This blog was last updated on February 28, 2024

Fluctuation in the wine market is not showing any signs of easing as producers, retailers and consumers continue to navigate the impacts of a global pandemic. It has never been so critical to keep a pulse on marketplace data given these shifting dynamics.

Nielsen is collaborating with Wines Vines Analytics and Sovos ShipCompliant to provide a much more comprehensive view of the U.S. off-premise wine category than ever previously available, with a data product that enables both separate and combined views of retail off-premise sales and direct-to-consumer (DtC) shipments.

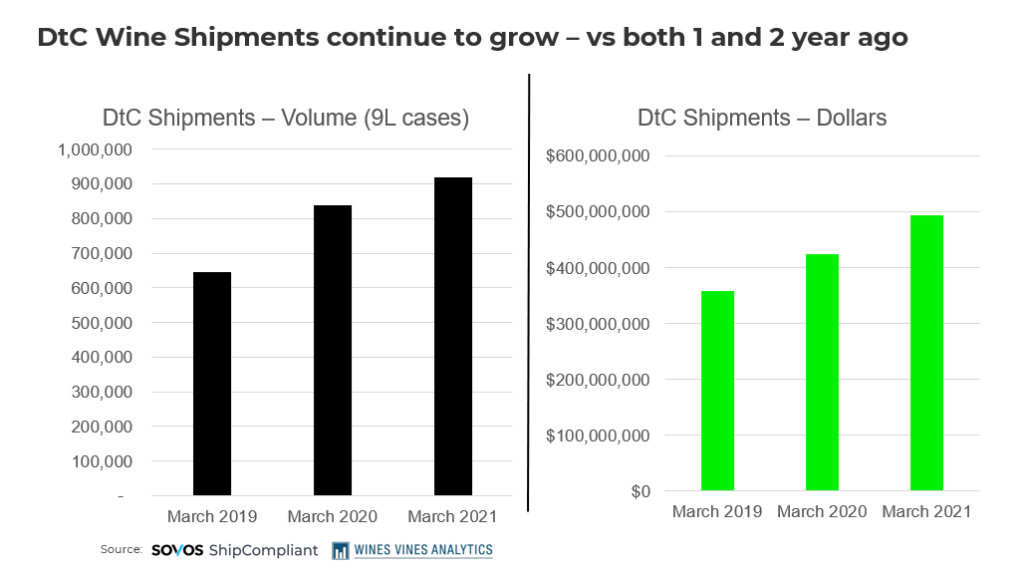

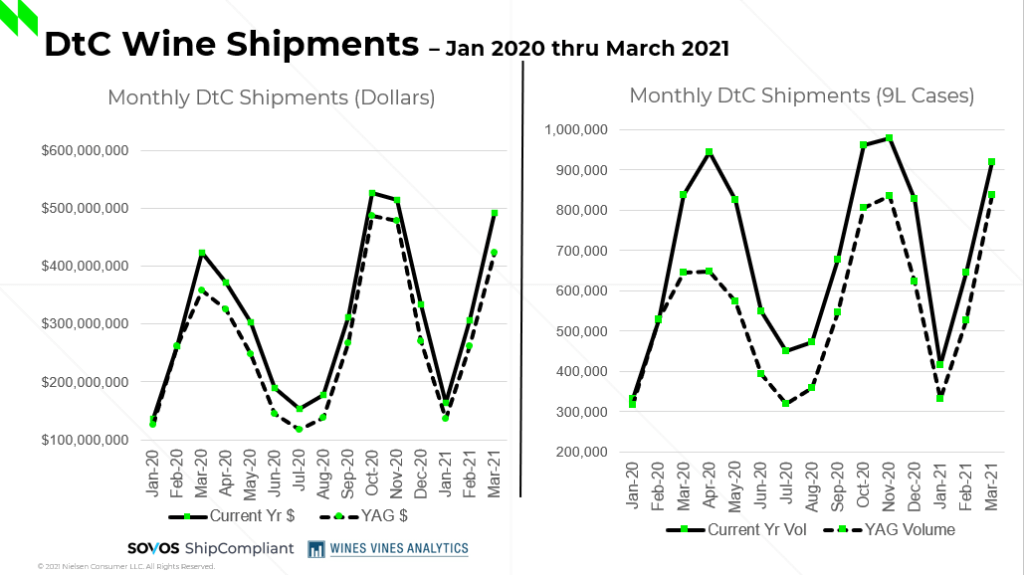

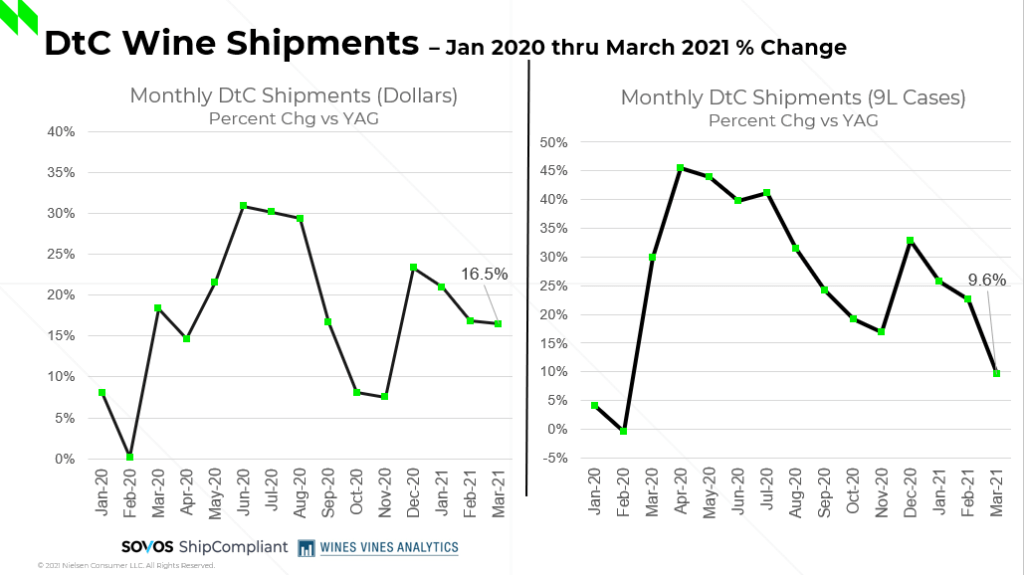

