companies carrying out economic activities in Vietnam. Finally, on 1 July 2022, a mandatory e-invoicing requirement is scheduled to enter into force nationwide. 2020 e-invoicing mandate postponement Despite the […]

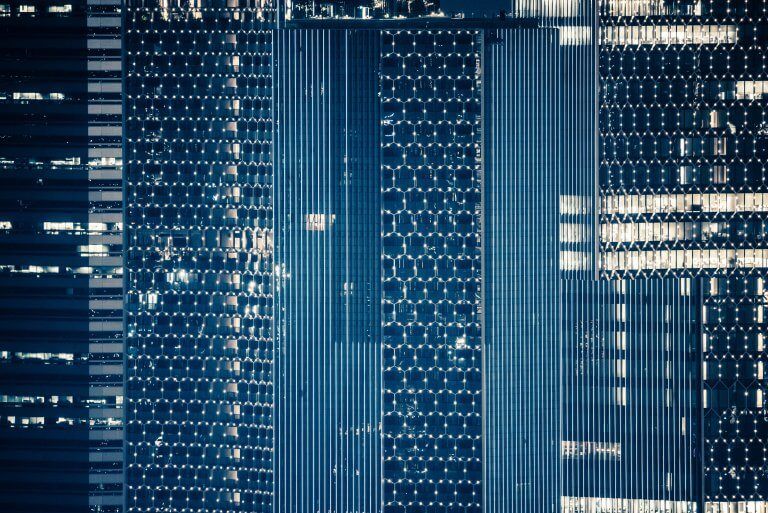

The Tax Bureaus of Shanghai, Guangdong Province and Inner Mongolia Autonomous Region have all issued announcements stating they intend to carry out a new pilot program for selected taxpayers based in some areas of the provinces. The pilot program will involve adopting a new e-invoice type, known as a fully digitized e-invoice. Introduction of a […]

In Part I of our series on the VAT Evolution, we explored the motivations of tax authorities and governments around the world to embrace digitization and technology of a method of increasing revenue collection and shrinking tax gaps. Then in Part II, Three Focus Areas for VAT we discussed some of the priority concerns for […]

Saudi Arabia will start its introduction of a new e-invoicing system from 4 December 2021. The mandate will require all taxable persons residing in the Kingdom to generate, process and store e-invoices electronically. In this episode of the Sovos Expert Series, Harri Vivian sits down with Selin Ring, Regulatory Counsel at Sovos, to explain how […]

In December, the expansion of China’s B2B e-invoicing pilot program, that enables certain taxpayers to voluntarily issue VAT special electronic invoices, was announced by China’s State Taxation Administration (STA). These e-invoices can be used to claim input VAT so are generally used for B2B purposes whereas VAT general invoices cannot so are commonly used for […]

Update: 8 March 2023 South Korea has recently approved a tax reform which introduces several measures for 2023, among which is the possibility of issuance of self-billing tax invoices. This tax reform amends the current VAT law to allow the purchaser to issue invoices for the supply of goods and services. However, this will only […]

In September, the Ningbo Municipal Taxation Bureau (NMTB) of the State Taxation Administration (STA) announced a pilot programme enabling selected taxpayers operating in China to issue VAT special electronic invoices on a voluntary basis. China’s VAT invoices China has two types of VAT invoices: VAT special invoices and VAT general invoices. The first type may […]

Addressing Base Erosion and Profit Shifting (BEPS) has been a key priority of governments around the world. The Organisation for Economic Co-operation and Development (OECD) has been working for years to tackle taxation issues across the globe. Much of the world has expressed concern about tax planning by multinational enterprises that make use of gaps […]

The world has witnessed how several Latin American countries have successfully adopted e-invoices to replace paper versions and close VAT gaps – the difference between the revenue governments are entitled to receive and what they de facto manage to collect. The positive effects of mandatory e-invoicing regimes, such as achieving simplification of the invoicing […]

For the first time in history, international business and governments have come together. Their aim was to define and agree a guiding set of principles for tax compliance in a world where continuous tax controls (CTCs) are becoming the norm. The International Chamber of Commerce‘s (ICC) executive board has now formally approved the first set […]

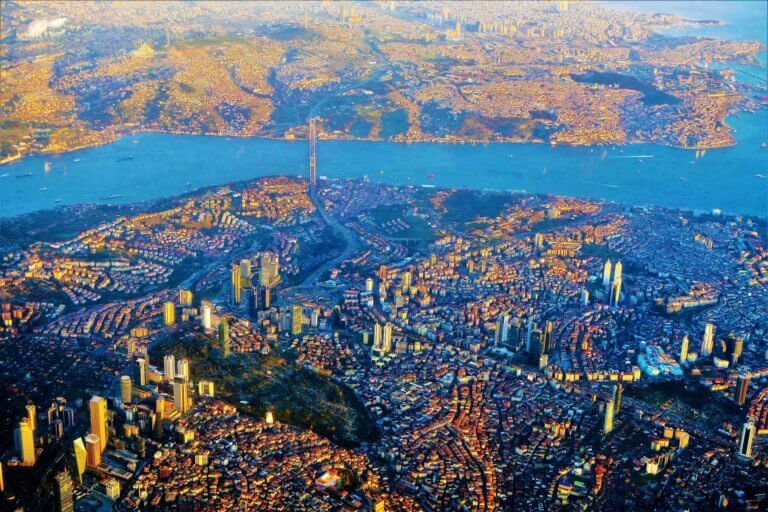

The General Communiqué no. 509 (communiqué) established the date of transition to the e-delivery note application and the full scope of the mandate. Whilst the communiqué addressed the general use of the application and the basic practices, it didn’t contain all the information businesses require and although the FAQ and information from the Turkish Revenue […]

