Featured Webinar

Piloting Tax Reform: Understanding Tax Events

In this second webinar of the “Piloting Tax Reform” series, we will dive into what tax events are, why they are fundamental for the correct calculation of taxes, and how companies can prepare for this new scenario. We will also see how the Sovos Tax Events solution automates and ensures compliance with this critical requirement. […]

Date

Feb 5, 2026

Time

Duration

1 hour

Upcoming Webinars

From W-9 to 1099: Why Tax Identity Management Is a Core Financial Services Control

Feb 11, 2026

1:00 PM EST | 6:00 PM UTC

1 hour

The IRS relies on accurate legal names and taxpayer identification numbers (TINs on information returns to match income, deductions, and withholding to individual and business tax returns. When name and TIN combinations do not match IRS records, that data cannot be reliably matched, contributing to underreporting, enforcement activity, and the nation’s tax gap. For filers, […]

Register

e-Transformation from the CFO’s Perspective: The Path to Penalty-Free Audits

Feb 17, 2026

5:00 AM EST | 10:00 AM UTC

Today’s CFOs are no longer managing only financial accuracy. They’re also driving real-time visibility. As global regulations continue to evolve, transparency and penalty-free compliance have become the new standard in audit processes. In this exclusive session, we’ll explore the role of financial leaders in the e-transformation journey and examine the financial impact of global regulations. […]

Register

Delaware Unclaimed Property Update: New Foreign Address Rules, Illicit Property Guidelines & Enforcement Trends

Feb 18, 2026

2:00 PM EST | 7:00 PM UTC

1 hour

Delaware has incorporated some controversial changes to its unclaimed property landscape, which all holders need to understand. Join Sovos General Counsel for Unclaimed Property, Freda Pepper, along with Ann Fulmer, National Director of Consulting Services, for a comprehensive review of recent developments that may fundamentally impact your compliance obligations—and create new complexities. What You’ll Learn: […]

Register

The Hidden Cost of Getting Use Tax Wrong: How to Stay Ahead of Auditors

Feb 19, 2026

2:00 PM EST | 7:00 PM UTC

1 hour

Many companies believe their use tax processes are solid — until an audit reveals costly gaps. In reality, manual reviews, inconsistent data, and outdated systems often leave businesses exposed to penalties they didn’t see coming. In this session, we’ll explore: The most common use tax compliance failures — and why they’re so easy to miss […]