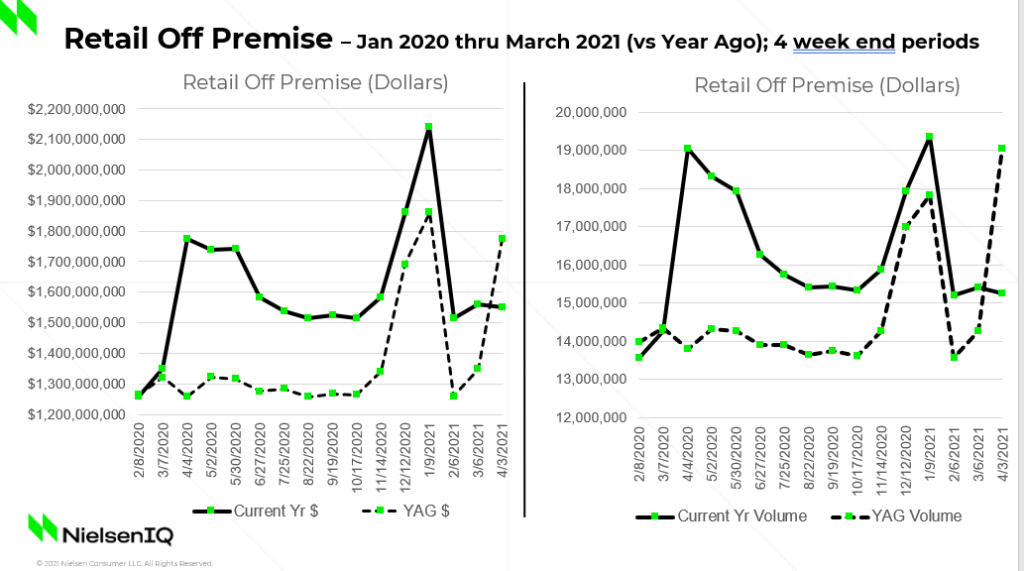

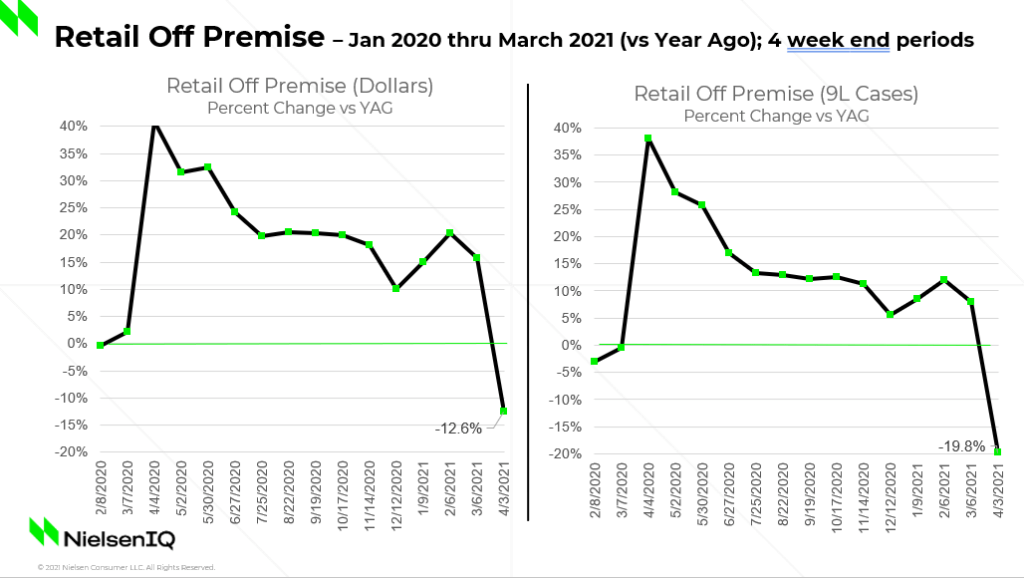

It’s important to note that the below numbers are comparing March 2021 to COVID-impacted periods of 2020. Easter 2021 was also one week earlier compared to last year. While the volume growth was still very positive, it was at its lowest point since the start of the pandemic.

Here are some highlights from the most recent data, along with commentary from Nielsen consultant Danny Brager.

DtC Shipments

- In March DtC shipments reached $493.1M and 919K cases shipped.

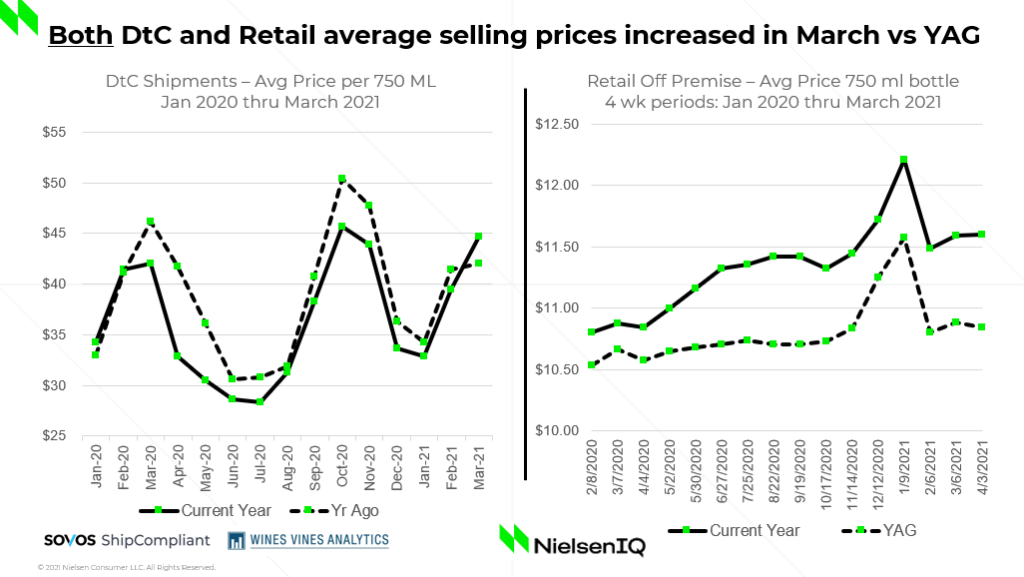

- For the first time since pre-pandemic months, dollars (+16.5%) grew faster than volume (+9.6%); the average bottle price shipped was $45 versus $42 one year ago.

- Napa origin growth had double digit dollar and volume gains in March.

- In March, the luxury price tier of $100+ had one of its best months of growth.

Retail Off-premise

- In March retail off-premise sales reached $1.5B and 15.2K cases.

- Wines over $20 performed well, with sales expanding further versus one year ago.

- Sparkling sales were a standout – it was the only one of the major wine types with increased sales as compared to March 2020.

Interested in knowing more (e.g., by price tiers, varietals, origin, winery size, geography)? Contact Danny Brager at danny.brager@nielseniq.com.

Take Action

Download the Direct-to-Consumer Wine Shipping Reporting for an in-depth look at the 2020 DtC wine shipping market.