What is PEPPOL?

What is Peppol? Peppol began in 2008 as an effort to standardize public procurement in governments across the European Union.

What is Peppol? Peppol began in 2008 as an effort to standardize public procurement in governments across the European Union.

Report IDC MarketScape 2024European Compliant E-Invoicing Vendor Assessment Sovos has been recognized as a Leader in the 2024 IDC MarketScape for European Compliant e-Invoicing solutions. Gain deep insights into the rapidly changing landscape of e-invoicing in Europe and see how Sovos can help your business navigate the complexities of compliance.

Unclaimed property compliance is one of those legal obligations that often flies under the radar for many businesses, especially smaller ones. However, failing to stay compliant can quickly turn minor oversights into major liabilities. In many cases, the penalties far exceed the value of the property itself, making it essential

Want to enhance security at your educational institution? In this webinar, we will show you how identity verification and electronic signatures can safeguard your academic processes. We will explore practical use cases such as electronic certificate signing and online exam security, among others. Learn how these tools can optimize your

The French tax administration has just announced structural changes to the 2026 French e-invoicing mandate that will discontinue the development of the free state-operated invoice exchange service. This decision will put increased pressure on taxpayers and software vendors to select a certified ‘PDP’ to fill the void created by this

UP Standard FAQ Frequently asked questions about Unclaimed Property Is UP Standard a cloud-based software or do I download it? UP Standard is completely cloud-based, allowing for real-time updates of unclaimed property regulations, ensuring your business is always in complete compliance and keeping your data secure. How do I know

Cost Calculator Calculate your direct and indirect tax compliance expenses Indirect Tax Technology Cost Estimates and Implementation Considerations There are two main approaches businesses go about implementing and managing their indirect tax tech stack. Some corporations use multiple point solutions from various tax technology vendors while others rely on a

In the first blog in our series, we introduced SAP Clean Core concept and how much is being made about its impact on business, specifically the ability to customize an ERP to meet operational needs. For part two, I’d like to address how businesses can use the SAP Clean Core

Much is being made about the introduction of SAP’s ‘Clean Core’ concept and how it will impact a business’ ability to customize its ERP to meet the unique needs of its operation. In this first blog in a series taking on the issue of Clean Core, I’d like to focus

Electronic invoicing in Chile Chile has long been a leader in adopting electronic invoicing, starting in 2001 with voluntary adoption for taxpayers. Its status as a pioneering country with e-invoicing is reflected by the fact that all taxpayers in the nation must issue and receive electronic invoices – one type

The direct-to-consumer (DtC) wine shipping channel has seen a continuation of movement tracked in the January release of the Sovos ShipCompliant/Wine Business Analytics Direct-to-Consumer Wine Shipping Report, with the top destination states experiencing a dip in volume and value. The latest data for the U.S. wine DtC shipping market reveals

Sovos Terms Of Service Shopify Tax Automated Filing Last Modified: July 23, 2024 Español These Sovos Terms of Service – Shopify Tax Automated Filing (these “Service Terms”) constitute a legal agreement between Sovos and Merchant. As used in these Service Terms, “we, “us”, “our” or “Sovos” means Sovos Compliance, LLC

Spirits, ciders and meads added to the list of products that are permitted to be shipped direct-to-consumer (DtC) in New York.

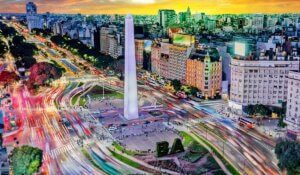

Argentina VAT Compliance: An Overview for Businesses Doing business in Argentina means meeting your tax compliance obligations. Adhering to requirements from multiple mandates, including both VAT and electronic invoicing, can be demanding for organisations. This page serves as an overview of tax obligations in Argentina, helping you to understand your

The Government of the Republic of Slovenia has released a draft proposal to implement mandatory e-invoicing and e-reporting for B2B and B2C transactions. This implementation would mark a significant shift in the country’s e-invoicing landscape. Should the proposal be approved, taxpayers will be subject to a two-fold obligation: they must

Experiences, Lessons Learned and Pending. We invite you to explore the changes that have occurred in the last 10 years of mandatory electronic invoicing, discover how far we have come and what the future holds. Invoicing solutions are mission critical for companies, regardless of the size of their operation, because

In this article, we will discuss what the Loper decision means and how it could ultimately impact sales and use tax compliance on both a big-picture and micro-determination level.

Do you operate internationally or dream of expanding in the future? Design a strategy now to navigate compliance on a global scale. It’s an essential part to mitigate your financial risk. Don’t miss the chance to hear real-world use cases. Sovos experts will take you well beyond the traditional compliance