Register

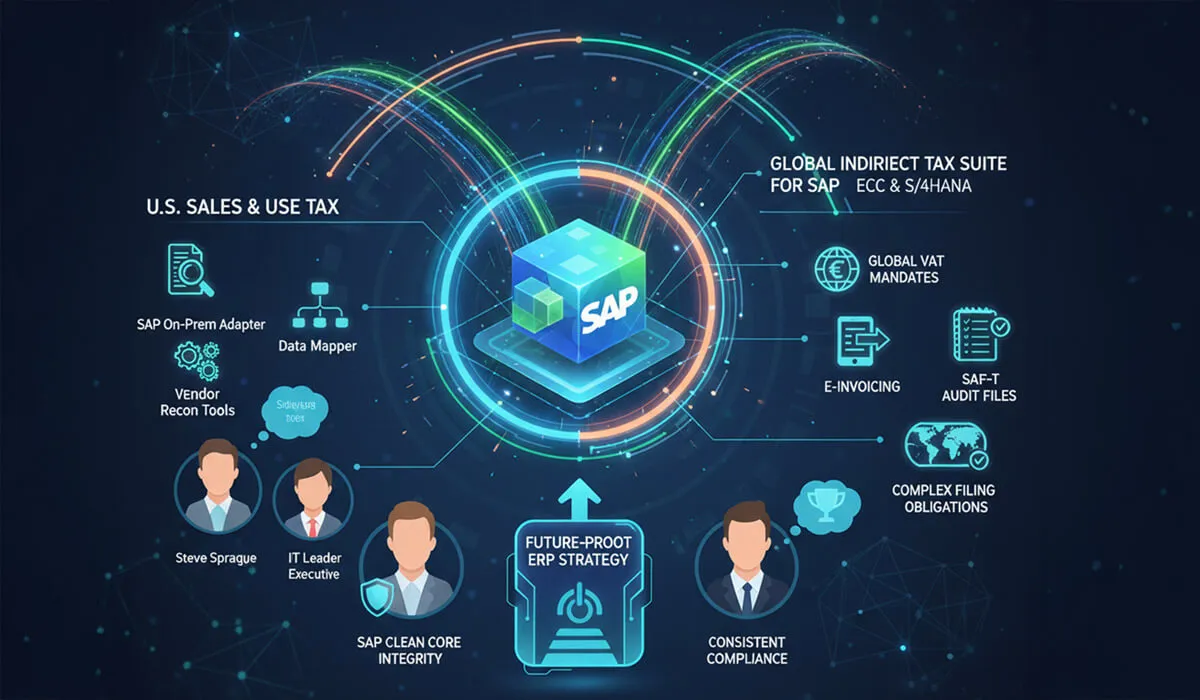

DIY or Done-for-You? Rethinking Tax Compliance Strategy in SAP

Feb 25, 2026

11:30 AM EST | 4:30 PM UTC

1 hour

How Tax Compliance Is Changing in SAP Tax compliance in SAP is no longer just an IT decision. It’s a strategic risk decision. As governments shift to real-time, transaction-level enforcement, SAP customers are being forced to rethink how tax compliance fits into their S/4HANA, Clean Core, and data governance strategies. Many organizations are evaluating ERP-native […]

Register

US Sales Tax Is Changing Fast. Are Your Controls Keeping Up?

Feb 25, 2026

12:00 PM EST | 5:00 PM UTC

1 hour

US sales tax and use tax rules are shifting faster than many global tax teams realize. In 2025 alone, new enforcement priorities, policy reversals, and state-level changes are already creating unexpected exposure for companies selling into the US from abroad or managing tax centrally outside the country. Join Sovos regulatory experts to break down recent […]

Register

The Road to 2026: How VAT, SAF-T and E-Invoicing Regulation Is Evolving

Feb 26, 2026

9:00 AM EST | 2:00 PM UTC

30 min.

As tax authorities push deeper into digital enforcement, VAT and e-invoicing are moving into a phase defined by real-time control, standardised data and increased transparency. As 2026 unfolds, the real challenge for businesses is not just tracking change but interpreting what it reveals about the direction of indirect tax compliance. This session explores how recent […]

Register

Financial Services Has a Sales Tax Blind Spot. Are You Exposed?

Mar 3, 2026

12:00 PM EST | 5:00 PM UTC

1 hour

Join Sovos regulatory expert Chuck Maniace and product marketing leader Vadim Nemtsev for a practical exploration of why Financial Services has become a high-risk sales tax segment and what your organization should do about it. Date Time Duration March 3, 2026 12:00 pm EST 1 hour Request Registration

Register

Designing an End-to-End Tax Compliance Strategy: Data, Control and Confidence

Mar 4, 2026

9:00 AM EST | 2:00 PM UTC

30 min.

As indirect transaction tax becomes more complex and digitally enforced, organisations are increasingly challenged by limited visibility into the data that underpins compliance. Tax-relevant information is often fragmented across AP, AR, ERP, billing and e-invoicing systems, creating inconsistency and risk well before returns are filed. This webinar explores the business impact of disconnected transaction data, […]

Register

Unclaimed Property Compliance Made Simple: A Live Demo of The Sovos Compliance Hub

Mar 25, 2026

1:00 PM EDT | 5:00 PM UTC

45 min.

Keeping up with unclaimed property requirements across all 50 states is no small task. Laws change frequently, dormancy periods vary, and due diligence rules differ by jurisdiction. Join us for a live demonstration of the Sovos Compliance Hub, a subscription-based resource designed to simplify unclaimed property compliance and give you the confidence to stay ahead of […]

Register

Previous / On-Demand Webinars

Filter Year:

Spanish (Mexico)

The New Horizon of Compliance: Intelligence, Visibility, and the Closing of Gaps

Jan 22, 2026

Governments use AI and real-time data to strengthen tax compliance and increase business visibility, transforming the relationship with authorities. In this context, predictive approaches such […]

Watch

English (US)

Driving Tax Determination Excellence: How Hyundai Powers U.S. Sales Tax with Sovos + SAP S/4HANA

Jan 22, 2026

Join Hyundai Motor America and Sovos for a behind-the-scenes look at how a major automotive brand streamlined U.S. sales tax compliance with real-time, SAP-integrated automation. […]

Watch

English (UK)

