This blog was last updated on March 11, 2019

As Peter Drucker once said, “In times of turbulence the biggest danger is to act with yesterday’s logic.” Yet that is exactly what many businesses today are in danger of doing while still working with technology that was built for an offline world. Sales tax software is a great case in point.

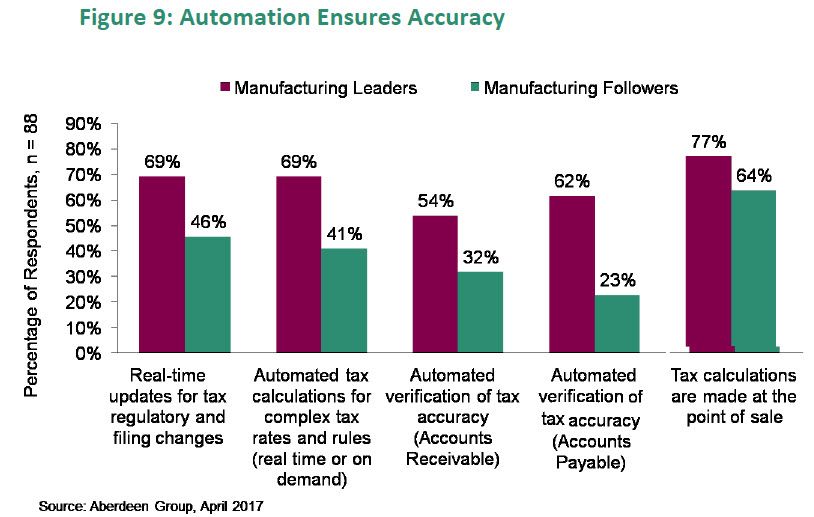

According to Aberdeen Group, 31 percent of companies surveyed indicated that audit penalties from not filing due to an unknown or missed liability were the biggest risk to their organization posed by their current sales tax software process. Interestingly, 69% of manufacturing leaders in tax, finance and IT departments cited using sales tax software for real-time updates for tax regulatory and filing changes.

Sales Tax Software and the Turbulent Digital World of Taxation

From tax reform to Wayfair vs. South Dakota and the potential overturn of Quill, to the rapid pace of transaction-level compliance spreading across Latin America and Europe, we’re in a turbulent time in the sales tax software business. Logic would tell you that managing tax compliance with spreadsheets and disparate legacy technologies is about to catch up with many businesses, increasing their national nexus and global footprints. However, some tax teams resign themselves to continue working with the same logic as they have for the past 10-20 years …Search endless state websites; track changes in Excel; wait for IT to implement, scan, fax, mail; rinse and repeat. It’s what they know, and just throwing more hours or contractors at the problem each month is getting the job done. But at what cost, on the front end, and audits and penalties on the back?

Sales Tax Software in the Cloud Has Multiple Business Benefits

Studies have shown that cloud-based sales tax software not only improves operational excellence through centralized, global data visibility, real-time compliance updates and greater adaptability to changes in systems, the regulatory environment and technical requirements, but it also reduces IT costs and reliance, improves collaboration between distributed finance, procurement and accounting departments, and greatly frees up employees to work on more strategic projects. Also, depending on the cloud infrastructure it relies on, it can become the platform for all tax determination and a single source of truth for all tax-related data, regardless of source system, and easily enable business change without tax getting in the way.

In addition to the process and workflow business benefits, sales tax software in the cloud also safeguards a business from the burden and risks associated with regulatory compliance market changes. Reducing the costs of audits, fines and penalties is one thing, but having protection from unforeseen tax laws or business growth and acquisition further frees businesses to grow without boundaries. Updating on-premises legacy technologies and manual processes with the necessary tax data is slow, time-consuming for IT, and opens up an opportunity for errors resulting in incorrect returns, penalties, late fees or worse.

Those businesses that have a solid finance and IT department relationship are going to be poised to take advantage of the value sales tax software in the cloud brings to both functions, not to mention related functions in procurement and accounting when buying and selling goods and services to support the business.

So how can CFOs and other finance leaders help the business realize the benefits of cloud-based sales tax software?

Finance Must Help Alleviate IT Backlog Issues

New levels of technology disruption in business continue to put a massive strain on IT teams, and today’s CFOs have an opportunity to strategically assess the value of technology requests that will do the most good. The growing surge of “shadow IT” (unsanctioned cloud applications typically a P-Card away from a line of business purchase) for primarily project-based productivity applications has enabled employees to get around technology spending priorities, but not without some substantial IT request backlog issues to help build and maintain these applications.

Add to this the larger enterprise and bottoms-up technology requests based on the needs of functional leaders, and CFOs now have an even larger responsibility to the organization and IT to prioritize spending decisions based on those software purchases that are going to bring the most value, help the business improve OpEx, get ahead of the competition, and safeguard the business from impending compliance risks.

Evaluate Tax Strategy During ERP or Cloud Digital Transformation Planning

Finance and IT must evaluate the tax strategy during ERP upgrade or cloud digital transformation planning and put the business in a better position to strategically determine how the business could further benefit from such a transition. Ensuring finance communicates its needs to IT and has all necessary information and requirements early in the process for when such moves take place will better align technology buying decisions to strategic business goals and priorities.

Take Action

Be a sales tax hero by safeguarding your business from the disruptive changes in tax with the world’s most complete sales & use tax determination platform. Request a Sovos Sales and Use Tax demo today. Moving to SAP S/4HANA? Safeguard the value of your SAP implementation.

Photo by Marleen Trommelen on Unsplash