The era of paper invoices is coming to an end. With the e-arşiv invoice system, you can issue an electronic invoice, even to non-registered e-invoice taxpayers. This regulation enables companies to send invoices directly to the end-user via e-mail removing the need for paper invoices. Due to the official statement from the Turkish Revenue Administration […]

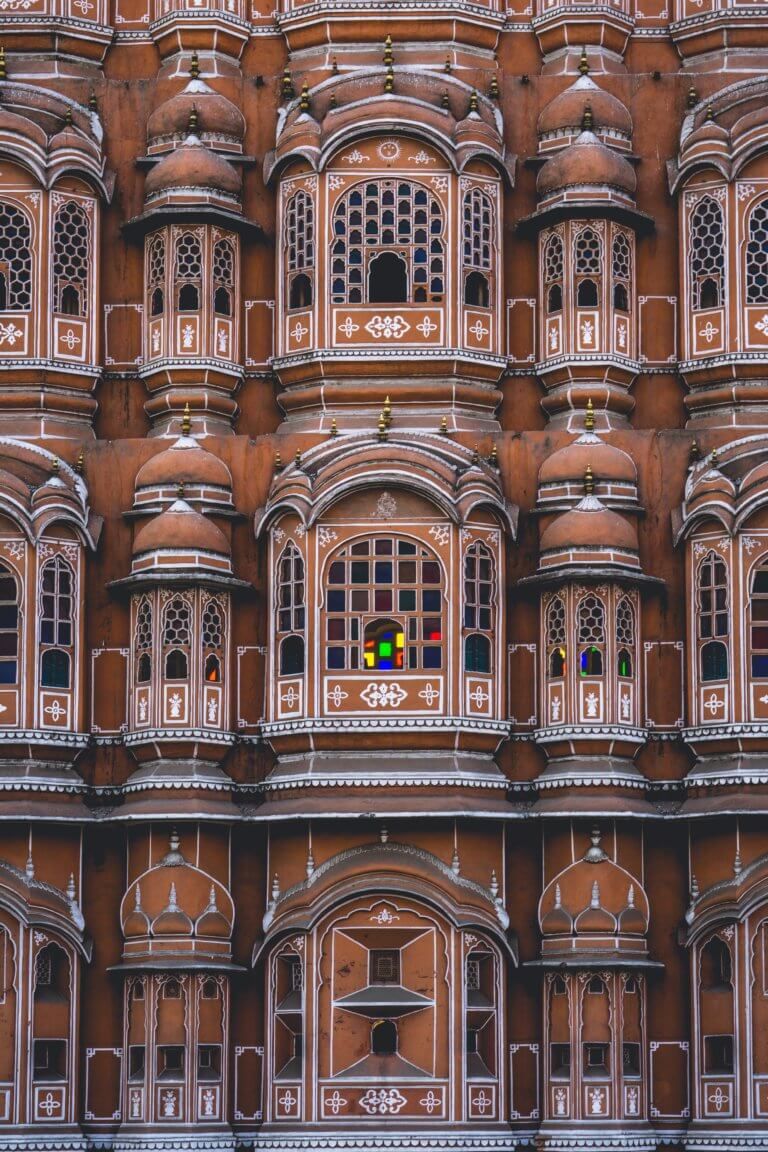

Renowned for its diversity, India is taking the same approach to its e-invoicing framework. There have been several changes and new possibilities included in the required processes and technical (“JSON”) invoice schema since e-invoicing was introduced. Such changes are unsurprising as many of the existing Continuous Transaction Controls (CTC) systems regularly bring new elements to […]

The Ministry of Finance in Vietnam recently presented a draft decree to the Prime Minister for ratification, indicating that the go-live date for mandatory e-invoicing in the country will be delayed from 1 November 2020 to 1 July 2022. This proposed delay is in response to difficulties encountered by local companies to implement a compliant […]

In the past five years, transaction automation platform vendors who embraced e-invoicing and e-archiving compliance as integral to their services grew on average approximately 2.5 to 5 times faster than the market. Two decades of EU e-invoicing: many options, different models Until 1 January 2019, when Italy became the first European country to mandate B2B […]

For companies operating in Turkey, 2019 was an eventful year for tax regulatory change and in particular, e-invoicing reform. Since it was first introduced in 2012, the e-invoicing mandate has grown, and companies are having to adapt in order to comply with requirements in 2020 and beyond. According to the General Communique on the Tax […]