Navigating Poland’s KSeF Expansion and Bulgaria’s SAF-T Mandate: A Practical Guide for 2026

Dec 11, 2025

European tax authorities are accelerating the move to real-time digital reporting, creating new rules and tighter deadlines for organisations. This session will break down the […]

Watch

Portuguese (Brazil)

Retrospective of the Navigating Tax Reform Series & Expectations for Piloting the Reform in 2026

Dec 11, 2025

The “Navigating Tax Reform” series followed, throughout the year, each advancement, regulation, and impact of the new tax model. In this special webinar, our experts […]

Watch

English (US)

Tis the Season for Tax Triggers: How to Keep Your E-Comm Sales Tax-Compliant This Holiday Season

Nov 20, 2025

The holidays bring record online sales — and record tax complexity. With every click and cart, ecommerce sellers risk crossing economic-nexus thresholds and triggering new […]

Watch

English (US)

Navigating the Perfect Storm: Seamless Invoice Processing Meets Smarter Tax Compliance

Nov 12, 2025

Join Tungsten and Sovos experts to discover how to future-proof your AP/AR operations amid evolving global compliance demands. Learn strategies for navigating U.S. tax modernization, […]

Watch

English (US)

Understanding the One Big Beautiful Bill: How Legislative Changes Will Transform Information Reporting and Withholding

Sep 17, 2025

The “One Big Beautiful Bill” (OBBB) represents one of the most sweeping shifts to the tax compliance landscape in recent history. With wide-ranging provisions that […]

Watch

English (US)

Different Rules, Different Risks: Understanding the Differences Between 1099-DA vs. 1099-B Reporting

Sep 4, 2025

As the IRS rolls out Form 1099-DA for digital asset transactions, financial institutions that have long reported on traditional securities through Forms 1099-B, 1099-DIV, and […]

Watch

English (US)

SUT RegTalk: Stay Ahead of Regulatory Changes and Market Trends That Matter Most To Your Business

Aug 20, 2025

Sales tax regulations are shifting fast—with key changes already impacting businesses in 2025. In this webinar, Sovos legal experts will break down the latest updates, […]

Watch

English (US)

From Cost Center to Growth Engine: Building a Business Case for Tax Technology Investment

Jul 30, 2025

In today’s rapidly evolving regulatory landscape, tax departments are under increasing pressure to enhance efficiency, ensure compliance and deliver strategic value. However, securing an investment […]

Watch

Turkish

Sovos&SAP Present | A Next-Generation Approach to SAP Clean Core Strategy and E-Document Compliance

Jul 17, 2025

In this on-demand webinar, SAP and Sovos experts discuss SAP’s Clean Core strategy and its impact on digital transformation initiatives. The session also highlights Sovos’ […]

Watch

French

VAT Recovery & Cross-Border Transactions: Anticipate, Optimize, and Recover

Jul 1, 2025

In this French-speaking webinar, we will uncover frequently overlooked opportunities in VAT recovery and highlight the essential obligations tied to cross-border transactions. Through practical examples, […]

Watch

English (US)

First Time Filing 1099-DA? What You Need to Know (And Do) Before the Deadline

Apr 29, 2025

Navigating 1099-DA reporting for the first time can feel overwhelming, especially with evolving IRS guidance and tight deadlines. This webinar simplifies the essentials, from understanding […]

Watch

English (US)

Tax Compliance 2025: Navigating SAP S/4HANA, Clean Core & Government Mandates

Mar 13, 2025

For multinational organizations, the intersection of regulatory mandates and technological transformation is creating a once-in-a-generation shift. Governments worldwide are enforcing continuous transaction controls, embedding themselves […]

Watch

Spanish (Chile)

Transforming the Patient Experience: Digital Security and Accessibility

Jan 23, 2025

In this webinar, industry experts explore how technology addresses key challenges in the healthcare sector, from protecting patients’ sensitive data to ensuring digital accessibility without […]

Watch

English (US)

3 Things Multi-National Corporations Need to Know about Sales Tax

Jan 14, 2025

Navigating U.S. sales tax requirements can be especially challenging for multi-national corporations unfamiliar with the complexities of state-specific laws, rules, and regulations. In this session, […]

Watch

Spanish (Chile)

Why biometrics have become part of people's daily lives and a success story for companies

Dec 8, 2024

In this webinar, our experts analyze real cases where biometrics improve security, optimize processes, and increase customer and user trust, along with strategies to improve […]

Watch

Spanish (Mexico)

Protect your transactions with Identity Verification and Electronic Signature: Sovos Trust Services for Mexico

Nov 26, 2024

In this webinar, Sovos experts discuss how identity verification and electronic signature solutions are essential to ensuring security and compliance in digital transactions. Discover how […]

Watch

Spanish (Chile)

Smart security for educational institutions: How to strengthen your processes with identity verification

Nov 14, 2024

Want to enhance security at your educational institution? In this webinar, we will show you how identity verification and electronic signatures can safeguard your academic […]

Watch

Spanish (Peru)

Simplify your processes and improve your customers' experience with identity verification and digital signature

Oct 29, 2024

Do you want to simplify your processes and enhance your customer experience? In this webinar, we’ll show you how identity verification and electronic signatures can […]

Watch

Spanish (Peru)

Are you looking for ways to optimize your onboarding processes and improve your company’s security?

Oct 15, 2024

In this webinar, we will explore how identity verification technology has evolved to offer faster, safer, and more efficient solutions. Don’t miss out! Sign up now and […]

Watch

English (US)

E-invoicing Compliance: A Critical Component of Your Global SAP Strategy

Sep 24, 2024

This webinar will offer an overview of global e-invoicing mandates and demonstrate how integrating e-invoicing into your compliance strategy can streamline processes, ensure regulatory alignment, […]

Watch

English (US)

Mastering Cross-Border Trade Compliance: Navigating EU Regulations and Tax Mandates

Sep 19, 2024

Cross-border trade requires navigating complex regulations, customs requirements, and tax laws – with compliance being essential to avoid costly penalties. Recent mandates in Romania highlight […]

Watch

English (US)

IRS Business Systems Modernization: Preparing Your Organization for Reporting Changes

Jul 30, 2024

The Internal Revenue Service’s (IRS) modernization initiatives are pivotal in enhancing the accessibility, efficiency, and security of tax information reporting processes for taxpayers. As these […]

Watch

English (US)

Keeping-up with the evolution of e-invoicing in Europe: focus on Germany, Belgium, Spain, Romania & Poland

Jun 27, 2024

In recent years, e-invoicing has gained unprecedented importance due to the digitalization of transactions, the acceleration of processes and the change in strategies of tax […]

Watch

Transform Your Tax Information Reporting and Withholding Process with Sovos + ComplyExchange

Jun 11, 2024

Discover the power of fully automating tax identity, withholding, and reporting through two tightly integrated solutions. Seamlessly merge individual and business tax documentation collection and […]

Watch

Transform your processes with e-signatures: Optimize, save and act sustainably

Apr 25, 2024

Discover how electronic signatures streamline your operations, guaranteeing security and reducing paper consumption. Join our webinar to explore how our solutions revolutionize business processes in […]

Watch

Focus on Financial Institutions: What You Should Know About 1099 and Unclaimed Property Reporting

Sep 28, 2022

Tax information reporting for financial institutions presents unique challenges and details to keep in mind when reporting specifics related to 1099 and Unclaimed Property. Incorrect or incomplete […]

Watch

VAT Reporting and SAF-T: Current Trends and Initiatives

Jun 15, 2022

Changes resulting from governments’ digitization initiatives can be complex, especially for multinational companies trading across multiple jurisdictions. Organizations must understand the details of forthcoming regulations […]

Watch

It’s all about the detail: The complexity of Insurance Premium Tax compliance in Spain

May 5, 2021

Our research amongst prospective clients suggests that complying with Insurance Premium Tax regulations in Spain continues to cause difficulty for businesses across Europe and beyond. The tax […]

Watch

Drei Gruende warum deutsche multinationale Unternehmen einen globalen Anbieter fuer eine Tax Compliance Loesung benoetigen

Dec 2, 2020

Nehmen Sie an diesem Webinar teil, um zu erfahren, wie Sovos Ihnen helfen kann:Automatisieren Sie alle Ihre indirekten Steueranforderungen vollständig, einschließlich elektronischer Rechnungsstellung, elektronischer Belege, […]

Watch

Partner Webinar: The Asian wave of VAT digitization What’s new as CTCs go East?

Nov 10, 2020

More and more countries are embracing the wave of tax digitization and other tax control changes that are currently spreading across the globe. The trend that originated in Latin America – mandatory e-invoices reported in (near) […]

Watch